Wallop for states over Covid debt as fears mount for federal AAA rating

Loss of coveted AAA credit ratings for NSW and Victoria triggers fears of a commonwealth downgrade within 12 months.

NSW and Victoria have been stripped of their coveted AAA credit ratings after ratcheting up debt levels in big-spending budgets, forcing S&P to deliver the first downgrades for the two states in more than 30 years and triggering expectations the commonwealth could follow suit.

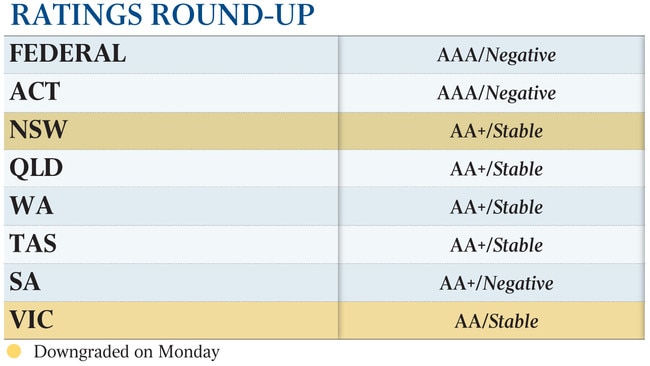

S&P Global Ratings on Monday lowered Victoria’s debt rating two “notches” to AA from AAA and NSW’s one notch to AA+, prompting CBA senior bond analyst Martin Whetton to say a commonwealth downgrade was now a likely scenario within the next 12 months.

Josh Frydenberg dismissed the prospect on Monday, arguing that S&P had reaffirmed the commonwealth’s AAA rating in October following the federal budget, and the ratings agency had said the NSW and Victorian downgrades would have “no direct or immediate effect on the sovereign rating at this stage”.

With growth rebounding following the lifting of COVID-19 restrictions, the Treasurer said the government was helping to “create jobs and rebuild the economy to secure Australia’s future” after spending to keep businesses afloat during the pandemic.

NSW Treasurer Dominic Perrottet said the credit rating decision reflected the difficulties faced by all governments through the pandemic. “We have had challenge upon challenge in 2020 — drought, bushfires and then COVID-19 — all of these have hurt our revenue base while at the same time the NSW government has responded with more than $29bn of economic stimulus and support,” he said.

“Our economic response has been about creating as many jobs as possible, supporting businesses through this time and maintaining a record level of investment in infrastructure.”

NSW and Victoria have held top credit grades since early 2003, when they were lifted to AAA in line with the commonwealth upgrade. They were last downgraded, from AA+ to AA, in 1989.

S&P sovereign analyst Anthony Walker said the ratings agency did not expect fiscal recovery in the next few years but was not critical of the spending the two states had undertaken to cushion the pandemic’s blow.

He said that without the extra spending “the recession and its consequences would have been much worse” and argued that, at AA, the states were “still very high credit rated” with no expectations for further downgrades in the medium term.

Mr Walker said only 24 states and provinces around the world were still rated AAA. They were in Germany, Canada, Switzerland, Norway and Sweden.

Federal and state treasurers have cast aside aspirations of surpluses and frugality during the health crisis in favour of racking up the biggest deficits in peacetime, funded by record levels of debt as they focus on keeping their devastated economies afloat through the sharpest downturn in nearly a century.

Victorian Treasurer Tim Pallas conceded the Andrews government did not have a timeline for restoring the state’s AAA credit rating, but said he had a four-step plan to return to surplus budgets and stabilise debt levels within five to eight years.

“We could (have sat) around hanging on to a AAA credit rating if I’d tried rather desperately to keep the budget in surplus but, at the same time, it would have brought enormous harm to the Victorian community and Victorian business, so the choice we made was to stand with the Victorian people,” Mr Pallas said.

He said his most recent budget responded to the challenge presented by the coronavirus pandemic by investing up to $49bn in “the things that matter to Victorians”. “We have always said we will manage the economy in a AAA rating manner, regardless of the outcome of key rating agencies, and that is exactly what we will do,” Mr Pallas said.

For both states, S&P blamed the downgrades on the “severe economic and fiscal shock” from the pandemic. In Victoria, the ratings agency pointed to debt levels set to reach 200 per cent of operating revenues in 2023, (up from 70 per cent in 2019), as the state wrestled with the fallout from its second wave of COVID-19 cases.

It was a less dire outlook for NSW where revenues are expected to be much lower even as debt surges to fund a large fiscal stimulus and infrastructure program.

Mr Whetton argued that a commonwealth downgrade was a “likely scenario” even if the economy improved strongly.

“We have held a view that Australia could be downgraded in recent months because its debt to GDP has jumped significantly above the threshold where S&P would normally give a ratings downgrade,” Mr Whetton said.

Former Liberal Victorian premier Jeff Kennett said S&P’s decision to downgrade Victoria‘s credit rating was “disappointing”, likening the Andrews government’s management of finances to that of the Cain and Kirner Labor governments in the late 1980s and early 90s.

The Kennett Liberal government inherited $33bn worth of debt when it won office in 1992 ($63.45bn in today’s money, adjusted for inflation), and had reduced that debt to about $5bn ($9.61bn today) by the time it lost power in 1999.

“It’s disappointing,” Mr Kennett said.

“It is not the end of the world, but the level of debt and the mismanagement of the current government reminds me of their predecessor in the ’80s, and the reality is there is nothing the government is doing now that leads me to have any confidence given their extraordinary blowout in public debt that we will be anything else than in a worse position in six months, in two years and five years.

“Importantly the level of debt is so obscene it will lead to a huge amount of wastage in the projects that they have nominated and are currently delivering, all of which are over-budget and behind time.

“This is not a challenge for the current generation, but certainly will be for the next, and I fear, the one after.”

Westpac head of rates strategy Damien McColough said a downgrade in 2020 had very different implications from a downgrade in 30 years ago, when it would have had a meaningful impact on a state’s borrowing costs, and even may have affected a state’s ability to access finance.

ADDITIONAL REPORTING: ADAM CREIGHTON

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout