Your noon Briefing: Aussie stocks plunge after Wall Street falls

Welcome to your noon digest of what’s been making news and what to watch for.

Hello readers. Here is your noon digest of today’s top stories and a long read for lunchtime.

Stocks plunge

Australia’s S&P/ASX 200 share index dropped 2.2 per cent to a five-month low of 5918.3 in early trade after sharp falls on Wall Street overnight. The falls took the index below the 6000-point mark for the first time since early June, and it is down more than two per cent in the year to date, having fallen seven per cent from a decade high of 6373.5 in late August.

-

US detains alleged tech spy

An alleged Chinese intelligence operative arrested in Belgium has been brought to the US and charged with conspiring to steal trade secrets from GE Aviation and other American aviation and aerospace companies, marking a rare break for the US in its increasingly aggressive effort to target Chinese industrial spying.

-

‘More than Tim Tams’

Chris Bowen has told the Outlook conference that COAG is a key economic body and “about more than the consumption of biscuits”, and would be part of a Shorten government’s economic program. Follow the conference in our live blog.

-

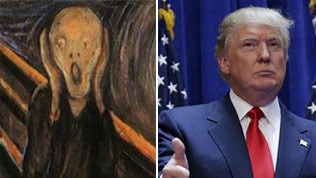

Trump’s crazytown

Whom the gods would destroy, they first make mad, we are told by the ancients. Donald Trump is no one’s idea of a god but his ability to reduce his opponents to wailing, gibbering husks, like demented characters in a Greek tragedy, seems increasingly Olympian in its reach, writes Gerard Baker.

-

The long read: Capitals crunch the numbers

Everyone’s jumping on the smaller Australia bandwagon, writes Adam Creighton, but our nation’s key cities aren’t as overpopulated as some experts claim.

“ ‘It’s time to tap the brakes,’Gladys Berejiklian wrote in The Daily Telegraph yesterday. In truth, it’d be more like driving 100km/h and stomping on the pedal with both feet.”

-

Comment of the day

“The taxpayer will be out of pocket somewhere between $30 and $60 billion after this project is finally sold to the only telco that should, and would be able to buy it. Unless of course our agenda driven Senate wants Chinese interests to operate our telecommunications.

“Australia’s future will be forever driven by progressive, slogan driven politics that delivers very little for the taxpayers dollar.”

John, in response to Telstra ‘could buy NBN for a song’.