Malcolm Turnbull labels income tax reform as ‘a win for Australian families’

The PM sells his legislated income tax reforms, saying the richest Australians will continue to pay the most.

Malcolm Turnbull has said the richest Australians will continue to pay the most tax under his legislated $144 billion personal income tax reforms, insisting the changes focus on helping lower and middle-income earners.

“Those on higher incomes actually pay more of the total tax take under our reforms than they do today,” the Prime Minister told ABC Radio this morning.

“This is what people have been talking about for years, having a tax system that is flatter, simpler, fairer and lower taxes and this is all targeted at low- and middle-income earners.”

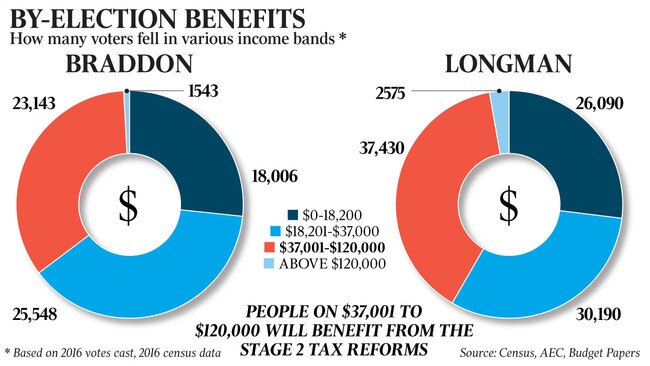

Mr Turnbull said voters had a choice between the government’s tax cuts and Labor’s policy to deny cuts to high-income earners at the five “Super Saturday” by-elections on July 28.

“Of course, these competing tax policies will certainly be key issues in those by-elections,” Mr Turnbull told the ABC in answer to a question.

He said the Labor Party had failed to come up with an alternate tax plan to ensure a strong economy.

“The Labor Party, which used to be the party which said it was delivering and working for aspirational Australians, now says aspiration is a mystery. Chris Bowen must wonder why he is in politics at all. Labor has abandoned the people the Labor Party was founded to support and protect. They’ve abandoned aspirational Australians.”

The government leadership has hit morning TV and radio to sell the new income tax package, which was passed by the Senate and signed into law yesterday, and is due to begin with the new financial year from July 1.

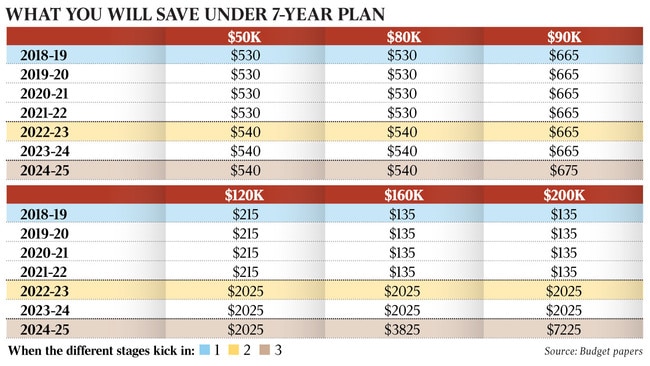

The changes will begin with a new low- and middle-income tax offset worth up to $530 a year rebate and a lift in the 32.5 per cent tax top threshold from $87,000 to $90,000.

The Prime Minister said he was hopeful the country’s economic progression could lead to an earlier implementation of the later scheduled tax reforms.

“I would love to think that we would be able to bring some of these tax cuts forward if the economy and if the budget enables it, but what we are committed to is long-term, comprehensive tax reform.”

Bill Shorten yesterday accused the government of “teaming up with Pauline Hanson to give themselves a $7000-a-year tax cut”. He claimed the tax cuts were “unfair and unaffordable”.

Labor’s policy is aimed at delivering deeper tax cuts for low-income workers.

This morning Scott Morrison also lashed out at suggestions the tax cuts were weighted in favour of higher-income earners, saying he refused to play a “class envy, populist game”.

The Treasurer said the policy was beneficial to taxpayers across the board.

GRAPHIC: Change in household tax paid

“The progressivity of our tax system is not under threat because what we’ve done is ensure everyone in Australia who works, they all work hard, they all pay tax and they all deserve tax relief and we shouldn’t be hitting others harder in higher taxes to play some class envy, populist game to try and appeal to those who are on lower incomes,” Mr Morrison told ABC Radio.

He said Mr Shorten was engaged in an “absolute con” by promising tax cuts to lower-income earners but raising taxes on those who earn more.

“What he’s doing it putting the tax burden up,” Mr Morrison said.

“Higher taxes is not good for the economy, it costs jobs, it costs investment, it’s a weaker economy which ultimately undermines the guarantee he can provide for services like Medicare.”

- with AAP

Earlier: ‘A win for Australian families’

Malcolm Turnbull and Scott Morrison have labelled their new personal income tax reform as “responsible”, “fair” and “a win for Australian families”.

“This is a win for Australian families,” Prime Minister Turnbull told the Nine Network this morning.

“It would get rid of a while tax bracket, it results in a tax system that is fairer and simpler and encourages and rewards aspiration. I’ve heard the Labor Party say ‘we can’t afford it’ but it is all budgeted for. Hard working, Australian families are able to retain more of the money they earn, it’s their money, not the government’s.”

Treasurer Scott Morrison hit back against suggestions the tax cuts did not align with his “living within our means’ mantra.

“Well the revenue impact of this package actually comes in the year we actually bring the budget back into balance in 2019-20,” Morrison told Seven Network this morning.

“With these changes we are hitting our 1 per cent of GDP surplus over the same period of the plan, $30 billion in net debt is paid down over the next four years while putting this plan into place. So it’s responsible, it’s fair and it’s affordable.”

The Treasurer said: “you don’t have a stronger economy by jacking up taxes”.

“With all the best advice, and looking at everything that’s ahead, this is the right way to ensure that Australians have the right tax relief to give them incentive in the economy,” he said.

“The best defence against the shocks from overseas is a strong economy and you don’t make your economy stronger by taxing people more.”

Finance Minister and Senate leader Mathias Cormann reiterated the benefits of reforming the current tax system and removing an entire tax bracket.

“We want lower and middle income earners of course to continue to move up that income scale, but we don’t want Australians, just because either through inflation or additional overtime or because they’ve got a better job, we don’t want them to just continue to be pushed into higher tax brackets which is a disincentive which would take them backwards,” Mr Cormann told ABC News this morning.

Pauline Hanson’s One Nation provided two crucial votes in support of the reform yesterday, and when asked what Senator Hanson received in return for her support Mr Cormann said: “She got the passage of lower, fairer simpler taxes for working Australians in return, which is of course a huge achievement which she contributed to.”

He continued however to confirm that Senator Hanson also secured a government commitment to examine a new regional apprenticeship program.