RBA review ‘does not compellingly portray the problem it is addressing’

An eminent economist says Australia’s economy has outperformed the UK and Canada, the nations the review of the Reserve Bank has chosen for its model of world’s best monetary practice.

Australia’s economy has outperformed the UK’s and Canada’s, the two nations the landmark review of the Reserve Bank has chosen for its model of world’s best monetary practice, according to an eminent economist.

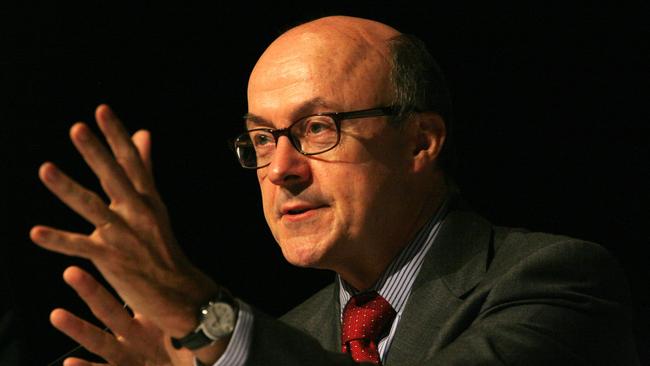

Former RBA board member John Edwards argues Australia has over the past three decades experienced higher per capita income growth and lower unemployment than Canada and the UK, where monetary policy decisions are made by committees of economists – the model now proposed for Australia.

“There is no claim in the report that the model used in the UK or Canada has produced better outcomes, because as a matter of fact it has not,” Dr Edwards writes in The Weekend Australian.

“The review does not compellingly portray the problem it is addressing.”

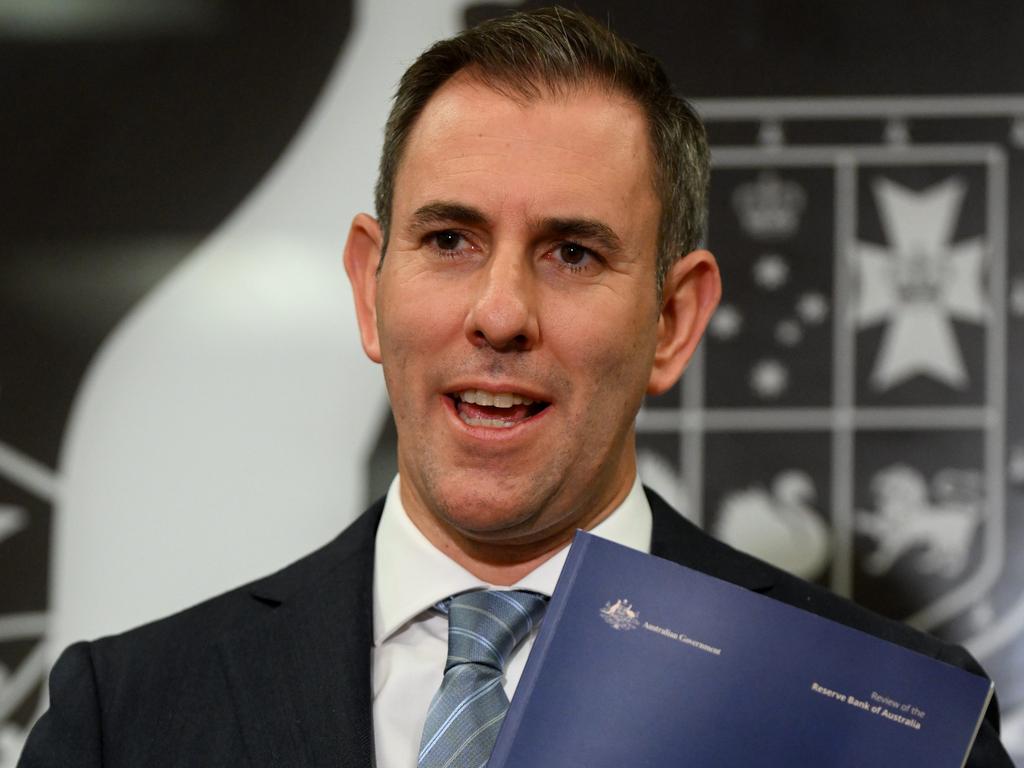

The Lowy Institute senior fellow and adviser to former prime minister Paul Keating said there was reason for Jim Chalmers to be wary of recommendations by the panel of three experts on the conduct of interest-rate policy.

“The objectives of monetary policy would be in legislation, not an agreement with the Treasurer and the RBA,” Dr Edwards said.

“The reserve power for the Treasurer to direct the RBA would be removed.

“It would be specified that the Treasurer would have no authority to direct the Treasury secretary in respect of his or her vote on the monetary policy board.

“The actual and reserve powers of the Treasurer in respect of monetary policy would be eliminated.”

Thursday’s wide-ranging review proposed the RBA give “equal consideration” to achieving full employment and controlling inflation when making future interest rate calls.

The panel’s 51 recommendations were supported in principle by the Treasurer and, if implemented, would lead to the most significant overhaul of the RBA’s systems, processes, personnel and culture in more than four decades.

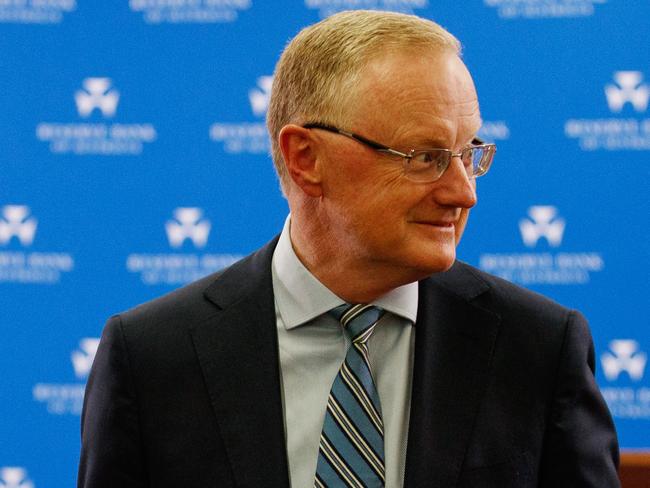

While welcoming the review and foreshadowing a busy work schedule for the central bank over the coming year, RBA governor Philip Lowe said the proposed reforms would not have changed recent economic outcomes.

“It’s not correct to say a different decision-making structure would make fundamental differences,” Dr Lowe said.

“We’re talking about improvements at the margin.”

Dr Edwards, who served on the board from 2011 to 2016, writes that the review’s “only serious criticism of the performance of the RBA is for the period 2016 to 2019, where it recounts a story that rates could have been lower, and if so employment could have been higher”.

“Otherwise, the report gives a big tick to the performance of the RBA under its current structure,” he said. He added that giving explicit and equal weight to full employment and inflation while recognising there will usually be a trade-off between them was a good, timely recommendation.

Westpac chief economist Bill Evans noted the review’s “extensive constructive changes” but said there were looming challenges around the RBA’s “dual mandate” on inflation and full employment, communication and the structure of the proposed Monetary Policy Board.

Mr Evans said that the board should be balanced and warned against relying on academic economists, “who seemed to consistently adopt a hawkish bias”.

As well, he said the review’s call for closer alignment between fiscal and monetary policy would be welcomed at the RBA.

Mr Evans pointed to a study by modeller Chris Murphy at the ANU, who calculated that inflation would have been three percentage points lower at the end of last year if budget and monetary policy had not been excessively expansionary during the pandemic. Mr Murphy attributed four-fifths of this excess inflation to loose fiscal policy.

“This example, while extreme, highlights the challenges faced by the bank in achieving its targets when other policy instruments are operating in a different direction,” Mr Evans said.

On Friday, Dr Chalmers said the Albanese government’s task was to ensure the May 9 budget and “monetary policy decisions of the Reserve Bank are operating broadly in concert rather than in conflict with each other”.

“Now we take seriously our responsibility to represent every part of Australia in the making of our economic policy and we want the Reserve Bank to take a similar approach,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout