DATAROOMDataRoomVulcan Energy has secured $1.1bn from investors and $2.5bn in European government backing to fund its German lithium project, demonstrating Europe’s urgent push for critical mineral security.

DATAROOMDataRoomThe Wall Street bank is bringing in more talent from other firms.

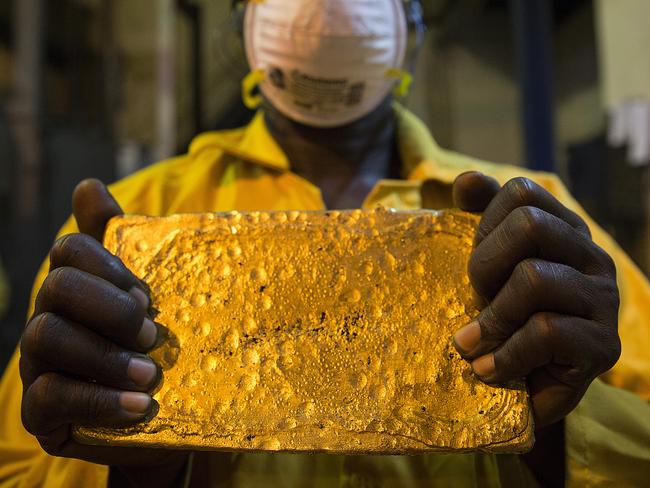

MiningMining & EnergyASX-bound Greatland Gold’s $700m-plus deal for gold and copper mines is making its backers, including Andrew Forrest, a lot of money. But it took connections and luck to make it happen.

OfficesPropertyDevelopers have unveiled a $20m revamp of a city office building – complete with golf simulator – designed to lure workers back into the CBD.

StockheadStockheadDespite sustainability-themed stocks losing market appeal, Canaccord Genuity sees a big revenue leap ahead or circular economy star Close the Loop.

Eddy Sunarto

StockheadStockheadAs prices begin to claw back ground after a savage plummet, Canaccord Genuity lithium guru Reg Spencer sees blue skies ahead and names some hot prospects.

Josh Chiat

StockheadStockheadCanaccord Genuity has labelled ASX lithium producer Argosy Minerals a good buy, setting a target price more than double its current value.

Eddy Sunarto

StockheadStockheadCanaccord Genuity says it ‘cannot stress enough’ the fragility of uranium supply, predicting another surge in prices – and the value of stocks in the sector.

Reuben Adams

StockheadStockheadCanaccord sees Acusensus’s share price doubling, as the road safety tech producer sets out to capture a bigger slice of a $1.8 billion global market.

Eddy Sunarto

STOCKHEADStockheadMining experts have given their take on the outlook for commodities in 2024. Aura Energy’s Andrew Grove says the nuclear sector is growing faster than previously neglected uranium stocks can supply plants. Canaccord Genuity’s Courtney Libby says lithium could be entering counter-cyclic play territory.

Josh Chiat

StockheadStockheadCanaccord analysts have noted an unusual sign – and some more-usual ones – that gold may rise again. And they’ve got a bit to say about lithium too.

Josh Chiat

StockheadStockheadPatience and attention to three key factors are keys to investor success in a battery metals sector down in confidence, says mining guru Tim Hoff.

Josh Chiat

StockheadStockheadBroker Canaccord Genuity is bullish about a tech-based parking management provider, while MA Moelis likes the look of a mining industry software firm.

Eddy Sunarto

StockheadStockheadAfter Albemarle’s new, improved takeover deal to buy Liontown, Canaccord is using a word lithium juniors will love to hear: ‘undervalued’.

Josh Chiat

DATAROOMDataRoomAMA Group is raising equity through Canaccord, with the smash repairs company tipped to be in search of about $60m.

StockheadStockheadWith the ASX investment market said to be in a liquidity crunch, Canaccord Genuity’s Tim Hoff says bucking the trend is all about discovery and delivery.

Josh Chiat

StockheadStockheadA firm helping combat distracted driving has caught the attention of Canaccord Genuity. Meanwhile, a farming stock has also been given a tick.

Eddy Sunarto

DATAROOMDataRoomThe nickel miner is said to have been sounding out potential investors for a possible raising through Canaccord.

StockheadStockheadCanaccord Genuity expects the lithium market to stay ‘relatively balanced’ this year. Which means just about all producers will keep making good money.

Josh Chiat

StockheadStockheadCanaccord Genuity says the lithium market has bottomed out – and it sees upside of as much as 384 per cent in these five ASX stocks.

Reuben Adams

StockheadStockheadPaladin Energy has been through the wringer, but a wiser PDN is poised to ride a new uranium wave and is seriously undervalued, says Canaccord Genuity.

Josh Chiat

DATAROOMDataRoomGenesis Minerals has gone cap in hand to investors to pay for its merger deal with St Barbara.

StockheadStockheadCanaccord Genuity says lithium prices, which hit stunning levels this year, will pull back in 2023 – but it still sees big upside in ASX juniors working in Canada.

Josh Chiat

DATAROOMBusinessFosters and Canaccord Genuity are co-lead managers for the West Africa gold explorer, with an IPO to give the company a market capitalisation of $19.9m.

SARAH PETTY

INVESTMENT BANKINGFinancial ServicesCanaccord Genuity’s Australian operation has paid more than $50m in dividends to its global parent after recording bumper profits.

MiningStockheadLithium prices have gone parabolic since the bull market kicked off in January 2021, and a bearish Goldman Sachs research report has been challenged.

Jessica Cummins

Margin CallMargin CallConspicuous, too, was Canaccord Genuity’s gold-medal-worthy back-pedal on Tuesday – which saw the investment bank slice its EML price target some 55 per cent from $4.50.

MARGIN CALLMargin CallHere’s a juicy morsel from, of all places, the world of prime Australian beef and the C-suite at the Australian Agricultural Company.

DISCLOSUREFinancial ServicesThe corporate regulator raised conflict of interest issues with investment bank Canaccord Genuity almost 12 months ago – but appeared to take no action despite its concerns.

KYLAR LOUSSIKIAN

DATAROOMDataRoomThe Chris Ellison-backed rare earths producer VHM has tapped Canaccord Genuity to raise funds as it revives attempts for an initial public offering.