Mirvac shows industrial might with ART tie up

The logistics property partnership is in line with the developer’s expansion into funds management.

The logistics property partnership is in line with the developer’s expansion into funds management.

The developer’s house prices are recovering but projects have been delayed by bad weather, says its new chief executive.

Megaport rockets on guidance upgrade. Bubs Australia launches China review. Bank of Japan to review monetary policy. Mirvac cuts outlook. Woodside defends climate policy.

The nation’s office market remains under pressure but big trades are beginning to take hold with offshore capital continuing to favour Australian towers.

GPT’s board could now be looking further afield for a new boss to run the country’s oldest property trust.

A new group of not-for-profits are set to become a major player in property and help address the housing crisis.

A ‘dire’ shortage of housing supply could worsen over the next five years as cash-strapped builders struggle to survive, Mirvac’s new CEO warns.

Sydney-based Revelop is backing its belief in the retail property resurgence by picking up Stanhope Village in Sydney’s northwest from Mirvac for above book value price of $158m.

The residential division is off, but the property developer will focus on funds and investments.

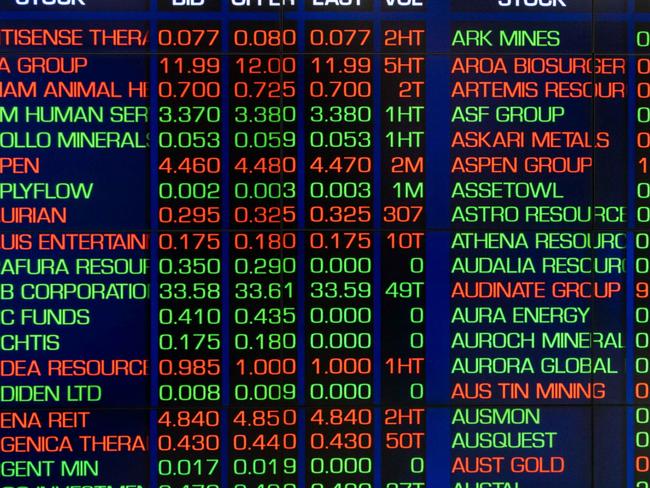

All ASX sectors end in the red. Investors dump AGL on guidance cut, $1.1bn profit loss. Dollar rallies on China rate cut talks. Fortescue eyes mass job cuts. Coal miners struggle.

The property developer, led by Susan Lloyd-Hurwitz, believes the looming residential shortage will favour stronger operators.

A man from Sydney’s exclusive eastern suburbs has denied threatening a taxi driver and stealing his car while drunk in the city.

Mirvac’s new boss Campbell Hanan isn’t starting in the job until March, but already there is talk that he could be pondering some big changes for the $8.4bn real estate investment trust.

Susan Lloyd-Hurwitz’s appointment will be announced next week. She will replace Sam Mostyn, who completes her two-year term this month.

Two new skyscrapers have been proposed to rise above the Sydney Metro Hunter Street Station, thanks to billionaire publican Justin Hemmes alongside developers Lendlease and Mirvac.

Some of Australia’s largest residential developers say it has become more difficult to shift off-the-plan apartments, even as rents begin to rise considerably.

The property veteran will step up at time when the housing market is turning.

The developer is sticking to its earnings guidance in the face of rising global interest rates and persistent wet weather, despite the housing slowdown.

Brisbane-based funds house Marquette Properties has swooped on an A-grade office complex in the city’s Southbank, snapping up a Grey St tower from Mirvac for just over $104m.

Scentre, Mirvac, Lendlease, Stockland – and now add GPT to the list of property companies seeking new leadership.

The unusual double resignation marks the end of Susan Lloyd-Hurwitz’s decade-long tenure at the developer, and there is already a frontrunner in the race to replace her.

ASX ends lower as bond yields surge and dollar falls. Mike Cannon-Brookes launches AGL board campaign, Baby Bunting dives on margins hit and Whitehaven downgraded.

Melbourne’s office market has sparked up with major sales with both Mirvac and Dexus looking to unload key buildings.

Mirvac has moved quickly to put the ultimate corporate governance band together to run the $7.7bn office fund it picked up from AMP.

Listed company Mirvac and US private equity house Blackstone are beginning the sale of Margaret St and MetCentre in Sydney’s CBD.

Mirvac has beaten its earnings guidance and has urged governments to improve housing supply in anticipation of the return to full immigration.

Two factors underpin Mirvac’s robust results on Thursday, as rising interest rates bite and rising construction costs send some developers to the wall.

ASX enjoys its best session in two weeks as discretionary and real estate leap. Mirvac jumps on earnings, Lake Resources rockets, while AMP and Telstra slide on FY22 results.

Chief executive Alexis George has expressed her disappointment after Mirvac won control of the wealth manager’s flagship wholesale office fund.

AMP’s hope of a clean exit from its Collimate Capital business has come unstuck after Mirvac won control of its flagship $7.7bn wholesale office fund.

Original URL: https://www.theaustralian.com.au/topics/mirvac-group/page/3