Warnings of price gouging for NDIS

The consumer watchdog has received a ‘steady increase’ in complaints from participants of the nation’s flagship disability scheme.

The consumer watchdog has received a “steady increase” in complaints from participants of the nation’s flagship disability scheme, as mark-ups on “NDIS approved” equipment push prices more than 10 times what the products are worth on the open market.

Anthony Albanese said on Friday the commonwealth would seek to rein in the growth of the National Disability Insurance Scheme to 8 per cent a year by 2026, down from its current annual growth of about 15 per cent.

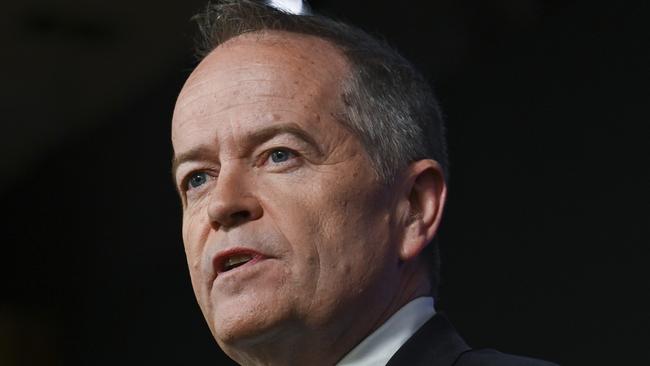

As part of the government’s announcement, NDIS Minister Bill Shorten set out measures in a $720m package aimed at reducing the cost of the scheme, including for NDIS participants to receive a list of “preferred providers” that will not include those found to be price-gouging.

However, an analysis of “NDIS” approved equipment compared to almost identical equipment online reveals mark-ups of hundreds of dollars.

While a folding walking stick costs between $30 and $40 on the open market, an “NDIS approved walking stick” can cost as much as $457 – representing a mark-up of more than 1200 per cent.

Similarly, a shower stool costing $150 online costs almost 1300 per cent more for one which is NDIS approved. Another shower chair found online retailed at $170, while an almost identical chair with NDIS approval went for $1150.

And a wheelchair valued at between $390 and $410 on the open market was listed at almost $1800.

“Price gouging is unacceptable and it’s no secret this is something we are looking to address as a matter of urgency,” Mr Shorten told The Australian. “For too long NDIS participants have been treated as human ATMs, not as valued clients by some unethical providers. If one provider is overcharging for their service, it means their participant cannot afford another service they need.”

“There is a culture among some Aussie contractors who think that, if it’s a government funded package, then you can rip it off and overcharge.”

Mr Shorten said the independent NDIS review would “look at this issue closely” when it reported back to government with recommendations in October.

The Australian Competition & Consumer Commission said on Wednesday it had received a rise in reports related to services provided under the NDIS.

A spokesman for the competition watchdog said it had prioritised conduct impacting consumers who were vulnerable.

“Over the years, the ACCC has observed a steady increase in reports received about service quality and access under the NDIS,” he said. “We can only intervene in misconduct where it raises concerns under the Australian Consumer Law, such as where consumers are misled about goods or services, or a provider is relying on unfair terms in contracts with consumers.”

The spokesman pointed to action taken against disability insurance providers who were engaging in misconduct, including an online seller of personal SOS alarms – Live Life Alarms – which was fined more than $25,000 in 2020 for publishing false testimonials on its website.

Another company selling therapeutic adjustable beds and adjustable lift chairs – trading as Revitalife – was also fined in 2022 for making unsolicited calls and visits to sell their products.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout