Sanctions fail: exporters defy Chinese trade bans

Despite the loss of $20bn a year in exports to China, our barley, coal, copper, cotton, sugar and timber producers have found buyers elsewhere.

Australian exporters are defying Chinese trade bans, limiting the damage of Beijing’s punitive economic campaign by finding new markets for almost all affected products.

Economic analysis reveals that although $20bn a year has been slashed from Australian exports to China, the nation’s barley, coal, copper, cotton, sugar and timber producers have either partially or completely offset this by diverting shipments to new buyers in other countries.

Lowy Institute chief economist Roland Rajah said only the nation’s wine traders had struggled to make up for the loss of their premium Chinese market.

Mr Rajah said that, with the exception of wine, the net loss to Australian exporters as a result of the bans — imposed over Australia’s call for an inquiry to the origins of COVID-19 — amounted to less than $1bn. But when all of Australia’s exports were taken into account, soaring iron ore prices had “completely swamped” the effect of the Chinese trade bans.

Chinese ambassador Cheng Jingye defended the trade bans on Wednesday and blamed Australia for “the difficulty we now have in the bilateral relationship”.

The Chinese embassy set out Beijing’s grievances with Australia late last year in a list that included the Morrison government’s call for a COVID-19 inquiry, the ban on Huawei participating in the 5G network and its foreign interference laws.

Trade Minister Dan Tehan unveiled a new strategy on Wednesday to help “Team Australia win in Asia’’, saying the Indo-Pacific presented a much more complex strategic environment than in past decades.

Mr Tehan said it would take a collective effort by government and the private sector to ensure Australia could capitalise on opportunities in the region in the next five to 10 years.

The Asia Society and Business Council of Australia’s Asia taskforce also recommended exports should make up 35 per cent of GDP by 2030, up from 29 per cent today.

It also warned that navigating the China relationship would require “strategic patience, avoiding over-reaction and emotion, maintaining long-established personal networks, and continuing to be prepared to co-operate on issues that benefit both countries”.

The council said diversification should not exclude China but be in addition to pursing the Chinese market. It identified Indonesia and Japan as countries Australian businesses could target for export opportunities in healthcare and financial services. South Korea and Vietnam also presented significant opportunities”, as industry sought to diversify beyond China.

Mr Tehan, whose Chinese counterpart, Wang Wentao, still refuses to speak to him, called on Australia’s business community to “step up to the plate” and engage with China where the government was unable to.

“We can’t sit on our hands and just sort of think ‘oh well that’s not very good’,” Mr Tehan told business leaders in Canberra.

“What we need to do is we have to find other ways to keep engaging and to keep sending that message that we do want a good relationship, we want a friendly relationship with China.”

In his report to be published by the Lowy Interpreter on Thursday, Mr Rajah said the impact of the Chinese sanctions had been “quite limited”.

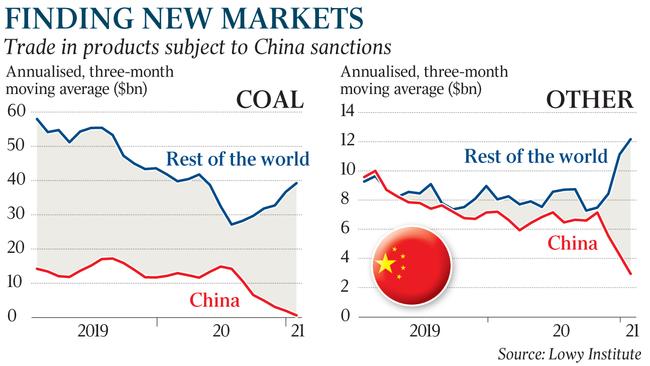

“Exports to China have predictably collapsed in the areas hit by sanctions, but most of this lost trade seems to have found other markets,” Mr Rajah said.

While ships carrying Australian coal had been unable to unload their cargo in China, causing a $6bn slump in the trade, Australian exports of the commodity were already down by about $7.5bn a year lower before the ban was imposed.

Mr Rajah said that, by January 2021, Australian coal exports to the rest of the world were running $9.5bn higher in annualised terms than before the ban.

“Whatever impact China’s ban on Australian coal might be having, it doesn’t seem to be enough to shift the overall picture a great deal once trade diversion is taken into account,” he said.

Mr Rajah found other Australian exports hit by the ban “show even clearer signs of substantial trade diversion”.

Sales of Australian barley, copper, seafood and timber to other markets rose sharply after the late-2020 trade sanctions. Australia’s wine exporters had “suffered terribly”, and beef exports were also down due largely to supply side issues, he said.

“On the other hand, a bumper barley crop has helped partially offset weakness in these other areas,” Mr Rajah said.

“Overall, Australia’s sanctioned exports to China other than coal held steady through most of 2020 at the equivalent of a little over $9bn a year, before falling to about half that level as sanctions escalated in late 2020.

“Meanwhile, exports in these same categories to the rest of the world rose by about $4.2bn in annualised terms — offsetting most of the loss.”

Mr Tehan said he had not received any response from Mr Wang, China’s Commerce Minister, after attempting to engage with him in January when he was handed the trade portfolio in a ministerial reshuffle.

“(But) we have previously had very good relations and there’s no reason why we can’t have them in the future,” he said.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout