Sharemarket will take stock after federal election

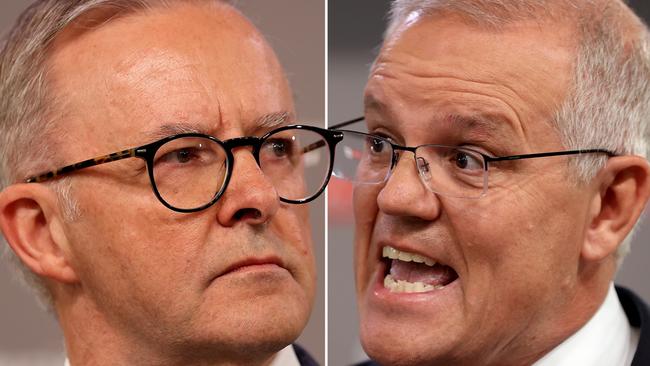

On Sunday, we will wake up to a nation led by Albo or ScoMo – complications aside. Let’s look at what that could mean for investors.

Failing an election day voting glitch that installs Craig Kelly as PM, Australians should be waking up to an Albo or ScoMo-led nation on Sunday morning and – yes – we’re familiar enough with them now to use their nicknames.

So how will the share market react to the third Labor government elected from the Opposition benches since 1972, or another Scott Morrison Houdini-style escape act using only a swizzle stick from a Blue Hawaiian cocktail?

History shows that investors move in mysterious ways and that Coalition governments aren’t necessarily better for shares. Often they just don’t care.

According to AMP Capital’s chief economist Shane Oliver, markets have risen by an average of 4.5 per cent three months after 10 of the 14 elections held since 1983.

–

For the latest small caps news, sign up here for free Stockhead daily newsletters

–

The most market-friendly polls were Bob Hawke’s breakthrough victory of 1983 (up 19.8 per cent), his re-election in 1987 (15.9 per cent) and the Coalition’s 2004 win against the crunching adversity of Mark Latham’s handshake (10 per cent).

Investors applaud when governments that were expected to be kicked out actually survive: the market rose 3.9 per cent after Paul Keating’s ‘True Believers’ election in 1993. Last election – in May 2019 – the market bounced an immediate 1.6 per cent after voters gave odds-on Labor the Short(en) shrift.

The worst investor reactions were the 12 per cent slide after Kevin 07’s 2007 win for the True Believers (in programmatic specificity).

The market fell 3.9 per cent after Bob Hawke’s fourth and final victory in 1990 and retreated 2 per cent after the Coalition’s 1996 win that ousted Keating.

This time around the specific policy differences are muted, so it comes down to assumptions about managing the national budget and steering monetary policy.

One presumption is that the Coalition would spend relatively more on defence than Labor, but that both parties would need to bring out the big guns.

That bodes well for minnow Xtek (ASX:XTE), which provides military hardware such as drones and ballistic armour.

Our Khaki portfolio includes the bigger Electro Optic Systems (ASX:EOS), which is in the high tech space game but also sells on-the-ground hardware such as unmanned drone vehicles and counter-drone defence systems.

–

Visit The Australian’s Stockhead page, where ASX small caps are big deals

–

Given Labor’s sharper focus on climate change, expect an increase in funding to bodies such as the Australian Renewable Energy Agency ARENA – which in turn funds private sector developers.

Deloitte Australia’s clean tech index lists no fewer than 88 ‘clean tech’ stocks, so good luck picking the handout winners. Current ARENA recipients include Hazer (ASX:HZR, hydrogen), and Genex (ASX:GNX, pumped hydro and grid solar).

What about housing?

Morgan Stanley describes both major parties’ schemes – the ability to tap super schemes and government co-equity – as “demand side” measures.

This is code for “likely to push up house prices even more”.

Both schemes are actually less generous than they seem, but would do no harm for housing-exposed property trusts such as Stockland Group (ASX:SGP) or building material suppliers such as CSR (ASX:CSR), AdBri (ASX:ABC) or Brickworks (ASX:BKW).

An obvious problem of the post-election performance numbers is that all things being equal, that’s how the market reacts.

But all things are never equal. Kevin 07’s victory was perfectly timed for the global financial crisis, while the 1987 post-poll surge was rudely truncated by the October share crash. Now we have a bear market and a war to muddy the picture.

Only a silly (election) sausage would read too much into the past trends.

Suffice to say, investors seem to welcome the mere fact that an election is out of the way – as do harried babies and genuine high-vis clad workers.

This story does not constitute financial product (or voting) advice. You should consider obtaining independent advice before making any financial decision

Read more Tim Boreham at stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout