Free pass to save firms: Chapter 11 bankruptcy laws to keep businesses afloat

Thousands of small businesses facing imminent closure will be thrown a lifeline under new US-style Chapter 11 bankruptcy laws.

Thousands of small businesses facing imminent closure will be thrown a lifeline under new US-style Chapter 11 bankruptcy laws that will allow them to trade their way out of insolvency and avoid being wound up by “vulture” administrators.

The stay of execution for small and family-run businesses as well as sole traders owing less than $1m to creditors will be the most significant reform to corporations and insolvency laws in 20 years and will potentially save thousands more small companies that are on the brink of collapse.

The move could save tens of thousands of jobs that are under threat, with almost 2000 micro businesses having been put into administration between April and July. It will have no cost to the budget but will be framed as significant supply-side reform

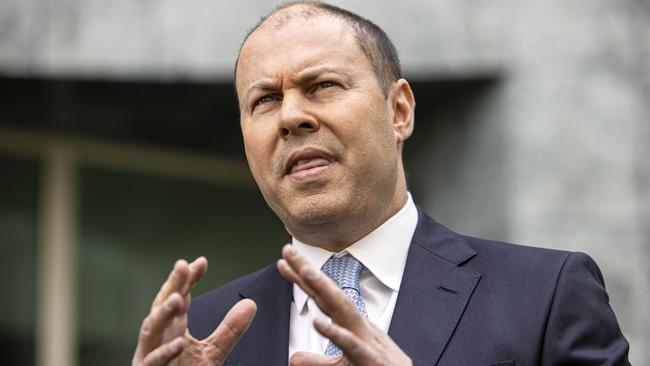

Josh Frydenberg said the new laws would strip administrators from the process and apply a key feature of the US Chapter 11 laws that allows directors and owners of the company to maintain control of their business as they seek to restructure and trade out of insolvency.

There are now more than one million businesses and companies accessing JobKeeper payments to keep them afloat.

Emergency temporary measures introduced in March to shield distressed businesses from being forced into administration by creditors will expire at the end of the year. The permanent structural reforms to corporations law will apply only to small businesses, and are expected to rescue up to 76 per cent of businesses currently insolvent largely because of COVID-19.

The government said 98 per of those were businesses with fewer than 20 employees.

A new two-tiered system, in line with US legislative changes last year and those recommended by the Productivity Commission, would be applied to treat small and large businesses differently under insolvency law.

It would effectively spare thousands of small businesses being forced into voluntary administration from which many would never recover.

“These are the most significant reforms to Australia’s insolvency framework in almost 30 years, and will help to keep more businesses in business and Australians in jobs,” the Treasurer said.

“The reforms are a critical part of our economic recovery plan and will help to boost business confidence and dynamism across the economy by allowing viable businesses to survive as our economy rebuilds.

“The government’s new reforms draw on key features of the US Chapter 11 bankruptcy process allowing small businesses to restructure their debts while remaining in control of their business. In addition to these regulatory changes, the government is providing an unprecedented level of support totalling $314bn to cushion the blow for households and businesses as part of our economic recovery plan for Australia.”

Current Australian law, which treats every company the same regardless of size, requires an external administrator to be appointed to take control of a company that enters insolvency over failure to repay debt, effectively putting creditors in control of the business. The high cost of voluntary administration can consume significant resources of many small businesses, making it impossible to restructure.

The system was already being reviewed by Mr Frydenberg and Assistant Treasurer Michael Sukkar before the pandemic hit and was anticipated to be part of the May budget before that was delayed to October 6.

The new insolvency regime will be turned on its head to apply a “debtor-possession” principle — a key feature of US Chapter 11 laws — that allows directors of the business to retain control while they try to restructure.

The business would be given 20 days to come up with a plan to trade out of the insolvency and offer a deal to creditors. The creditors would then be given 15 days to vote on accepting the deal.

A senior government source said the days of the “lawyers’ picnic” were over when it came to small businesses in distress.

“This gives small businesses a viable pathway out of insolvency without the vultures coming in and picking the eyes out of it,” they said.

The laws would remove costly administrators from the process unless the creditors refused to accept a debt restructure and chose to potentially force the company into liquidation.

The new insolvency laws, which would dramatically reduce costs for distressed businesses seeking to avoid liquidation, will apply to those with liabilities of under $1m.

The criminal penalty regime that currently exists and forbids directors from continuing to trade while insolvent would be scrapped.

It would also benefit creditors, who need to be paid and who would get a better deal with the saving of money otherwise lost through administrator fees.

Mr Sukkar said the government believed the “one size fits all approach” put small business at a disadvantage and unnecessarily forced many to go under when they could have been saved.

“We also believe that a small-business owner should get the opportunity to decide on how to reorganise their business or whether to wind down,” he said.

“These fundamental reforms will give nearly 80 per cent of business owners the opportunity to consider their options in a more timely and cost-effective way.

“We want to ensure that when the pandemic has passed, Australian businesses can recover strongly and it will be critical that distressed businesses have the necessary flexibility to either restructure or to wind down their operations in an orderly manner.”

Reserve Bank governor Phil Lowe warned in August that there would be a wave of insolvencies, with many businesses unlikely to recover from the forced economic hibernation imposed in March to tackle the spread of COVID-19 and prevent a health crisis of the scale now afflicting much of the rest of the world.

The process for businesses beyond recovery would also be streamlined to allow for a quicker and less costly liquidation process.

The protections put in place in March, which have been extended, increased the threshold liabilities at which creditors could force legal demands on a business from $2000 to $20,000.

They also extended the 21-day requirement to respond to creditor demands to six months.

These measures are credited with reducing insolvencies, based on the same period in 2019, by 46 per cent.

A temporary reprieve of bankruptcy laws, which applies to individuals, prevented people from being forced into personal bankruptcy.

With both due to expire on December 31, the level of insolvencies was expected to rise dramatically.

Micro-businesses are most at risk. There are currently 919,000 micro businesses — regarded as those with turnovers of less than $2m a year — on JobKeeper.

There are a further 82,000 small to medium-sized enterprises on government assistance.

These are businesses with turnover of between $2m and $250m.

There are further 2000 large companies — those with turnovers of above $250m — also accessing JobKeeper.

The shake-up would replace the administration process with a Small Business Restructuring Practitioner who would help the company board restructure its business.

The new laws include complementary measures that would waive fees for practitioners to register as a liquidator, or SBRP, which would expand the pool of experts in this field and further reduce costs for small businesses needing restructuring.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout