Private cash the answer to 2032 Olympics stadium woes, says industry think tank

Private investment can ease the pain for taxpayers of funding pricey Brisbane Olympics venues.

The “sharp pencil” of private finance should be used to ease the burden on taxpayers to fund multibillion-dollar projects for the 2032 Brisbane Olympics, a new review of the infrastructure program has found.

The analysis by industry think tank Infrastructure Partnerships Australia says private sector investment “offers a potential relief to budgetary pressures” that sank plans to rebuild the Gabba stadium or replace it with a venue purpose-built for the Games.

A consortium led by a leading live music promoter and talent manager Live Nation has expressed interest in co-developing the $2.5bn Brisbane Arena, relocated from its original site atop a CBD train station to avert the cost blowing out to a projected $4bn.

IPA’s latest pipeline report found that the nine major stadiums constructed in Australia for and since the Sydney 2000 Olympics were collectively valued at $6.3bn, with an average price of $792m. In addition to the 83,000-seat Sydney Games HQ, Stadium Australia, the list includes: Optus Stadium in Perth ($1.6bn); Melbourne’s Docklands stadium ($460m); and the rebuilt Sydney Football Stadium ($862m).

While the Queensland government accepted the March recommendation by an expert panel led by former Brisbane mayor Graham Quirk to shift the proposed arena, it rejected the key finding to build a $3.4bn stadium at inner-northside Victoria Park for the Olympics and to replace the ageing Gabba as a top-tier cricket and AFL venue.

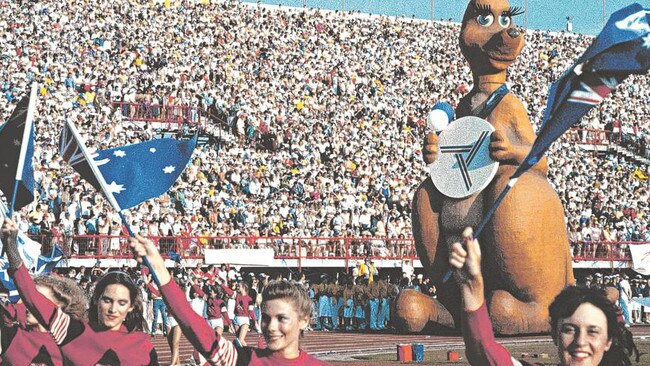

Premier Steven Miles said the state government could not justify the expense when “people were doing it tough” in a cost-of-living crisis. Instead, it will spend up to $1.6bn by Mr Quirk’s estimate to upgrade the vintage stadium used for the 1982 Commonwealth Games on Brisbane’s southside, even though it is poorly served by public transport.

The IPA insists a public-private funding partnership should be on the table. “With the rising cost of stadiums on the mind, the sharp pencil of private finance offers a potential relief to budgetary pressures,” its report said. “The public-private partnership model is no stranger to stadium development, for good reason.

“With an accessible revenue stream, strong historical performance and long concessions available, stadiums make for an attractive deployment of the model.”

The report also found the state faced a challenge to complete the 18 major rail projects and 17 road projects due to be delivered by 2032, collectively valued at $52bn. These include the Cross River Rail subway in Brisbane, the Brisbane Metro “train on wheels” service, Gold Coast light rail and the Direct Sunshine Coast Rail Line – all considered critical to connectivity for a regionalised Games.

IPA forecast that the workforce required to deliver the state’s infrastructure pipeline over the next five years would be 127 per cent larger in the final quarter of 2026 compared to current labour demand.

This coincided with a national peak in labour demand, up 60 per cent over the period to 2029.

“There is clear opportunity for private investment which could be applied to delivery across projects like Brisbane … Arena,” said Infrastructure Partnerships Australia chief Adrian Dwyer.

“Australia needs to ensure the policy and regulatory settings encourage private finance in the sector … There is capital ready and waiting to invest in quality projects; what’s required is governments to make the call.”

Live Nation confirmed to The Weekend Australian it was “still very much interested in the Brisbane Arena project” with consortium partners Plenary Group and Oak View Group, though this is understood to be contingent on the procurement being “bundled” to include the lucrative management rights after the hall of up to 18,000 seats was completed.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout