Jobs return, tax surges deliver $23bn budget bottom-line boost

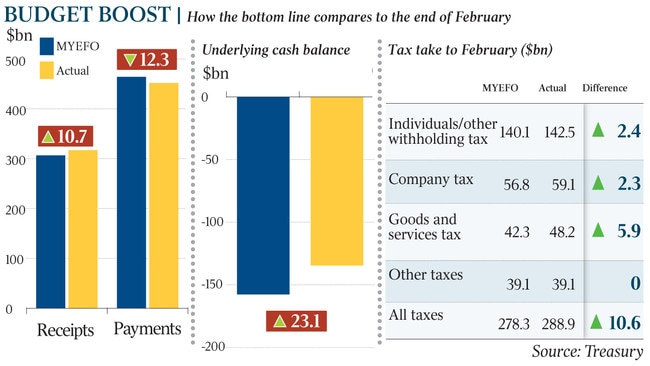

Recovery cuts the coronavirus-induced budget deficit by $23.1bn.

Australia’s economic recovery has cut the nation’s coronavirus-induced budget deficit by $23.1bn, with more than 2.8 million people coming off welfare and wage subsidy payments since the peak of the pandemic.

Ahead of the JobKeeper wage subsidy ending at the weekend, Finance Minister Simon Birmingham will release updated financial statements on Friday showing that a surge in tax revenue and a greater than expected number of people moving off welfare has boosted the budget bottom line.

With all the jobs lost during the pandemic now restored, government payment forecasts have been reduced by $12.3bn, fuelled by $4.4bn in lower JobSeeker dole payments and a drop in demand for grants and other subsidies, including the JobKeeper scheme and cashflow boost.

Tax receipts for the year to February jumped $10.7bn, driven by surges in goods and services, company, individual and superannuation fund taxes.

Senator Birmingham said with consumer sentiment and business confidence returning to pre-pandemic levels and unemployment falling from a peak of 7.5 per cent to 5.8 per cent, more people were in jobs than before COVID-19.

He said while the economic recovery was tracking well, the deficit bill was still “huge”.

“We know that since the start of the pandemic, we have injected around $33bn through the emergency payments into our welfare system to support unemployed Australians,” he said.

“While it won’t all be smooth sailing going forward, we are seeing a remarkable recovery in the labour market. The jobs are coming back and that means our welfare bill is coming down.

“This is still a huge deficit in anyone’s language, but more people in work is providing a marked improvement to date thanks to lower unemployment payments and more taxpayers.”

Amid the Morrison government’s $251bn commitment in direct COVID-19 economic support, the December mid-year budget update had projected a year-to-date underlying cash balance deficit of $157.7bn, which has been recast down to $134.6bn.

Senator Birmingham said JobKeeper and coronavirus supplement payments had “placed significant strain on our budget position”, with Australia facing its “largest ever deficit” as a share of the economy in the nation’s peacetime history.

More than 300,000 Australians have graduated from JobSeeker and Youth Allowance payments since a mid-September peak of 1.6 million.

In addition to JobKeeper ending on Sunday, the $150 fortnightly coronavirus supplement payments and HomeBuilder grants cease on Wednesday.

Treasury secretary Steven Kennedy told a Senate estimates committee on Wednesday that up to 150,000 jobs could be lost when the wage subsidy ends.

Dr Kennedy said 110,000 businesses receiving JobKeeper were in a vulnerable position, having reported that their revenue was still 75 per cent below pre-pandemic levels coming into the March quarter, but he did not expect the labour market recovery would be derailed.

“We expect the unemployment rate has peaked and will continue that downward trajectory, even if there is a bump in the next month or so,” he said.

While Scott Morrison and Josh Frydenberg have reiterated the need for Australians to transition from taxpayer-funded COVID-19 payments back into jobs, the government is preparing to roll out ongoing supports for the worst-affected industries and regions ahead of the May 11 budget.

New NAB analysis of its business customers has revealed the wage subsidy contributed only a tiny amount to business revenue in March compared with virtually all revenue growth around the middle of last year.

NAB chief economist Alan Oster said the data showed the end of JobKeeper was “not going to have a big impact at a macro level”.

But Mr Oster said the NAB figures showed the expiry of the scheme may might well still have “a significant impact” on firms operating in certain industries and firms that continued to suffer from COVID-related restrictions, including many in the hospitality sector, travel agents and businesses in the central business districts of Sydney and Melbourne, where many office workers are yet to return.

Australian Bureau of Statistics data released on Thursday showed a major jobs rebound in manufacturing jobs.

Industry Minister Karen Andrews said the figures revealed manufacturing jobs had almost returned to pre-pandemic levels, increasing to 902,000 jobs last month.

Ms Andrews said the 54,900 boost in manufacturing jobs over three months was directly linked with the government’s extension of the instant-asset write-off, lower energy costs and focus on skills.

She said major manufacturers including BlueScope Steel, which recorded a 78 per cent lift in first-half profits, Visy, Campbells and Planet Innovation were expanding operations and putting on more workers.

ABS data on Thursday also revealed that total household wealth soared by more than $500bn over the three months to December — the biggest increase since 2009.

Climbing housing values accounted for more than half of the 4.3 per cent increase, as the cheapest loans in history and a V-shaped labour market recovery reignited the property market.

Total household wealth and wealth per capita were at record levels of more than $12bn and $467,709 respectively. Through the year, growth was 7 per cent ($790.2bn), slightly below the long term average of 7.3 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout