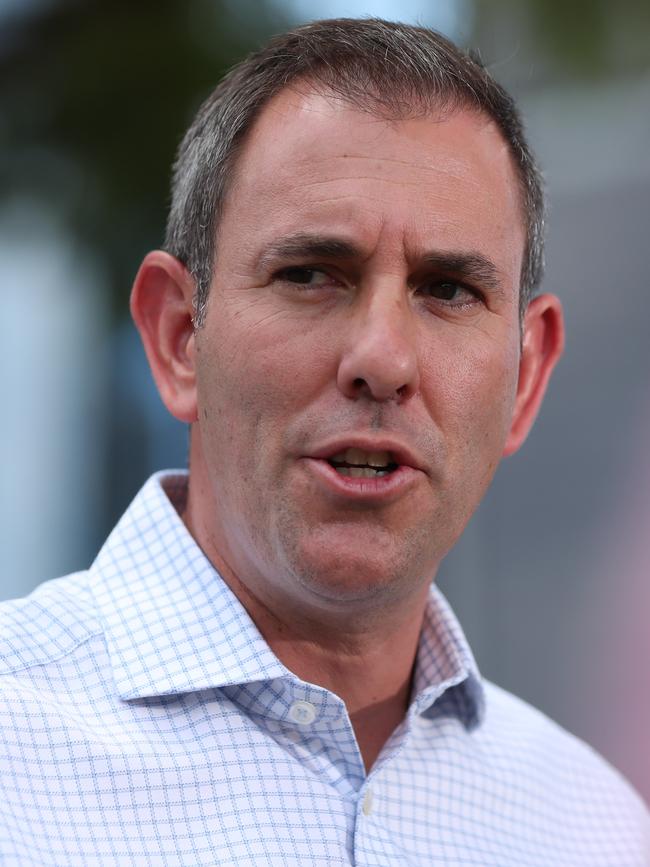

Mining heavyweight BHP has raised fears it could be the next target for a super-profits tax as Treasurer Jim Chalmers searches for new revenue to help pay off Australia’s heavy debt.

With little from Chalmers on a broader tax reform agenda – outside of a bruising superannuation battle – talk of new taxes appears as though big business is jumping at shadows. But the fear of a tax hit is real among executive ranks. BHP’s comments also show trust between Canberra and business needs some resetting, particularly after the Albanese government’s “emergency” intervention in the coal and east coast gas market just before Christmas.

Woodside boss Meg O’Neill last week was unequivocal when she warned about a change to the petroleum resource rent tax in light of their bumper $US6.5bn ($9.7bn) result, saying the energy major could spend its investment cash in other countries. Bank bosses are keeping their heads down, but are concerned their sector faces another bump to Scott Morrison’s hated bank levy, which slaps an additional tax on lenders based on the size of their balance sheets.

BHP’s anxiety has risen sky high after Queensland’s Palaszczuk government last year pushed through a much bigger than expected hike to coal royalties, a move likely to raise an additional $3bn over the next few years. BHP’s quietly spoken but determined chief executive, Mike Henry, has responded to this by going on a capital strike. No new funds will be spent expanding BHP’s mining operations in Queensland.

Now he has issued the same warning to Chalmers. “Any attempt to address structural pressures on the budget by increasing the tax burden on business will result in a similar outcome: reduced investment, fewer jobs and, in the long term, lower living standards for Australians,” BHP says in its pre-budget submission.

BHP has also hit out at the government’s next wave of industrial relations reforms, including sector-wide enterprise bargaining and “Same Job, Same Pay” that seeks to have employers pay labour hire workers the same pay as direct employees – a move that directly hits miners. Combined, this will compound Australia’s existing economic challenges around productivity and competitiveness, BHP says.

In many areas the miner’s pre-budget submission backs key areas of the Albanese government’s social and economic agenda, including outlining BHP’s commitment of $300m to boost skills and training as well as efforts to improve regional childcare in regions where it operates, to assist women in the workforce.

BHP itself is changing as it positions its portfolio towards “future-facing” commodities like copper and nickel which will be in strong demand in the switch to green energy.

And BHP will electrify the energy debate as it urges Canberra to consider nuclear as part of the power mix to help Australia hit its net zero targets by 2050. The comments mark the first time the miner has formally called on Canberra to formally consider the nuclear option as part of the solution to what is expected to be a bumpy energy transition.

“We are most likely to get an efficient and effective energy system, and support innovation, if we do not constrain the options available to the market,” BHP says in its submission.

BHP mines uranium as a by-product of its giant Olympic Dam mine in outback South Australia.

The miner urges the Albanese government to look over the horizon of short political cycles and to the global megatrends set to reshape the Australian economy.

It notes demand for many of Australia’s booming exports – including coal, oil, gas, and iron ore – will come under increasing pressure as the world moves to decarbonise. Australia will need more investment to diversify and strengthen the economy but will face strong competition as other countries accelerate efforts to attract capital.

Here BHP notes the US and Canada are actively taking steps to spur on critical minerals investment, particularly around value-added processing. It notes Australia, which has significant resources, needs to move quickly to attract the capital needed to build out new sectors and take advantage of global demand.

Getting defensive

A slowing economy will soon start exposing bad management teams and poor strategies, representing the biggest test for Australian businesses since the global financial crisis.

That’s the view of top stockpicker Matthew Haupt of the Wilson Asset Management $1.7bn WAM Leaders fund, who says the heat is on bosses and how they navigate the coming 12 months.

The Reserve Bank is expected to push through another interest rate hike on Tuesday – its tenth in as many months – taking the cash rate to 3.6 per cent. This will be the highest level in more than a decade for the rate that influences borrowing costs throughout the economy.

While households started feeling the pinch from the very start of last year’s rapid fire rate hike cycle, businesses are now seeing the lag effect of costs come through. And that’s starting to hit the bottom line.

Haupt was speaking following his fund’s review of corporate Australia’s profit reporting season. Overall, results for companies in the December half showed strong resilience across most of the market. However the environment has clearly turned.

“Best breed management will shine in this environment, whereas the weak will get shown up,” Haupt says. “If you’ve got the wrong management, wrong culture and wrong strategy, it all falls apart”.

More than $40bn in bottom line profits delivered by Australian companies over recent weeks were boosted as inflation added to the revenue line. But earnings have started to show businesses were also starting to show the strain of inflation. Wages, fixed costs and even borrowing costs are all moving higher, Haupt says. And this was more noticeable in the period covering three months to end-December.

“Now it is crunch time. Managers have two choices: cut jobs and increase productivity. Good ones will do a combination of both – bad managers will probably just cut jobs,” he says.

Haupt’s WAM Leaders listed investment fund has nearly $1.7bn under management and has delivered a 15.2 per cent annualised return since it was launched in 2016. This is more than double the broader market.

The fund, chaired by top manger Geoff Wilson, invests in S&P/ASX200 stocks and counts pipeline operator APA, BHP, Commonwealth Bank, Dexus, Westpac and National Australia Bank among its biggest holdings.

Haupt was already on a defensive footing for his fund, even as optimism was building into the markets through the first few weeks of the year. That means he has a higher exposure to stocks such as infrastructure play Atlas Arteria or Transurban that tend to perform well regardless of the economic cycle.

With a string of negative indicators coming through including slowing business and consumer confidence numbers, a clearly slowing economy through the December quarter, and the prospect of the cash rate pushing even higher in Australia, the risk-reward equation for being defensive looks even more compelling.

“We’re looking for companies that actually can ride out the cycle,” he says. This means consumer staples, and infrastructure such as toll roads. He also points out real estate trust Dexus is sitting on high quality office buildings, but trading at a 40 per cent discount to its net tangible assets, meaning it looks compelling despite the cycle, while packaging business Orora delivered a positive surprise. Other names jumping out at Haupt include QBE Insurance, which as a globally exposed insurer is benefiting from rising interest rates and by hiking insurance premiums. He is increasingly cautious on banks – not for the prospect of rising lending losses – but intense competition on mortgages will again crunch their margins.

Now the reality has dawned on markets that inflation is stickier than initially thought around the world and there’s more reason for US interest rates to be higher for longer. This has driven a heavy sell down in the past two weeks.

Just over the weekend high profile Federal Reserve official Mary Daly said in a speech “further policy tightening, maintained for a longer time, will probably be necessary”.

Haupt says when the market turns the move could be quick, but there is a risk the sheer size of the inflation problem means markets should be planning for rapidly adjusting interest rates for years.

“We could be in for a (Alan) Greenspan era where you’re cutting, raising and cutting rates as we navigate inflation. That’s why it’s prudent to have that slight defensive view.

“Defensives do well when the economy goes bad, but defensives do well when interest rates fall too. The cash flows means you’re going to get revalued up. That makes them a safe bet right now.”

johnstone@theaustralian.com.au