Turnbull delivers on historic income tax cut reforms

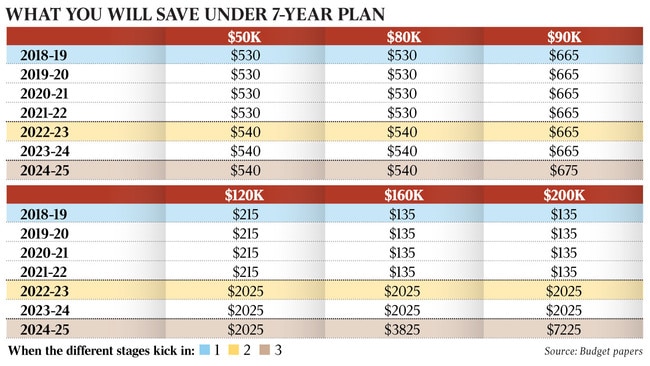

Malcolm Turnbull secures the most significant tax reform since the GST but he now faces a new battle | WHAT YOU SAVE

Malcolm Turnbull secured the most significant tax reform since the GST when the Senate passed $144 billion in personal income tax cuts for 10 million Australians but the Prime Minister faces a new battle in the Senate next week over company tax cuts.

Mr Turnbull will now lead the Coalition into the critical Super Saturday July 28 by-election battles with the most significant political victory of his leadership under his belt.

More than 160,000 voters in three seats the Coalition will contest — Mayo in South Australia, Longman in Queensland and Braddon in Tasmania — will receive tax cuts of up to $530 a year after Pauline Hanson and One Nation colleague Peter Georgiou voted with the government to pass the historic reforms.

Mr Turnbull accused Bill Shorten of being the enemy of aspiration as the Labor leader was locked in to an election platform of repealing at least $70bn of the government’s personal income tax cuts. But the victory could come at the cost of the company tax cut reforms.

Senator Hanson, who secured a guarantee from the government that it would examine her plan for regional apprenticeships, said the government would have to deliver more action on multinational tax avoidance if she were to consider supporting the remaining company tax reforms, which would cut the rate from 30 per cent to 25 per cent for all businesses.

“If they come to me and say, ‘We’re going after multinationals, we’re going to get — heaven help us if we can get it — about 100 billion out of them’ or something like that, then we’ll sit down and talk,” the One Nation leader said.

Finance Minister and Senate leader Mathias Cormann, who has been credited by colleagues for securing nine crossbench votes needed for the personal income tax cuts, said he would not give up on having company tax cuts passed next week.

Mr Turnbull described the personal income tax plan as a historic reform. “This is the most comprehensive reform of personal income tax in a generation,” he said. “It is fair, it rewards and encourages enterprise, it encourages and enables aspiration. That is what this is all about. Above all, it says to Australian families: we believe in you. We want you to keep more of the money you have earned. It is not the government’s; it is yours.”

The Business Council of Australia said the passage of the income tax cut bill represented an important first step on tax reform.

BCA chief executive Jennifer Westacott said the changes preserved the progressive nature of the tax system while rewarding aspiration and effort. Ms Westacott said company tax cuts were the second crucial element of the tax reform task. “Personal and company tax reform done together is good for workers, good for jobs and good for the economy,” she said. “Now is the time to turbo charge the economy.”

GRAPHIC: Change in household tax paid

With Mr Shorten coming under sustained pressure in parliament this week, he accused the government of “teaming up with Pauline Hanson to give themselves a $7000-a-year tax cut”. He claimed the tax cuts were “unfair and unaffordable”.

Labor’s policy is aimed at delivering deeper tax cuts for low-income workers.

The price for One Nation’s support for the personal income tax cuts was a government commitment to examine a new regional apprenticeship program.

The reforms, which were signed into law yesterday after Senator Cormann rushed to Government House following the vote to get royal assent, are due to begin on July 1. They will start with a new low- and middle-income tax offset worth up to $530 a year as a lump sum rebate and a lift in the 32.5 per cent tax top threshold from $87,000 to $90,000.

From July 1, 2022, the existing low-income tax offset would increase from $445 to $645. The threshold for the 19 per cent tax bracket would rise from $37,000 to $41,000 while the 32.5 per cent tax bracket would extend from $90,000 to $120,000.

Two years later, the 37 per cent bracket would be abolished and the 32.5 per cent tax bracket pushed out to $200,000.

Scott Morrison rejected Labor’s claim the government was delivering a tax cut to the wealthy.

“There’s millions of people obviously paying tax and particularly in those brackets that go up to about $120,000 — that’s where the bulk of Australians are,” the Treasurer said. “It’s only 4 per cent of Australians who are actually in the top tax bracket but they pay 30 per cent of the tax. Now, at the end of this plan they’ll actually pay 36 per cent. So this idea that it’s all beer and skittles for high-income earners, actually no. They’ll end up paying an even greater share.”

Mr Shorten denied he was engaging in a class war despite Labor having launched a phone campaign in Longman demonising Mr Hanson as a patsy for the big end of town for backing the tax cuts.

Labor, which had originally voted for the government’s cuts in the lower house, claimed it was prepared to back only the first phase of the government plan, with its own policy designed to deliver up to $900 for the lowest paid workers. The Opposition Leader then accused the government of having no plan to pay for it.

He said it was “not class war” to demand bigger tax cuts for the majority of workers and more funding for school and hospitals.

Senator Hanson, whose preferences in Longman are likely to decide the by-election’s outcome, hit back, describing Mr Shorten as a leader who would be the worst prime minister the country had seen if he were elected.