Unfunded super bill a $200bn debt bomb

Australia’s $1 trillion gross debt bill has been inflated by a $200bn superannuation liability blowout fuelled by record low interest rates.

Australia’s $1 trillion gross debt bill has been inflated by a $200bn superannuation liability blowout fuelled by record low interest rates, as the Morrison government delays accessing the $161bn Future Fund to offset unfunded pension schemes.

Commonwealth pension programs administered by the Department of Finance — including defined benefit schemes for public servants, judges and former MPs — drove up federal debt levels with superannuation liabilities jumping to $241.8bn in 2019-20.

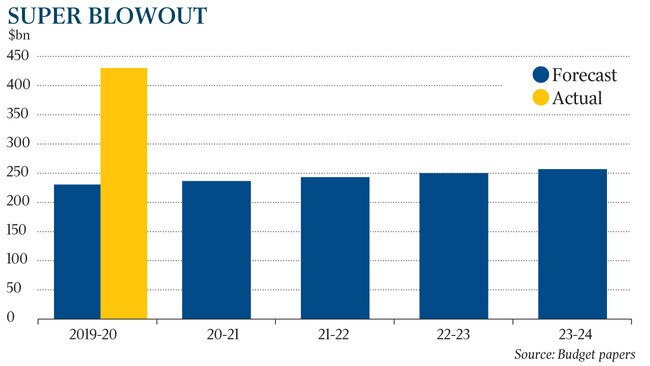

The combined commonwealth superannuation liabilities, including military and defence benefits schemes, hit $430.1bn by June 30 — $200bn more than predicted — amid volatile shocks to Treasury’s long-term forecasts.

The Future Fund, led by former treasurer Peter Costello, was set up in 2006 to support unfunded liabilities that will become “payable during a period when an ageing population is likely to place significant pressure on the commonwealth’s finances”.

Analysis by The Australian reveals major public service superannuation fund liabilities have recorded a $90bn increase in five-years, putting pressure on the budget’s medium-term gross debt projections.

Legislation enacting the sovereign wealth fund stipulated that it could be used to cover unfunded superannuation liabilities from “the time when the balance of the fund is greater than or equal to the target asset level”, or from July 1 this year.

The October 6 budget confirmed gross debt projections over the medium term reflected the federal government’s decision not to “draw down on the Future Fund’s earnings to meet unfunded superannuation liabilities” until 2026-27.

Finance Minister Mathias Cormann said the government would delay “drawing down from the Future Fund to allow the fund to grow to fully offset the present value of projected unfunded superannuation liabilities”.

The government’s use of a 5 per cent discount rate to value liabilities across government-controlled super funds, based on actuarial advice, has been dramatically downgraded reflecting changes in spot rates on long-term government bonds.

Auditor-General Grant Hehir said the “highly sensitive” valuation of superannuation provisions, which he classified as a high audit risk rating, was “complex” and required expert judgment in finalising long-term assumptions, including salary growth and discount rates.

As part of his audit, Mr Hehir focused on the design and management of defined benefit schemes and the “methodology and reasonableness of the key assumptions applied in estimating the superannuation provision”.

Senator Cormann said the difference in the budget estimate for superannuation liabilities and the final outcome for 2019-20 was based on the “spot rate on long-term government bonds” used for valuation, and not the discount rate of 5 per cent determined by actuaries preparing long-term cost reports.

“In addition to reducing volatility, the use of a long-term discount rate enables comparison between updates without being affected by short-term deviations in rates,” Senator Cormann told The Australian.

“The impact from the use of different discount rates does not impact the underlying benefits of scheme members.”

Due to the long-term nature of superannuation liabilities, he said, the “valuation is highly sensitive to the discount rate used — reductions in the discount rate will increase the value of the liability reported, and vice versa”.

While the Commonwealth Superannuation and Public Sector Superannuation schemes, which closed to new members in 1990 and 2005, have a combined membership of 329,682, the Judges’ Pension, Governors-General Pension, and Federal Circuit Court Judges Death and Disability schemes remain open.

The Commonwealth Superannuation Corporation lists 140,439 customers under the Public Sector Superannuation Accumulation Plan, 180,203 in Military Super and 21,588 under the ADF Super scheme.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout