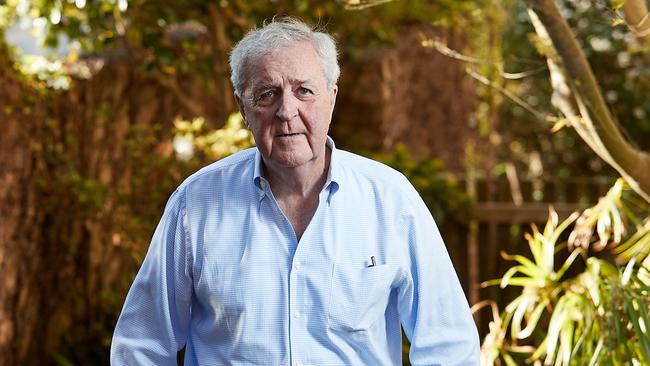

RBA changes ‘a huge risk’, says ex-governor Ian Macfarlane

Former Reserve Bank governor Ian Macfarlane brands as a ‘disgrace’ Treasurer Jim Chalmers’ decision not to put changes to the RBA out for open debate.

Former Reserve Bank governor Ian Macfarlane has intensified his critique of the proposed changes to the Reserve Bank of Australia, saying their full implementation would put the bank’s future “at a huge risk” and constitute an “experiment” in its operations.

In an interview with The Australian, Mr Macfarlane has criticised the recommendations of the review into the Reserve Bank released last April and accepted “in principle” by Jim Chalmers, and branded as a “disgrace” the fact the Treasurer did not put the report out for open debate.

Mr Macfarlane warned the review’s recommendations would undermine the bank and the authority of the governor “would be reduced out of all proportion to what any other central bank has done”.

Mr Macfarlane, who served as governor from 1996 to 2006, has gone public because he believes there is a serious danger the bank’s effectiveness will be prejudiced unless the recommendations are curtailed.

“I think something is slowly building,” he said.

“People are realising that this is really a silly review. These issues should have been sorted out three or four months ago. No other central bank puts the governor in such a weak position.”

Mr Macfarlane provided a table to The Australian that outlines the essence of his critique and exposes the unique nature of the changes being proposed for the Reserve Bank. The heart of his argument is that the review has retained the dominance of part-time members on the RBA board – seven out of nine members – while transforming the board from an “advisory body” into one that “proactively shapes policy decisions” – that is, functions as a decision-making body.

“These two features are incompatible,” Mr Macfarlane said.

“They result in a board structure unlike any other central bank. The 290-page report does not recognise this anomaly or attempt to justify it.”

Mr Macfarlane’s table shows that five of the top central banks – from the US, Europe, Japan, Sweden and Switzerland – have no part-time experts on their decision-making body. Another four have part-time members – the central banks in Canada, Norway, New Zealand and the Bank of England – but in each case “the part-timers are a minority”.

But Australia would be the outlier. Under the review’s proposals, part-timers would constitute 78 per cent of the RBA board, an overwhelming majority, with the governor and deputy governor in a minority having two of out nine members on the board.

Mr Macfarlane said: “We are being asked to entrust two-thirds of voting power on monetary policy to a group of people we don’t know anything about. They are referred to as experts, but experts in what? The RBA is being asked to outsource its core competence – monetary policy – to a group of unknown competence.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout