Fashion site valued at $100 billion

Mysterious Chinese company Shein has been valued at about $100 billion, more than Zara and H&M combined. But is it really about the clothes?

Mysterious Chinese company Shein has been valued at about $100 billion, more than Zara and H&M combined. But is it really about the clothes?

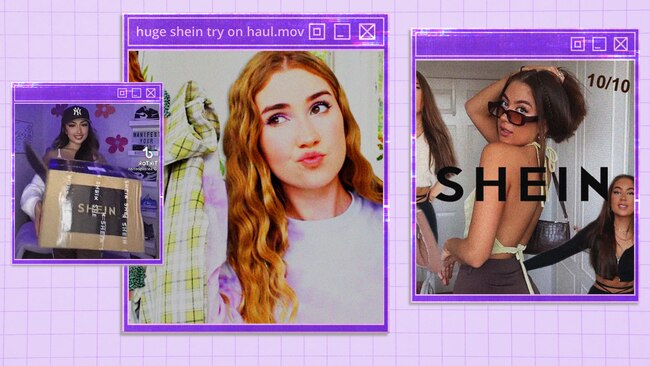

Australian @jessdunstan_ rips open a white package, dropping 11 smaller Shein packages onto her desk. It’s a #sheinhaul.

“Literally ordered, like, 20 items for $140 ... I’m so excited,” she says.

Inside, there is a pair of black sandals (“a vibe”), two caps (“I’m obsessed, are you kidding”), five pairs of sunglasses (two for the boyfriend, “he’ll look good in them … big yep”), five shirts (“looks a bit see-through but we can work with it”), a phone case, a ring for the boyfriend, a pair of shorts and a dress (“it's not really me but it was, like, 20 bucks”).

She does not have many followers but the video has 333.6k views.

Shein sells pleated lowrise mini skirts for $12.95, sweater vests for $14.45 and chunky Chelsea boots for $34. You can also buy rhinestones for your car steering wheel, DIY cupping therapy devices, resistance exercise bands and a tiny feather-duster to clean your keyboard.

At any one time, Chinese company Shein has more than 250,000 products in its “women’s clothing” category and about 6700 products are added each day, according to Swiss sustainability advocacy group Public Eye.

When the low-cost international delivery arrives at your door, you might be disappointed by the paper-thin feel of the 17 clothing items you purchased for $200.

Yet, it will probably look good posed up in a TikTok video or Instagram photo, and maybe that is all that really matters. It is all that matters to Shein, anyway.

The fast-fashion retailer has been valued about $100 billion, and it could not have done it without TikTok.

“I don’t think they could have gotten out of China, and become popular in the West, that easily without TikTok. Shein was never going to be what it is now without social media,” UTS fashion researcher Mark Liu said.

“Shein has been able to embed its own influence in social media … It’s no longer about the clothes themselves. They feel really cheap. You only need to find your size insofar as it looks like it fits in a TikTok video.”

The “fashion apex predator” is attempting to secure $1 billion in funding from large US investors after receiving its $100 billion valuation, Bloomberg reported this week.

This valuation is more than the market value of Inditex (which owns Zara) and H&M - the world’s two biggest clothing companies - combined.

Shein, which took market share during the pandemic when we could only flaunt new clothes via social media, is more Amazon or Alibaba than Zara or H&M.

“H&M and Zara are fast fashion, that’s what they do. Shein are doing search engine optimisation, they are embedding sales into social media by dressing influencers who already have an audience. It’s new and novel. It’s a totally different animal,” Dr Liu said.

Shein orders small amounts of many clothing items from its manufacturers. It then dresses TikTok influencers and waits to see which designs go viral. It then produces lots of that item quickly and cheaply, and ships it directly from the factory floor to the consumer. Rinse and repeat.

“From a valuation point of view, they’re a hybrid of a tech company and a fast fashion company. They’ve managed to straddle Asia and the West. They’ve grown and now they’re going in on Western venture capital … It’s something remarkable from a business perspective and slightly terrifying from an environmental perspective," Dr Liu said.

Although Shein is about as transparent as a black hole about its environmental and labour practices, the billions of views on TikTok’s #SheinHaul suggests the production of these often single-use clothes is too loved to change.