Newspoll: Superannuation a win with voters but Anthony Albanese made to pay

A majority of voters have embraced the government’s superannuation tax plan despite marking down Labor and Anthony Albanese.

A majority of voters have embraced the government’s superannuation tax plan despite marking down Labor and Anthony Albanese, who has suffered a further plunge in approval following two weeks of heated debate over taxation and accusations of a broken election promise.

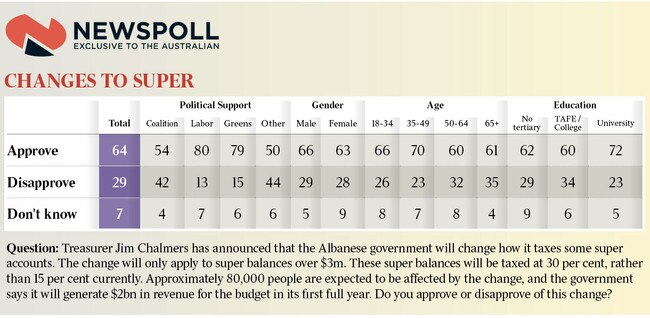

An exclusive Newspoll conducted for The Australian shows almost two-thirds of voters approved of Jim Chalmers’ plan to double the concessional tax rate for super balances over $3m.

There was overwhelming support among Labor voters. A majority of Coalition voters also backed the policy, due to take effect in 2025, despite Peter Dutton’s vow to repeal it if the Coalition were to win the next election. But the political mismanagement of the broader tax debate by the government, which last week forced the Prime Minister to rule out taxes to the family home, has coincided with a slide in Mr Albanese’s own approval ratings, which have fallen to their lowest level since the election.

Mr Albanese’s satisfaction score fell for the second consecutive survey, dropping two points to 55 per cent.

This is now seven points down on his post-election high of 62 per cent.

Those dissatisfied with his performance also rose sharply on the previous poll in February – from 33 per cent to 38 per cent – giving the Prime Minister a net approval rating of 17 per cent.

While Mr Albanese still enjoys a significant lead over his rival as preferred prime minister, 54 per cent to 28 per cent, the gap between the two leaders has tightened, with the Opposition Leader posting his best result on this measure since the election. There was little shift in voters’ assessment of Mr Dutton’s performance, with a one-point fall in net approval rating to minus 11.

The shift has also been reflected in the head-to-head contest between Labor and the Coalition, which has also narrowed to the tightest margin since May last year with a two-point gap now separating the major parties’ primary vote.

The poll of 1530 voters conducted between March 1 and March 4 shows the Coalition’s primary vote lifting a point to 35 per cent while Labor dropped a point to 37 per cent.

While Labor still enjoys a commanding lead on a two-party-preferred split, this measure also narrowed to 54-46 per cent.

This is the closest the two parties have been since the first post-election poll was conducted in July, but still represents a two-point swing toward Labor since it was elected. The movement in the numbers for the major parties, however, is within the margin of error.

The Greens, locked in a battle with the government over the future of the climate change safeguard mechanism, dropped a point to 10 per cent – the minor party’s lowest level of support in this term of parliament, and more than two points down on its election result.

Pauline Hanson’s One Nation party lifted a point to a post-election high of 7 per cent while other minor parties and independents remained on 11 per cent. This category now includes Clive Palmer’s United Australia Party, which has consistently polled at 1 per cent.

The latest Newspoll also surveyed voter attitudes toward the super tax changes announced by the Treasurer and Mr Albanese last Tuesday.

A large majority – 64 per cent – approved compared to 29 per cent who did not. Voters were presented with the policy as outlined – super balances over more than $3m would be taxed at 30 per cent, rather than 15 per cent currently.

The government claims that approximately 80,000 people would be impacted by the change, which would generate an extra $2bn in revenue for the budget in its first full year.

A total of 80 per cent of Labor voters approved of the policy. But 54 per cent of Coalition voters also approved.

Support was strongest among those aged 35-49 – 70 per cent – with the lowest level of support among 50-64-year-olds. But even among this cohort, 60 per cent approved.

Dr Chalmers on Sunday continued to defend the policy against Coalition attacks.

“This is a modest change, but a really simple choice. This is a modest change that only affects half a per cent of Australians,” he said in Brisbane. “There will still be generous tax concessions for everybody in the system, but a little bit less generous for people with more than $3m in their superannuation accounts – and it doesn’t come in until after the next election.”

Opposition Treasury spokesman Angus Taylor on Sunday claimed the policy was “flawed” and would affect a broader range of Australians over time, describing it as a “significant breach of trust”.

“If I’m investing as a 20-year-old, it will be close to 50 years before I get access to that money and the way that is treated along the way is hugely important. People have to be able to trust it. Any change must be extremely cautious,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout