Victorian Treasurer Tim Pallas has no target for ratings recovery

Victorian Treasurer Tim Pallas has conceded the Andrews government does not have a timeline for restoring the state’s AAA credit rating.

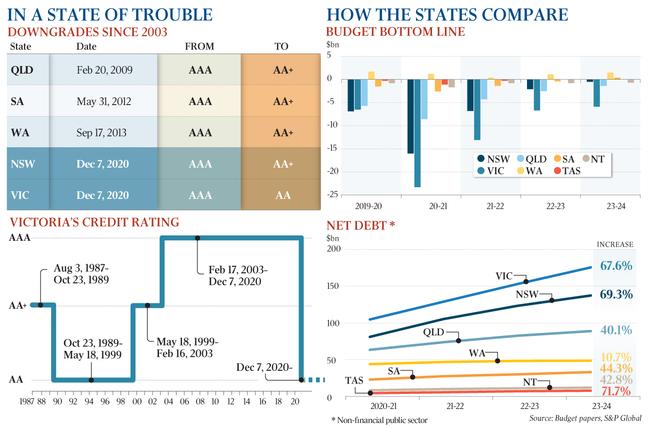

Victorian Treasurer Tim Pallas has conceded the Andrews government does not have a timeline for restoring the state’s AAA credit rating, but says it does have a four-step plan to achieve budget surpluses and stabilise debt within five to eight years.

Asked whether he had a time frame in mind for getting back to a AAA rating, Mr Pallas said: “Well, no.” However, he said the “most important thing”, was for the government to adhere to a four-step plan, which will see it create jobs, reduce unemployment and restore economic growth; return the budget to an operating cash surplus; return the budget to operating surpluses; and, fourth, stabilise debt levels.

“My anticipation is that we will be able to reach the second and the third step of the strategy that the government’s identified, and the fourth one, for that matter, in the second term of the forward estimates, which is year five to eight,” Mr Pallas said.

“We could sit around hanging on to a AAA credit rating if I’d tried rather desperately to keep the budget in surplus, but at the same time, it would have brought enormous harm to the Victorian community and Victorian business, so the choice we made was to stand with the Victorian people.”

Mr Pallas said his most recent budget responded to the challenge presented by the pandemic by “investing up to $49bn in the things that matter to Victorians”.

“The governor of the Reserve Bank of Australia has been very clear about the economic prescription for these unprecedented times: increase your borrowings,” he said. “That’s why we — like the federal government and other states and territories across Australia — are borrowing to drive investment, create jobs and revive our economy.

“The decision by S&P Global Ratings to revise its long-term issuer credit rating on Victoria to AA reflects the impact coronavirus is having on economies around the world.

“No one is immune from the impacts of the pandemic, but Victoria is more strongly placed than most jurisdictions in the world to recover. The sacrifices of each and every Victorian in driving numbers down — and keeping them down — mean we can reopen and rebuild. We have always said we will manage the economy in a AAA-rating manner, regardless of the outcome of key rating agencies, and that is exactly what we will do.”

Former Victorian premier Jeff Kennett said S&P’s decision to downgrade Victoria‘s credit rating from “AAA/watch negative” to “AA/stable” was disappointing, likening the Andrews government’s management of finances to that of the Cain and Kirner Labor governments of the late 1980s and early 90s.

The Kennett Liberal government inherited $33bn worth of debt when it won office in 1992 ($63.45bn in today’s money, adjusted for inflation), and had reduced that debt to about $5bn ($9.61bn today) by the time it lost government in 1999.

“It’s disappointing,” Mr Kennett said of the downgrade. “It is not the end of the world, but the level of debt and the mismanagement of the current government reminds me of their predecessor in the 80s, and the reality is there is nothing the government is doing now that leads me to have any confidence, given their extraordinary blowout in public debt, that we will be anything else than in a worse position in six months, in two years and five years.

“The level of debt is so obscene it will lead to a huge amount of wastage in the projects that they have nominated and are currently delivering, all of which are over-budget and behind time.

“In other words, this is not a challenge for the current generation, but certainly will be for the next and, I fear, the one after. So while I think my children … might get through their lives, I fear for the wellbeing and security of my grandchildren.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout