The former prime minster is right that use of the overnight cash rate to guide inflation, which he as prime minister helped establish in the early 1990s, is at a dead-end, and not just in Martin Place.

Central banks the developed world over have consistently demonstrated their impotence over the past decade as rates of consumer price inflation defied successive cuts to interest rates.

Central banking has become an alphabet soup of “policies” that have had little impact on the real economy, outside putting a rocket under asset prices.

But Mr Keating’s call to fire up the metaphorical printing presses and put however much money in the government’s bank account it asks for, is risky and premature.

No other nation — not even the quantitative easing pioneer the Bank of Japan — has directly purchased bonds from its government, let alone dispensed with the pretence of government bonds entirely, and then simply plonked the dollars requested in the government’s account at the RBA.

For Australia to do so would risk undermining “the stability of the currency”, which along with “full employment” is another of the Reserve Bank’s legislative mandates. History shows us that unemployment can’t be shifted for long by monetary policy anyway; money, as they say, is a veil.

It’s not as if the RBA hasn’t changed policy to accommodate the coronavirus recession.

Interest rates are almost at zero, and the banking system has access to an unprecedented $200bn line of cheap credit.

And the Reserve Bank has already purchased about $60bn worth of state and federal government bonds with newly created money.

But it’s doing this indirectly on the secondary market, where the price of those bonds can be first set.

In any case, state and federal governments are having no trouble whatsoever borrowing on the open market, at interest rates around 1 per cent for 10 years, which is less than the rate of inflation.

If they wanted to borrow more, they easily could, at little cost. It’s not for the RBA to tell the government to spend more.

Finally, would a Coalition government steeped in the importance of fiscal discipline really want the central bank to resort to money printing on its watch?

Our response to COVID-19 has been radical enough — let’s keep monetary policy conventional for a bit longer yet.

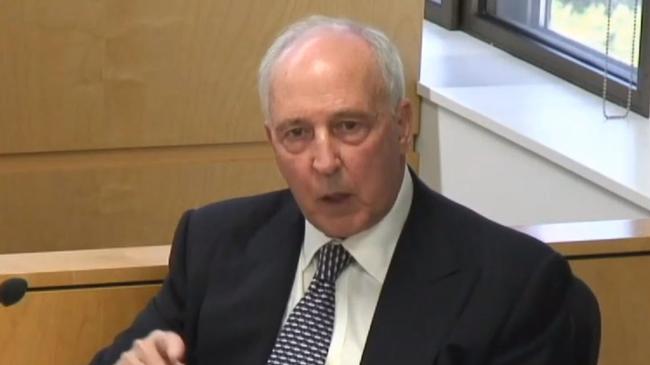

Paul Keating’s spray at the Reserve Bank on Wednesday, demanding it “help the government” by printing money to “reach full employment”, suggests the former Labor leader spent lockdown reading a bit of Modern Monetary Theory.