Generational success due to good advice

Through five decades and three generations, a Bunbury-based drilling company has thrived and prospered with help from their Chartered Accountant.

-

-

Now in the hands of the third generation, the Bunbury-based, family-owned BDC Drilling has tackled the often vexed issue of succession planning head-on.

As family enterprises age, it’s common for them to disintegrate as family members adopt different priorities or decide their interests lie elsewhere.

But BDC executive director Jason Linaker says the key to family business longevity is not to shoehorn younger members into management roles, but to enable them to participate as passive shareholders or perhaps not all.

“Any family business has its challenges, so it’s important to put that formality around them so everyone knows where they are going,” he says.

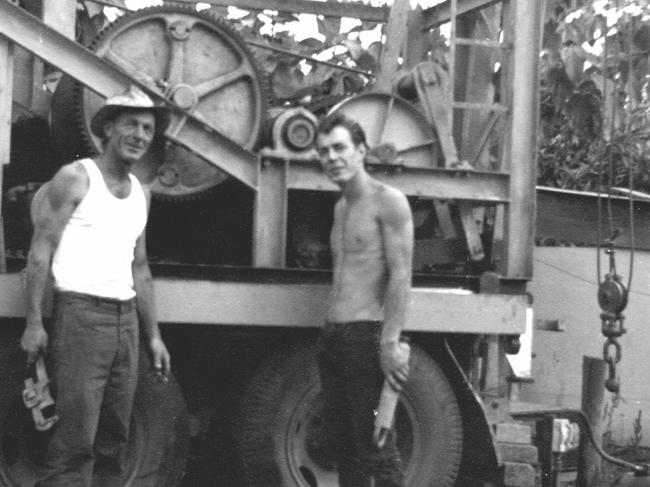

Originally known as the Bunbury Boring Company, BDC was founded in 1955 by patriarch Len, who fashioned his first rig from a three horsepower Ronaldson-Tippett petrol-kerosene motor, then commonly used in agriculture.

By drilling through the town’s hard basalt geology, the company secured Bunbury’s water supply. Business boomed and the company expanded from the civil sector to resources.

Len retired in 1983, handing over to his son Brian, who in turn retired in 2010 and ceded joint control to his sons Stephen and Jason.

For close to five decades, BDC has been guided by Chartered Accountant Stephen Down, a director of the long-standing Bunbury firm AMD Group.

The relationship runs much deeper than an annual financial check-up: Down chairs the BDC board and has worked with all three generations “in some shape or form”.

“I knew Jason when he was knee high to a grasshopper,” he says. “We have seen the transition from grandfather to father, to the sons and recently the change of one son [Stephen] to a non-executive director and joint owner.”

Jason, 52, says that as BDC grew it became apparent that family members did not need to work in the business to be owners.

Jason didn’t join the business full time until he was aged 25, initially working on the rigs during holidays while completing a business degree. He also owned and managed a music store, Disk Connections. His older brother Stephen joined BDC as a school leaver in 1983, but retired in 2018.

“Steve [Down] has certainly assisted with that and made us see the importance of planning ahead,” Jason says.

“We have grown to a point where we are corporatised enough to understand you put the best people in the role. We have built an excellent management team that has helped us maintain a long period of year-on-year growth.”

Another key to BDC’s success has been prudent financial management – as guided by Down – including investing in technology and diversifying revenues to counter the West’s perennial boom-and-bust resources cycle.

“We are a fairly conservative family in terms of our tolerance for risk,” Jason says. “I wouldn’t sleep very well at night if we had the same levels of debt as a lot of other businesses in our sector.”

Down says succession planning was helped by a rigorous approach to corporate governance and a well-documented shareholder agreement.

The business does not depend on any individual family member, allowing it to continue to prosper even if current directors became incapacitated or decide to divest.

“Over the years there has been a lot of trust between the family and myself, which enabled Stephen to stay as director, but retire from the day-to-day operations knowing that he has good communication back into the company,” Down says.

“Unless you have that trust and understanding it can become difficult, especially if the right checks and balances aren’t put into place.”

With annual turnover of around $30m-40 million, BDC remains a water well drilling specialist but is heavily involved in resources activities, such as dewatering Pilbara iron ore mines for top-tier miners.

Down provided invaluable advice on the creation of a second family business, kwik-ZIP, which produces patented casing centralisers and pipeline casing spacers for production wells and pipeline construction.

Working on a ‘virtual’ basis principle with outsourced manufacturing, overseas distribution and warehousing, kwik-ZIP exports to countries including the US and Britain and is deployed by major Australian water utilities.

“It’s an offset to the ups and downs of the drilling industry,” Jason says.

Via AMD’s overseas affiliate network BKR, Down helped kwik-ZIP navigate tricky issues such as foreign exchange and Britain’s value added tax.

Down, 67, represents some of the largest organisations in WA’s south west and has helped many of them grow from small businesses to larger state-based, multi-site companies.

“Everyone thinks of chartered accountants as numbers people, but it is about people and relationships,” he says. “Numbers take care of themselves and technical accounting skills – while important – should be a given.”

Jason adds: “I don’t think Steve Down could do the role he does without knowing the entire family as well as he does.”

Given Jason and Stephen have five adult children between them, BDC could pass to a fourth generation of Linakers.

“But we don’t necessarily see our children working in the business in a full-time role,” Jason says.

“The maturity of the business is such that that doesn’t preclude them from taking part and being the owner at some point in future.”

-

This content was produced in association with Chartered Accountants ANZ. Read our policy on commercial content here.