‘Worst-case’ gas bills and worse ahead

Gas prices on the east coast are already at their worst-case scenario and retailers are set to raise them a further 20 per cent from next month.

The most competitive household gas prices on the east coast are already as high as Jim Chalmers’ worst-case scenario, as retailers hike prices by a further 20 per cent from next month.

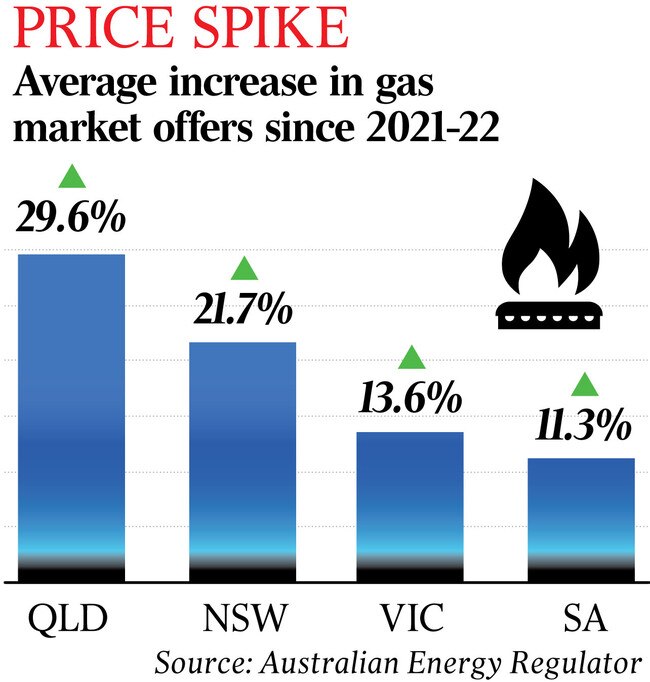

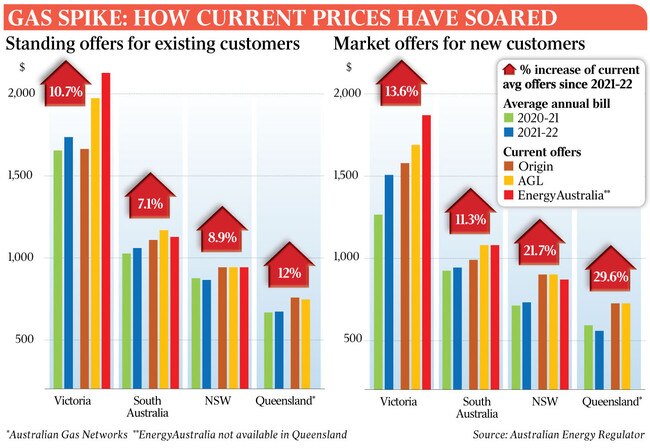

The Australian’s analysis of current market offers from Origin, AGL and EnergyAustralia shows prices have increased by 30 per cent in Queensland, 22 per cent in NSW, and 19 per cent averaged out across those states, Victoria and SA over the past year.

Households are set to come under even more pressure, with EnergyAustralia on Tuesday announcing its residential gas customers in Victoria on variable market contracts would see their bills increase by an average of 26.7 per cent from February 1.

Origin and AGL last week said their rates would increase by 22.1 per cent and 21.4 per cent respectively from next month.

Announcing Labor’s price cap on wholesale gas last month, the Treasurer warned that without action, retail gas prices were expected to increase by 20 per cent in both 2022-23 and 2023-24, “with the majority of the gas price increase for this year having already occurred due to global energy shocks.”

“With these policy interventions, Treasury now forecasts that retail gas prices would rise by around 18 per cent this financial year, with most of this increase having already occurred, and by around 4 per cent in 2023-24 – rather than 20 per cent in each year,” Dr Chalmers said on December 9.

The price revelations come as top gas producers say they won’t finalise new supply contracts for 2024 until the Albanese government unveils its controversial mandatory code of conduct.

The government failed to ease industry concerns about its energy market intervention after the consumer watchdog released new compliance guidelines for the temporary gas price cap on Tuesday. Gina Rinehart-controlled Senex warned that uncertainty over the mandatory code of conduct could hobble gas deals spanning nearly two decades.

Industry Minister Ed Husic accused gas producers, who said uncertainty over the policy had paralysed the market, of “having a bit of whinge” and being addicted to “Putin profits”.

“There might be some who are addicted to the Putin profits they are making and they are going through withdrawal symptoms but they should be under no illusions about the determination of the government to get the balance right in terms of pricing,” Mr Husic told Sky News.

“They were making big profits even at half of this gas price cap of $12. They were still doing very well, thank you very much. They can still do very well, thank you very much. But again as a government we’ve got to get the balance right, not just for the gas companies making the big profits but for other business that are dependent on gas as well.”

The Australian revealed on Monday many smaller retailers were not taking new residential gas customers, and AGL had ceased signing up new commercial and industrial customers after struggling to secure ongoing supply from producers following the Albanese government’s imposition of the price cap.

Ai Group climate and energy adviser Tennant Reed said he did not believe the cap would have put any downward pressure on household gas prices at this stage.

“Retailers will have been pricing offers to household customers based on either, ‘we don’t think we can secure more gas’, or ‘circumstances haven’t changed’, Mr Reed said. “That might start moving quite rapidly with the greater clarity that the upstream suppliers ought to have, especially after this afternoon’s document from the ACCC.”

Mr Reed said the price cap was likely to have a significantly lower impact on prices for households than on the wholesale market.

Explaining the latest price hike on Tuesday, EnergyAustralia chief customer officer Mark Brownfield said: “Recent government actions are focused on the wholesale gas price for future contracts. We supply customers from our existing wholesale gas contracts, some of which were contracted during 2022.”

Gavin Dufty, general manager of policy and research at St Vincent de Paul, warned of delayed and extreme bill shock in the middle of this year, when increased winter heating costs were likely to coincide with hikes in mortgage repayments and other key household expenses.

“After switching on their heaters, people will be falling off their chairs with the size of the bill,” said Mr Dufty, also an Energy Users Australia board member.

“What we’d be saying to people is when you get that notice that your prices are changing for gas, please make sure that you’re on the best-worst deal that’s out there. They’re all bad at the moment, but getting a better deal will save you hundreds of dollars.”

The Australian’s analysis of current offers from the big three retailers — which between them hold more than 75 per cent of the east coast energy market — shows standing offers have increased by a smaller margin than market offers when compared with average annual household gas bills, as calculated by the Australian Energy Regulator, for the 2021-22 financial year.

Standing offers are the higher, less competitive rates retailers apply to customers who do not shop around — with minimum terms and conditions set by regulators, including that they can only be changed every six months.

Market offers are the more competitive deals retailers use to lure new customers.

Standing offers in Queensland have increased by an average of 12 per cent, by 11 per cent in Victoria, 9 per cent in NSW and 7 per cent in South Australia averaging out to 10 per cent across the four states.

Grattan Institute climate and energy program deputy director Alison Reeve said the fact that Victoria and South Australia do not export gas internationally had played a role in limiting hikes in the market prices in those states.

“NSW doesn’t export either, but it does import more from Queensland than Victoria does,” Ms Reeve said.

Volume also played a role in tempering price rises in the colder southern states.

Victorian households use an average of almost 50,000 MJ of gas annually, compared with 7200 MJ in Queensland.

A spokesman for Energy Minister Chris Bowen said the government had been “extremely concerned about the sustained pressure to global energy markets, cause by Russia’s illegal invasion of Ukraine – that has pushed gas and coal prices to unprecedented levels all over the world.”

“In Australia, that’s made worse by nearly a decade of division, inaction and policy uncertainty on climate and energy under the Liberals and Nationals, which has left Australia overly exposed to these international fuel prices,” the spokesman said.

“That’s why the government took urgent action with the states and territories a few weeks ago to deliver the energy price relief plan, which will shield Australians from the worst impacts of price increases, and deliver responsible and targeted relief to families, small businesses and manufacturers.

“If we didn’t take this urgent action – the average family would be $230 worse off this year.

“We expect gas producers to act promptly to implement the price cap. The ACCC has released its compliance and enforcement guidance and is closely monitoring the behaviour of gas producers to ensure it is consistent with their obligations under the temporary price cap and the (Australian Domestic Gas Security Mechanism), and is ready to exercise its enforcement powers if it becomes aware of any contraventions of the price cap – especially if they become aware of any conduct intended to circumvent the price cap.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout