Dark days for housing until 2020

Sydney and Melbourne’s beleaguered housing markets will not turn the corner until well into 2020.

Sydney and Melbourne’s beleaguered housing markets will not turn the corner until well into 2020 as confidence in residential property plumbs new lows.

Separate reports yesterday from the National Australia Bank and investment bank Credit Suisse tipped little respite for at least the next year.

Credit Suisse joined the ranks of the more bearish forecasters, tipping an overall 25 per cent fall in Sydney house prices.

The investment bank joined AMP, whose chief economist Shane Oliver this week downgraded his outlook to a 25 per cent drop in Sydney and Melbourne house prices through the cycle, worsening from his previous prediction of a 20 per cent fall.

National Australia Bank is less pessimistic, expecting housing prices will fall 15 per cent from the market’s peak to its bottom in Sydney and Melbourne.

However, NAB’s surveys found consumer and professional confidence in the country’s housing market had plumbed new lows in the final quarter of last year.

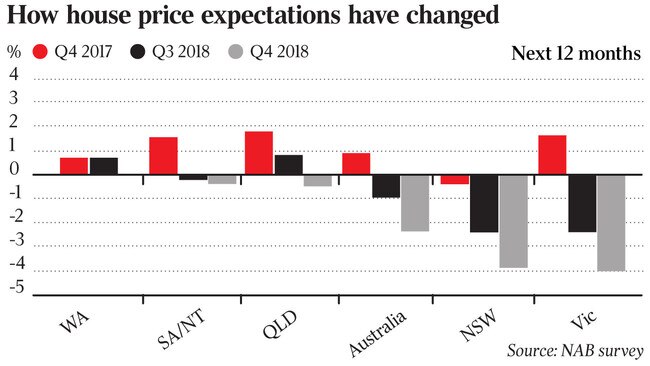

“Property professionals now anticipate much sharper house price falls in NSW and Victoria over the next one to two years but prices are also expected to fall or remain flat across the rest of the country,” the survey of 300 property professionals found.

NAB also sampled 2000 consumers on their attitude to the housing market and found consumers were less bearish than analysts and professionals.

In bad news for the economy, consumers largely plan to sit on their hands, with eight in 10 people saying they don’t plan to buy, sell or take out a mortgage this year.

The survey revealed a high level of uncertainty, with around four in 10 people saying they didn’t know if it was a good time to buy, sell or take out a mortgage.

“Overwhelmingly, the majority plan to sit tight and do nothing,” NAB chief economist Alan Oster told The Australian.

Consumers thought the pace of housing price falls would ease this year, expecting home prices in NSW to drop 3.1 per cent, with Victoria to be down 2.9 per cent. Around the country prices were expected to fall 2.1 per cent.

Researcher CoreLogic has put the fall in values for Sydney at 11.1 per cent from the July 2017 market peak, with Melbourne values falling 7.2 per cent.

Meanwhile, Credit Suisse believes the earliest Sydney’s housing market will level out is in the second half of next year, unless there is a cut in official interest rates or a government stimulus directed at housing.

“We could easily see detached house prices fall by another 10 per cent, having already fallen roughly 15 per cent from their late 2017 peak,” Credit Suisse said.

The investment bank expected the Reserve Bank to drop the cash rates, saying in its note that “the next move in rates will be down rather than up”.

While the amount of new housing development was slowing rapidly, Credit Suisse said another 30 per cent drop in housing construction on top of expected declines would be needed to bring the market back into balance.