‘They can afford to pay’; Symes doubles down on land tax

Victorian Treasurer defends land tax hikes that has left a Dandenong sandblasting business reeling after its land tax bill spiralled from $8700 to more than $203,000.

Jaclyn Symes has defended a 2300 per cent land tax hike on a Victorian small business owner, saying that businesses have a greater capacity than ordinary households to cough up taxes.

The Treasurer doubled-down on the government's tax hikes after the owner of a Dandenong South sandblasting business that has worked on some of the biggest construction projects in Melbourne, including the MCG, was left reeling after his land tax bill spiralled from $8700 to more than $203,000 in the past decade.

Asked about the tax hit on Thursday, Ms Symes said the land tax payable by property owners was directly attributable to the value of their land.

“We want to ensure that we get the balance right in relation to the levies and taxes that people pay, we want to ensure that we have the revenue for the services that Victorians rely on to be delivered,” Ms Symes said.

“We don’t want impacts on those that are suffering cost of living pressures, ordinary households and the like, that’s why we set our tax settings with consideration of those that have the greater capacity to pay.”

Angie Romas, who has run his steelwork, sandblasting and painting business DH Corrosion & DPC Coatings for more than 20 years, is in the frontline of Labor’s assault on businesses and property investors that will see the Allan government reap a predicted $9.3bn from land taxes – including its extra Covid debt levy on landholdings – in 2027-28, up from the $5.2bn it collected in 2022-23.

Labor has hiked land taxes as Victoria buckles under state debt which last year’s budget forecast to grow from $156.2bn this year to $187.8bn in June 2028.

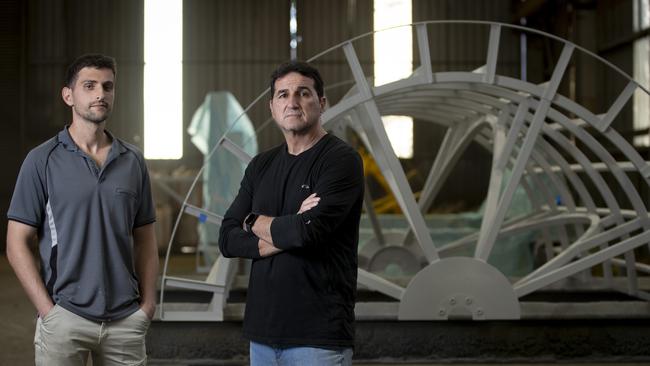

Mr Romas, 60, who owns his business with his son Adam, 28, wrote in March to Ms Symes, who will deliver her first budget as the state’s treasurer next Tuesday, pleading for relief. He told The Australian on Wednesday he had not received a response.

In his letter to Ms Symes, Mr Romas said he was looking at closing his business because the land tax had “become too large a cost to justify” its continuation at the premises.

Mr Romas said his business – which employs 14 people and has been a supplier for major Victorian projects including the MCG expansion and refurbishments, Docklands Stadium, Southern Cross station and EastLink bridges — had been operating consistently at its Dandenong South site since 1973.

“This business generates a steady tax income stream (GST, payroll tax, company tax) for the state and federal governments,” Mr Romas wrote. “Why do Victorian businesses employing people and generating income for our federal and state governments get penalised so harshly with land tax? Who would want to start a new business in Victoria? The idea of running a business, employing workers, and striving to generate a profit only to pay a significant portion of this profit over to the state government in land tax has become a ridiculous business model.”

On Thursday, Ms Symes said she was in the process of receiving advice on Mr Romas’ letter and that a response would be forthcoming.

“I receive a lot of correspondence,” Ms Symes said.

“I respond personally to people that write in about land tax.”

The Victorian Chamber of Commerce and Industry, in its submission for Tuesday’s state budget, called for a reduction or removal of taxes that it said were stifling business investment, including land taxes and stamp duty. “State-based taxes on business dampen business growth and investment,” the chamber’s submission stated. “Further, the business community is already wearing both the mental health levy and the Covid debt levy, both of which have had a significant financial impact.

“There is no possibility of absorbing any further tax impost.

“Just three taxes alone – payroll tax, land tax and land transfer duty for commercial and industrial land – represent an average 40 per cent of Victoria’s total tax revenue. These taxes have increased at an average annual rate of 7.6 per cent in nominal terms.”

The chamber’s chief executive, Paul Guerra, said the spike in land tax was “pushing costs to unsustainable levels, stalling investment, slowing transactions and choking growth”.

“Instead of boosting activity, these changes are scaring off new and existing businesses and investors,” Mr Guerra said. “Winding back land tax would send a clear message: Victoria is open for business. If not, investment will keep heading elsewhere.”

Mr Romas said he was considering subdividing the land or selling it and moving to a smaller factory. However he said operating on a smaller property would reduce his business because it required a large property to handle and treat large fabrications and volumes of steelwork required to complete big projects.

“Why are business owners being extorted to pay for major projects and debt the state government has incurred?” he asked.

Mr Romas said he thought the government were trying to drive him out of the property “so that they can crystallise a sale of the property and then get the stamp duty”.

The state government expects to collect more than $10bn from Victorian taxpayers in stamp duty in 2027-28, up from $8.5bn in 2024-25, according to estimates in last year’s budget.

In its 2023 budget, the government introduced the extra land tax – the Covid debt levy – which applies until 2033 on eligible landholdings as part of its “Covid debt repayment plan”.

Revenue from the Covid debt levy on landholdings was expected to be $1.3bn in 2024-25 then grow by an average of 5.8 per cent per year, while land tax revenue was forecast to be $6.5bn in 2024-25 and estimated to grow by an average of 6.2 per cent per year over the forward estimates in last year’s budget.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout