House values won’t show turnaround until 2020, experts say

CoreLogic has joined the list of property analysts downgrading their outlook for the housing market.

CoreLogic has joined the list of property analysts downgrading their outlook for the housing market, with head of research Tim Lawless predicting values in Sydney and Melbourne will fall 18-20 per cent from peak to trough.

“It’s a buyers’ market,” he said.

Mr Lawless had previously expected a 15 per cent drop in values for the two cities. CoreLogic joined the chorus of economists and commentators who have voiced increasingly pessimistic expectations for 2019, with most not expecting a turnaround in housing until well into the following year.

AMP chief economist Shane Oliver downgraded his forecast to a 25 per cent drop in Sydney and Melbourne housing prices from the market’s top to bottom, worsening from his previous prediction of a 20 per cent fall.

Investment bank Credit Suisse also predicted a 25 per cent peak-to-trough fall for Sydney.

National Australia Bank was less pessimistic, expecting housing prices to drop 15 per cent over the cycle in Sydney and Melbourne.

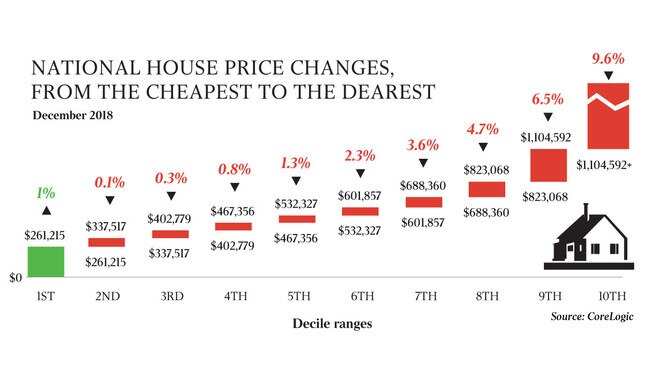

CoreLogic found last year only homes priced under $261,000 recorded price growth, with values around the country sliding 2.3 per cent in the final quarter and down 4.8 per cent over the year.

The lowest priced category of homes saw values lift 0.9 per cent for the quarter and 1 per cent for the year, CoreLogic’s Decile Report, which divides the market into 10 price bands, found. The top end of the market was hardest hit.

“The more expensive the property, the bigger the fall in value,” CoreLogic said.

It comes as potential for changes to negative gearing and capital gains tax policy from an incoming Labor government put strain on the residential market.

Squeezed credit supply is also hitting the market, with banks tightening lending ahead of the royal commission’s final report, due next month. Figures released by the Reserve Bank this month revealed lending to property investors was growing at its slowest rate in nearly 30 years.

Meanwhile, CoreLogic’s data showed over the past 12 months, properties valued at $1.1 million or more recorded the largest price falls. These homes fell by 9.6 per cent for the year and 4.2 per cent for the quarter, while the second-most expensive band of houses fell 6.5 per cent for the year and 2.8 per cent for the quarter.

“The trends across each decile suggest stronger housing market conditions are persisting across the most affordable end of the valuation spectrum, potentially being supported by a surge in first- home buyer activity,” Mr Lawless said.

Housing values in Sydney fell 3.9 per cent over the December quarter, the biggest quarterly drop since 1983. All price categories in Sydney recorded value falls, with not even the cheapest property escaping, CoreLogic found. None of the 10 bands saw a fall of less than 3 per cent over the three months.

In Melbourne, values fell by 3.2 per cent over the quarter.

Brisbane saw mixed results, with values increasing in the second, third and fourth price bands while overall values fell 0.1 per cent for the quarter. Hobart bucked the national trend last year with values rising 8.7 per cent.

More Coverage

Read related topics:Property Prices