Worst hit to superannuation since Global Financial Crisis as market losses mount

Workers face losses on their super funds for only the fifth time in three decades, as the market sheds $270bn since June 7 rate hike.

Australian workers face losses on their superannuation funds this financial year for only the fifth time in three decades, as fears about rising US interest rates took losses on the Australian sharemarket to more than $270bn since the Reserve Bank’s rate hike on June 7.

The All Ordinaries sharemarket index fell a further 1.8 per cent on Friday, its sixth consecutive day of losses, as shockwaves from the US Federal Reserve’s decision to raise rates by 0.75 percentage points on Thursday spooked international markets.

Global investors have become increasingly convinced that the US Federal Reserve’s “do whatever it takes” approach to taming 40-year highs in inflation will drive a global downturn next year.

NAB chief economist Alan Oster said the world’s largest economy could plunge into recession next year.

“Very rarely does a boom kill itself; nearly always it gets killed by the Fed,” Mr Oster said.

NAB’s updated set of forecasts next week would show US real GDP growth slowing to 1 per cent in 2023, a sharp deceleration that would be consistent with climbing unemployment, Mr Oster said.

“My rough rule is if you can’t grow your economy by more than 1 per cent and your unemployment goes up by 1 per cent, then that’s a recession,” he said.

Fears about the US economy come as the RBA is expected to raise rates by 50 to 75 basis points next month to tackle inflation which the bank’s governor Philip Lowe believes could reach 7 per cent by the end of the year.

Inflationary pressure has been fanned by the east coast energy crisis, which has forced power retailers to increase electricity and gas prices by more than 10 per cent as they face spiralling wholesale prices.

After Westpac’s monthly survey this week showed consumer pessimism had reached levels only seen during previous recessions, Mr Oster said NAB’s internal card data showed a sharp drop in spending in the week immediately after the most recent RBA move.

Mr Oster said that if rates reached 2.5 per cent, then the higher mortgage repayments would more than account for even a 4.5 per cent wage rise for a worker on an average income. “Put in higher electricity prices, and you worry about consumers,” he said.

While Treasurer Jim Chalmers has played down the prospects of an economic downturn, pointing to strong growth and jobs figures, AustralianSuper chief investment officer Michael Delaney this week warned there was a “quite material” risk of a global recession, and that Australia would find it “very hard to be exempt from it”.

Mr Delaney said China’s economic boom had helped cushion Australia’s economy from worldwide downturns over the past 20 years, “but those conditions aren’t likely to be repeated”.

AustralianSuper’s balanced investment option was returning -4.2 per cent as of Thursday for this financial year to date. If that return remained negative, it would be the first time since the global financial crisis.

With heavy losses across financial markets intensifying over recent weeks, Chant West senior investment research manager Mano Mohankumar estimated that the investment loss in the median balanced super fund was between 5-5.5 per cent for the financial year to date. He said the median growth fund’s performance for 2021-22 had been positive at the end of May, but in June there had been double-digit losses across assets, from Australian and global shares, to bonds, to listed property.

“With nearly two weeks of the financial year remaining, we don’t really know what that median performance estimate will be,” Mr Mohankumar said.

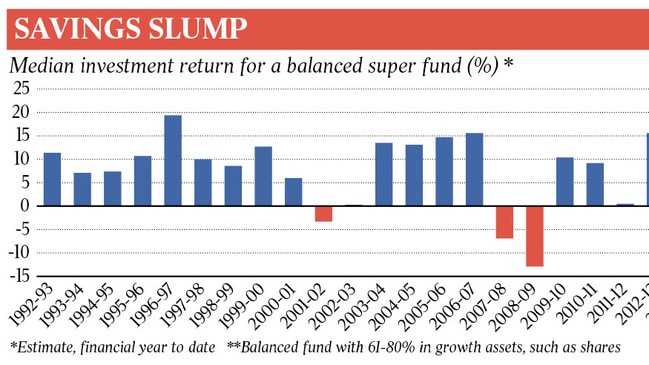

The expected loss in superannuation savings would mark only the fifth time in three decades that fund returns had been negative.

Mr Mohankumar said it was important to put the prospect of one “down” year in context, and urged super fund members not to rush out of growth assets. “This year does come on the back of an 18 per cent median return last year, which was the second highest return since the introduction of super in 1992,” he said.

Stephen Miller, an investment adviser at GSFM Funds Management, said his “not-very-confident judgment would be that we’ve probably seen the worst” of the financial market declines.

“Bond yields are in sight of a peak, and equity markets are in sight of trough,” Mr Miller said. “Does that mean we will see a bounce? No. The sharemarket will bounce along the bottom for a while.”

He said investors needed to get used to a semi-permanent higher level of interest rates.

Property markets are also expected to correct as interest rates rise. ANZ this week forecast a 15 per cent decline in housing prices nationally over the coming 18 months.

Dr Lowe said this week the RBA would “do what’s necessary to get inflation back to 2 to 3 per cent’’. “And it’s unclear at the moment how far interest rates will need to go up to get that,” he said.

“I’m confident inflation will come down over time but we’ll have to have higher interest rates to get that outcome and how much higher remains to be determined.”

Economists interpreted the comments as further evidence that the RBA board at its next meeting in July would deliver its second consecutive double hike of 0.5 percentage points, which would take the key policy rate to 1.35 per cent. Analysts now expect rates to reach above 2 per cent over the coming six months.

Official figures released on Thursday showed the labour market continued to boom in May, with the number of employed Australians jumping by 61,000 in the month and unemployment remaining steady at 3.9 per cent.

National cabinet on Friday agreed to fast track visa applications to speed the entry of foreign workers to ease workforce shortages that were contributing to supply chain congestion.

Anthony Albanese said the backlog was placing pressure on the construction industry and leading to increased costs. The Prime Minister said the government had reassigned public servants from other duties to clear the backlog.

Mr Oster said the economic data had proved positive, but he was becoming “increasingly nervous” about the outlook and that the RBA and its global counterparts were “moving too fast”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout