What led to the ASX Wolf’s downfall

He was found to have breached financial advice laws in a precedent-setting court case against social media "finfluencers".

He was found to have breached financial advice laws in a precedent-setting court case against social media "finfluencers".

Tyson Scholz’s persona as the high-rolling “ASX Wolf” on Instagram propped up his financial services business, which he didn’t have a license to run, breaching financial advice laws, a court has found.

The first major court action from corporate regulator ASIC against unobliging social media "finfluencers" found Scholz received a total of $1,156,500 for private tips, Discord mentorship and Zoom seminars between October 2020 and August 2021, but didn't hold a financial services license during this time.

ASIC deputy chair Sarah Court said more finfluencers would be the subject of enforcement action if they offered financial advice without being qualified.

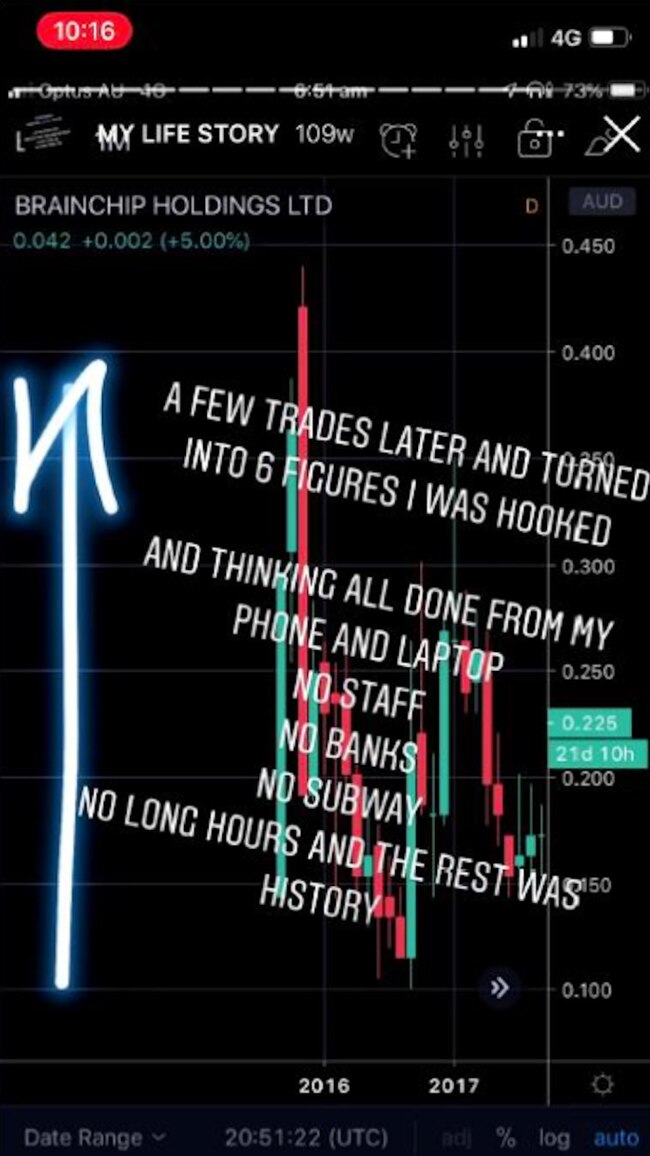

His "self-made success story" was advanced through his Instagram stories. With posts of Ferraris, speedboats, and private jets, he gave the impression "this lifestyle had been achieved… as a consequence of his share trading on the ASX,” Federal Court judgment read.

"A few trades later ... turned into 6 figures and I was hooked," he wrote in one Instagram story. "All done from my phone and laptop, no staff, no banks ... no long hours," he added.

From about March 2020, Scholz posted "good investment" options on social media platforms which then influenced his followers to acquire shares in those companies. This increased his shareholding, which he admitted he knew in WeChat conversations.

He then changed his Instagram handle to @asxwolf_ts and adopted the persona of the "ASX Wolf", where he gained 20,000 followers.

By mid-2020, he started selling private tips to clients for $500 and ran Zoom seminars for the same price designed to teach attendees about trading on the ASX. "10 years of my trading career has been rolled into this package" is how he promoted the classes.

Scholz also ran an online Discord group - known as the "Wolf mentorship channel" or the "Black Wolf Pit Channel" - about trades, with a $1000 a year subscription.

He would post stories about shares in particular companies, and "although it might be said that these stories were posted for ‘free’ for anyone to read ... it is objectively unlikely that Mr Scholz posted these stories for no gain to himself".

In the judgment, the Federal Court found Scholz gave financial product advice through stories posted on the Instagram account, tips given to clients privately, in seminars, and Discord channels, and direct messages, and that his activities as the ASX Wolf amounted to carrying on a financial services business.

While Scholz argued there he was possibly exempt from holding an Australian financial services license to carry on his business through the Corporations Act, this was rebuffed by Justice Kylie Downes, as well as the argument that he was providing personal rather than general advice since it was disseminated through public social media accounts.

No penalties have been handed down yet but the corporate regulator ASIC is seeking Scholz be prohibited from promoting or carrying on the business of providing recommendations in return for payments of money or carrying on any financial services business in Australia.

The matter will return to court on January 31.