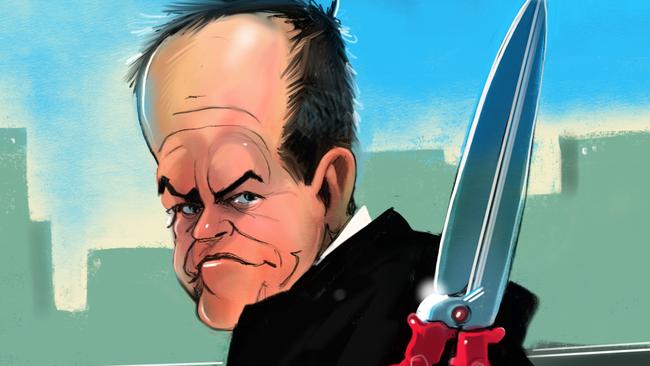

The debate about company taxes during this election campaign — should they be cut or should they stay where they are — highlights exactly what’s wrong with modern politics. Oppositions oppose what they once supported for base political advantage. Tony Abbott did it previously and Bill Shorten is doing it now.

In the budget handed down last month, the government outlined a 10-year plan to reduce company taxes in stages, starting with small businesses before eventually applying the cut to all businesses. Despite having proposed a company tax cut of the same quantum (albeit limited to small businesses) in his budget reply speech last year, Shorten has sought to paint the Coalition’s plan as a sop to the business community.

The attack fits neatly within his wider attempt to divide the community along class lines. If you doubt this characterisation of Labor’s campaign tactic in this election, consider how personally Malcolm Turnbull’s wealth is being targeted. An advertisement attacking cuts to health and education starts with a picture of Turnbull and the words “Maybe it’s because he never had to rely on these services”.

If the contradiction by Labor on company tax cuts ended there, we simply could put it down to politics — both sides backflip when they see an advantage in doing so. But the Labor retreat on company tax cuts is more brazen because its finance team has long argued in favour of such cuts, for exactly the same reason Turnbull is now.

None other than Chris Bowen — the man who would be treasurer, henceforth charged with implementing Labor’s economic blueprint if Shorten becomes prime minister — is in favour of company tax cuts. Or he was until very recently.

In his book Hearts and Minds, Bowen wrote: “It’s a Labor thing to have the ambition of reducing company tax, because it promotes investment, creates jobs and drives growth.” The book was spruiked by the publisher as Bowen’s vision for a better

Australia.

Opposition assistant Treasury spokesman Andrew Leigh told me last year on Sky News: “We know the company tax rate is a significant drag on growth, largely because capital is more footloose than labour and so there’s potential for us to miss out on high-quality investment if we have too high a company tax rate.”

Leigh is right. When Paul Keating, followed by Peter Costello, cut company taxes, Australia then had one of the lowest rates in the OECD. Today, we have one of the highest.

Lower company taxes stimulate investment. To take advantage of our geographical location we need to remain competitive, and attractive conditions for business do just that. But don’t take my word for it.

When Labor was last in government its finance minister at the time, Penny Wong, now opposition leader in the Senate and Labor’s campaign spokeswoman, said: “We understand that the cut in the corporate tax rate is important to increase productivity, to promote broad-based economic growth and to encourage more investment and jobs across Australia.” Jobs and growth is the Coalition’s slogan.

Labor now wants to suggest that company tax cuts don’t benefit workers, but the former head of the Department of the Treasury, Ken Henry, who also drafted Kevin Rudd’s tax reform paper, has said: “The consensus of public finance theorists is that in Australia, if the company income tax were to be cut, the principal beneficiaries will be workers.”

If you don’t believe Henry, maybe Leigh can convince you of the link between the company tax rate and the workforce. Before Labor flipped to oppose company tax cuts, Leigh wrote in The Australian Financial Review: “In a recent review of the literature, William Gentry (Williams College) concludes that most of the impact of a corporate income tax rise falls on workers. Increase company taxes by 10 percentage points, and wages fall by 6-10 per cent.”

Leigh wrote that in the countdown to the 2010 election, when Labor was campaigning on cutting company taxes. The slogan as to why doing so was necessary? For jobs and growth. Sound familiar?

Labor now argues that a higher company tax rate won’t leave workers worse off.

This week on Sky News Leigh didn’t back away from his past observations, because apparently the benefits for workers won’t be felt for years.

For some reason that didn’t matter back then but, hey, things change, I suppose. I’d have thought the lag time sounds like a good reason to get on with the cuts. Either way, it’s ironic that Labor is serving up 10-year costings forecasts to mask the imbalance in its books across the traditional four-year forward estimates, yet similarly long-term projections about company tax cut effects are too far off to secure Labor’s support.

So Labor’s finance team, once united in favour of company tax cuts, is now united against them.

In an era of presidential-style politicking, its collective backflip could be forgiven if it simply is playing follow the leader. Shorten opposes company tax cuts, other than one rhetorical overreach in his budget reply speech last year, so everyone else in Labor must follow suit.

Wrong. In a speech to the 2011 Australian Council of Social Service national conference Shorten said: “Friends, corporate tax reform helps Australia’s private sector grow and it creates jobs right up and down the income ladder.” Up and down the income ladder.

That was then; now, Shorten seeks to paint company tax cuts as all about helping big business, even though Turnbull’s cuts start with small business.

John Maynard Keynes once said: “When the facts change, I change my mind. What do you do, sir?” Too often in politics this important caveat is disregarded in the name of consistency. However, the Keynesian defence doesn’t apply to the company tax backflip. Debt was an issue when Labor advocated cuts, and it’s still an issue. The fragility of the economy was evident then, as it is now. The need to stimulate jobs and growth was a priority then, just as it is now, which is why the rhetoric Labor used is so reflective of the rhetoric coming from the government today.

Why does Labor now oppose company tax cuts? For political advantage, nothing more — using the Coalition’s support for such cuts to paint it as only looking after business.

Peter van Onselen is a professor at the University of Western Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout