Petrol, interest rates drive cost-of-living crunch

Australians will cop higher prices at the bowser and steeper mortgage repayments, with Jim Chalmers reinstating the full fuel excise but pledging to monitor attempts at gouging.

Australians facing a cost-of-living crunch will cop higher prices at the bowser and steeper mortgage repayments, with Jim Chalmers reinstating the full fuel excise to boost the budget bottom line but pledging to monitor attempts at gouging.

Amid interest rate hikes and soaring inflation, the Treasurer will confirm on Monday that he has ordered the competition watchdog to ramp up surveillance of petrol prices and crack down on profiteering when the 44.2c-a-litre fuel excise returns on September 29.

In a bid to neutralise attacks from the Coalition over cost-of-living pressures in the final two parliamentary sitting weeks before the October 25 budget, the federal government on Monday will announce the largest indexation increase to welfare payments in more than 30 years.

Social security payment increases for more than 4.7 million Australians, including dole recipients, pensioners and single parents, follows pressure from the Greens and community groups to lift the JobSeeker rate.

As motorists brace for higher petrol prices in the December quarter, when inflation is tipped to rise to 7.75 per cent, the Reserve Bank of Australia board on Tuesday is expected to heap more pressure on households and lift the cash rate to 2.35 per cent. The RBA has flagged it will likely authorise further interest rate hikes in coming months.

The welfare payment boost follows the Morrison government’s $9bn social security and JobSeeker increase last year, described as the largest ever budget measure for working-age payments and the single biggest year-on-year increase to the rate of unemployment benefits since 1986.

Social Services Minister Amanda Rishworth said the government was providing a “safety net” to protect disadvantaged Australians and ease cost-of-living pressures.

JobSeeker payments for recipients without children increase by $25.70 a fortnight to $677.20, with single-parent carers receiving an extra $35.20 a fortnight to $927.40.

Ahead of the full fuel excise resuming, Dr Chalmers has instructed Australian Competition & Consumer Commission chair Gina Cass-Gottlieb to intensify fuel price monitoring and “make sure Australians motorists get a fair deal at the bowser”.

“Refiners, importers, wholesalers and retailers should consider themselves on notice – the ACCC is keeping a very close eye on fuel prices across the country to make sure any increases are justifiable,” Dr Chalmers, who has promised extra cost-of-living support in the budget, said.

“There should be no doubt that if there is evidence of misleading or anti-competitive conduct by fuel retailers, the ACCC will take action.”

In response to cost-of-living pressures and soaring oil prices sparked by Russia’s invasion of Ukraine, the Morrison government used its pre-election March budget to temporarily halve the fuel excise.

The ACCC, which will release a new report on petrol, diesel and LPG prices on Monday, is analysing retail price data daily across all metropolitan and regional locations and has warned fuel companies against misleading motorists about sudden price hikes.

With motoring groups raising concerns about the long-term trajectory of fuel excise revenue, The Australian understands the Albanese government is considering options to follow state governments, which have flagged road user charge models in recent budgets.

Detailed work was prepared under the Morrison government to look at overhauling the antiquated fuel excise regime.

Plunging excise revenue fuelled by the uptake of low-emissions vehicles, combined with more electric vehicles on the road, have sparked concerns about future funding for infrastructure projects and maintenance.

The Albanese government is understood to prefer working collaboratively with the states and territories to adopt a nationally consistent road user charge model that will not negatively impact the take-up of electric vehicles.

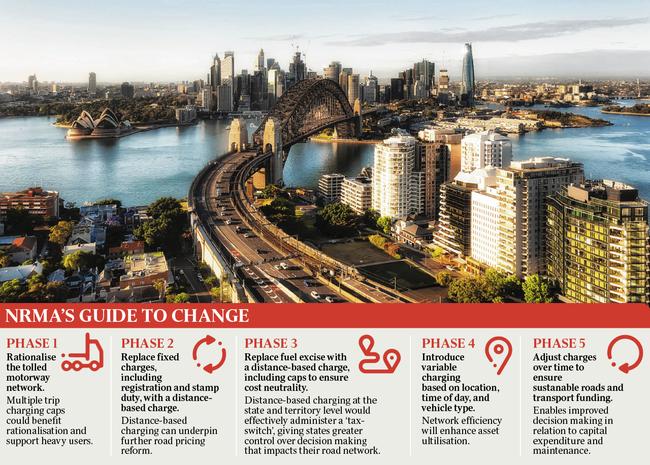

The NRMA on Monday will say it is time to “transition the antiquated tax system, safeguard the uptake of electric vehicles from premature charges, and improve equity for all road users”.

The motoring group said the fuel excise would increase up to 46c a litre this year and a “more progressive and equitable user-pays charging model will help ensure that governments are able to raise the necessary funds to build and maintain roads over the long term”.

NRMA membership and motoring chief executive Emma Harrington said governments must work together to transition the fuel excise to a more “equitable model that’s better suited to Australia’s changing mobility landscape”.

“Australia is now ready for sensible reform of the tax system to ensure a fairer and more equitable way of charging motorists for road use without increasing the burden on families and businesses,” Ms Harrington told The Australian.

“The fuel excise is increasingly becoming less sustainable as a revenue source. The NRMA believes a road user charge model, initially based on distance travelled, will ultimately best serve Australian motorists as we move into the future. Once established, a road user charge should evolve to consider further use factors to improve equity and road network efficiency, including location, time of day and vehicle type.

“Price adjustments should also be considered over time to ensure sustainable funding.”

The NRMA says a road user charge should not create further barriers to the uptake of electric vehicles in Australia.

“Last year, the NRMA supported introducing a 2.5c/km (indexed to CPI) charge on EVs, but only from 1 July, 2027, or when EVs represent 30 per cent of new vehicle sales. The NRMA worked closely with the NSW government on setting this balanced approach to a road user charge, which has since been adopted by several other state governments.

“Transitioning the fuel excise to a road user charge model should be revenue-neutral and not increase the overall tax burden on motorists.

“Reform should include consolidating other road-related taxes and charges, including registration and stamp duty, to simplify the system and improve transparency for motorists.”

The NRMA said the existing fuel excise “increasingly leaves those in regional and remote areas who drive longer distances or have fewer public transport options worse off”.

The Albanese government has prioritised four pieces of legislation in parliament this week, including its electric car discount, Fair Work Act amendment to allow paid family and domestic violence leave, establishment of Jobs and Skills Australia and changes to the Emergency Response Fund. Debate on the climate change bill will begin in the Senate on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout