Warning on gas deal delays and blackouts

Leading gas producers say they won’t finalise new supply contracts for 2024 until the Albanese government unveils its controversial mandatory code of conduct

Leading gas producers say they won’t finalise new supply contracts for 2024 until the Albanese government unveils its controversial mandatory code of conduct, as confusion over the wholesale gas price cap triggers opposition claims there could be rationing and blackouts.

The government failed to ease industry concerns about its energy market intervention after the consumer watchdog released new compliance guidelines for the temporary gas price cap on Tuesday, with the Gina Rinehart-controlled Senex warning uncertainty over the mandatory code of conduct could hobble gas deals spanning nearly two decades.

“Until our shareholders understand the full range of regulatory risks introduced under this new legislation, they are unable to make an investment decision, and … Senex cannot sell gas that flows from that investment,” a Senex spokeswoman said.

“The new laws and lack of clarity to date around the mandatory code have made it impossible to contract with confidence, and (this) puts Senex’s investment, and therefore new gas supply to homes and industry, at risk.”

Like Senex, Woodside was reviewing the Australian Competition & Consumer Commission’s guidelines on the gas price cap but said it would wait to see the details of the mandatory code of conduct before finalising sales agreements for 2024.

“Woodside remains in discussions with buyers for sales agreements pertaining to 2024 and beyond, that were ready to be executed in late 2022,” a company spokeswoman said.

The ACCC has warned it will punish gas producers with substantial fines if they withhold supply from the domestic market. Its guidelines, released on Tuesday, confirm it will be watching out for any deals designed to avoid the $12-per-gigajoule price cap, which applies only to uncontracted wholesale gas sold this year.

Such deals would include producers raising prices by linking supply deals to commodity and inflation costs; setting up contracts based on high demand periods; and variable deals based on take or pay provisions. The regulator will also police extra add-on costs, such as transport and supply, being added to tariffs.

Energy Minister Chris Bowen said the new ACCC guidance meant gas producers now had “no excuse not to get on with supplying the energy Australian businesses need”.

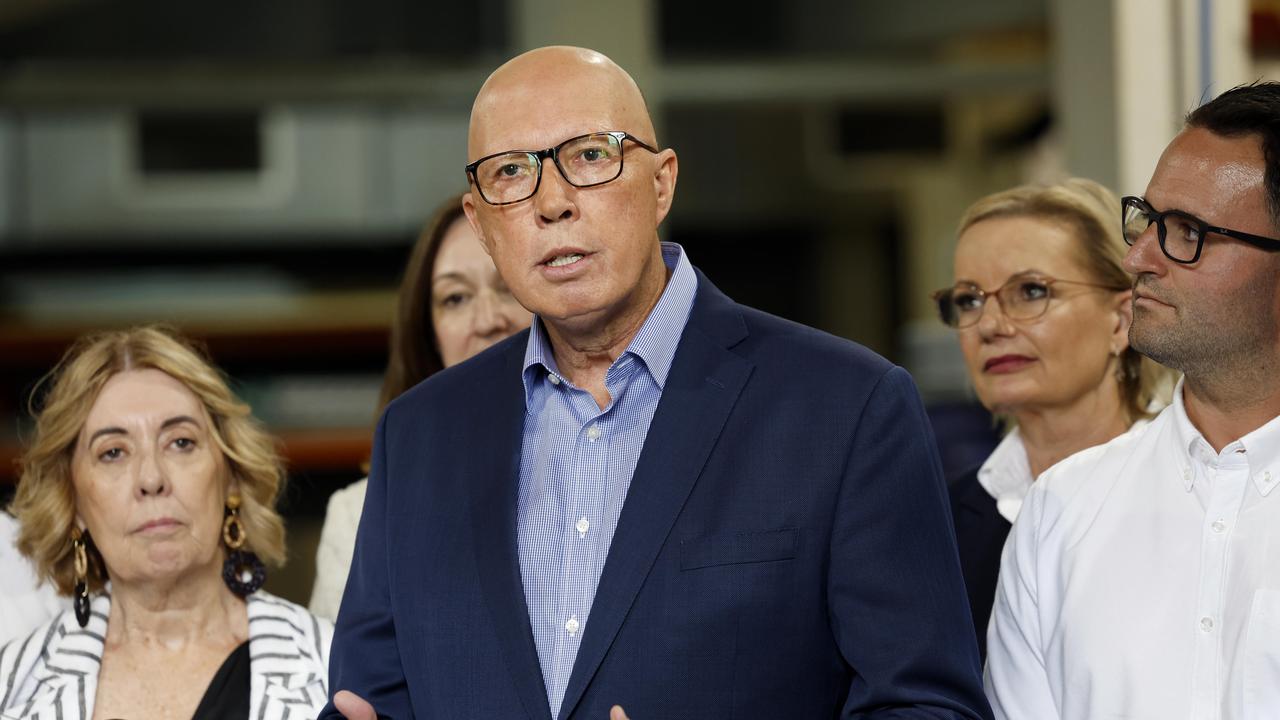

The pushback from Woodside and Senex came as opposition finance spokeswoman Jane Hume said the gas price cap – which has been in place since December 23 and will be reviewed mid-year – and a mandatory code of conduct could lead to energy rationing and gas shortages.

“We’re already beginning to see that. Experts are telling us just in the last couple of days that price-fixing leads to gas shortages, gas shortages can potentially lead to rationing, (which) can potentially lead to blackouts,” Senator Hume said.

“That’s going to affect not just Australian consumers but Australian manufacturers and retailers and the economy as a whole. The best way to lower the price of gas is to increase the supply of gas. That was the Coalition’s objective through its national gas infrastructure plan. Experts are saying Labor should be adopting it.”

Her comments were based on analysis from Credit Suisse energy expert Saul Kavonic, who cautioned there’d be a “grinding to a halt of almost all contracting behaviour” from 2024 when the mandatory code of conduct and “reasonable price” mechanism was operational.

But Mr Bowen lashed the Coalition’s record on energy policy, saying it had failed to deliver its promised gas-led recovery and created a “gas bin fire” after nine years in power.

“The opposition had a choice, and instead of voting to shield Australians from skyrocketing power prices due to Putin’s illegal invasion of Ukraine, they voted for higher energy prices and no help for families and businesses doing it tough,” Mr Bowen said.

Consultation on the mandatory code of conduct, which could result in a requirement for gas to be permanently sold at a reasonable price, ends in early February.

While the peak gas industry body said Labor’s market interventions were making it “harder and harder” to ensure domestic supply for the east coast, the Australian Industry Group said the ACCC’s “clear” gas price cap guidance should provide a firm basis for 2023 gas deals among any market participants that were not yet fully contracted.

“Suppliers acting in good faith have a clear run. If any anomalies remain, they are likely to be both very niche and quickly clarified,” said Ai Group chief executive Innes Willox, who represents gas-intensive industries.

“The best solution to all of this is to increase gas supply. Sadly, governments at all levels appear for now incapable of making the decisions to give us all gas at a long-term affordable price.”

Producers said the ACCC’s narrow guidance on price caps showed they were right in holding off striking new deals for 2024 and beyond, saying they may have potentially and unknowingly been non-compliant with the watchdog’s advice.

Jim Chalmers conceded the government’s market intervention was a “relatively substantial thing” but was the “best available” solution to reduce household energy bills after considering all options. “Inevitably, not everybody wants to have their prices capped and so there will be a bit of back and forth as we bed it down and people get their heads around it,” the Treasurer told the Today show.

Australian Petroleum Production and Exploration Association chief executive Samantha McCulloch said it was important the industry could ensure supply for its customers and understand the rules of the game.

“With fines of up to $50m possible, we want to also ensure we are complying with these rules that … are still being defined by the government,” she said.

“APPEA and its members have been seeking clarification from the government on a number of questions and issues.”

Energy Users Association chief Andrew Richards said he hoped the industry could move forward with deals and customers would start to see downward pressure on gas prices.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout