First-home rentvesters in crossfire of negative gearing

The removal of negative gearing would make it harder for young people to get a foot onto the property ladder through reinvesting as more investors rely on the tax concession.

The removal of negative gearing would make it harder for young people to get a foot on the property ladder through reinvesting as more investors rely on the tax concession.

“Rentvesting” refers to the practice of buying where you can afford and renting where you want to live, which is a trend anecdotally on the rise as property prices continue rising in half of all capital cities. As many first-home buyers struggle to overcome the deposit hurdle, Ray White chief economist Nerida Conisbee said the foreshadowed removal of negative gearing would make the investment route less attractive.

“We know that rentvesting is popular, mainly with younger people,” Ms Conisbee said.

“It allows them to get on the property ladder, which we know is really the best way to create wealth and prevent being a renter once you hit retirement.”

For much of 2010s, around 60 per cent of all investors were reporting a loss on their properties, which they were able to be offset through negative gearing when they filed their tax returns. Ultra-low interest rates and rapidly rising rents saw the same proportion break-even through the 2020-21 and 2021-22 financial years.

While more recent data is not available, PropTrack economist Angus Moore believes decade-high interest rates have likely caused the market to revert to historical trends.

“I’d be surprised if we were still seeing, you know, below 50 per cent negatively geared,” Mr Moore said.

“For many investors, even though rents have been growing very quickly and rental markets are very tight, mortgage costs are probably still going to be quite significant and possibly larger than rent.”

Nationally, rental yields sat at 4.4 per cent in the June quarter, which is below the average owner-occupier variable rate of 6.36 per cent.

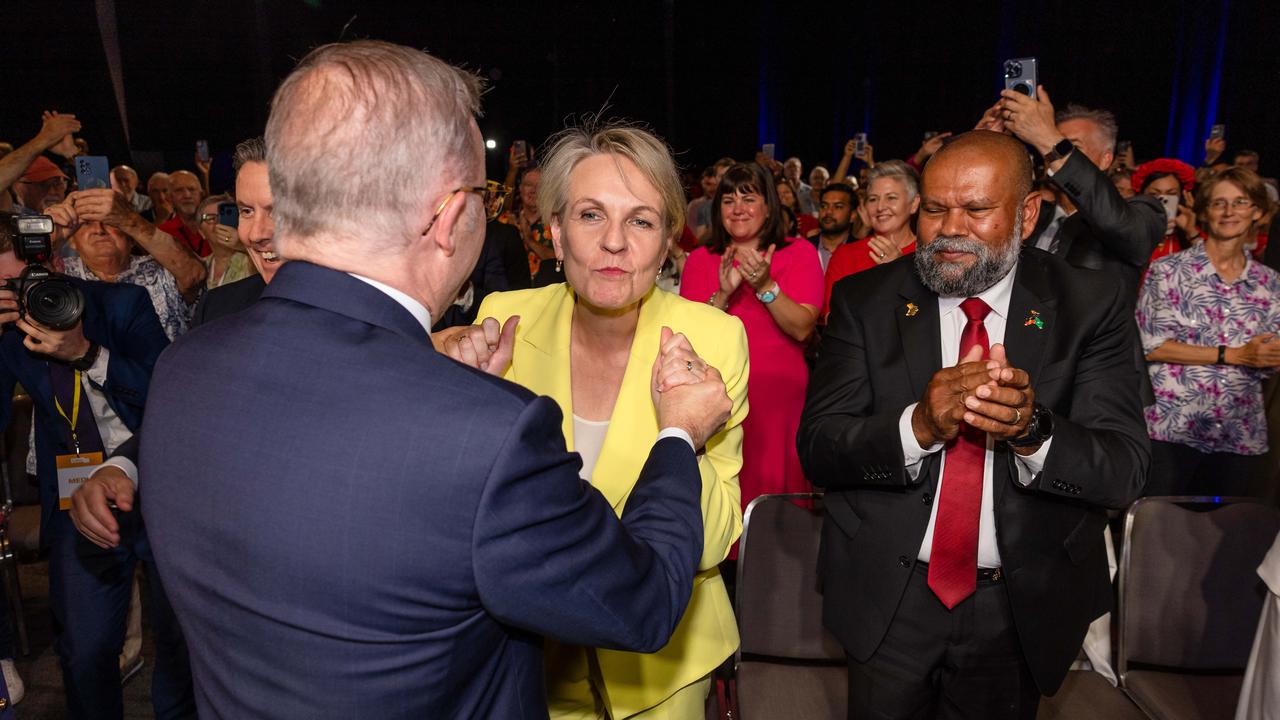

Prime Minister Anthony Albanese did not rule out changes to negative gearing on Wednesday after it was revealed public officials had been asked to explore policy options.

The Real Estate Institute of Queensland chief executive Antonia Mercorella said repeated studies had shown there was a minimal link between negative gearing and higher house prices.

“To make a major change to the rental sector during a time of low vacancy rates across Australia and long social housing waitlists could be catastrophic for the housing sector,” Ms Mercorella said.

“It would be unwise for the federal government to seek to eliminate what is essentially a straightforward tax deduction for property investors.

“Abolishing negative gearing would eliminate a range of economic benefits, fail to tackle housing affordability, and impact everyday Australians the hardest.

“It is particularly disappointing given the new federal Housing Minister’s statement in August that the government had no intention of changing the current negative gearing system.”

A recent survey from Property Investment Professionals of Australia found one in seven investors were paying between $10,000 and $60,000 a year to maintain their properties. The increase was linked to additional mortgage interest and the rising cost of insurance, taxes, management and compliance.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout