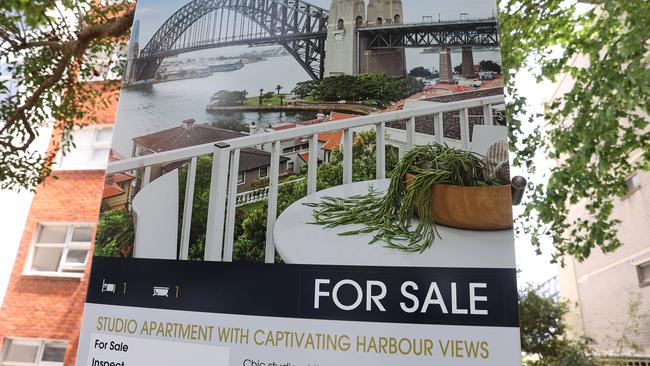

Desperate to get on the property ladder as prices keep climbing? Yellow Brick Road chair suggests ‘rentvesting’

Aussies desperate to get onto the property ladder are urged to think hard before they buy. Here’s why you might be better off renting.

Personal finance author Mark Bouris has urged Aussies desperate to get onto the property ladder to think about “rentvesting”, whereby you rent a dwelling to live in that fits your lifestyle while buying one that your budget can handle.

The Yellow Brick Road Group executive chairman spoke to Sunrise on Wednesday about the difficulties of getting on the property ladder.

Australian housing values dwelling values have rocketed about 22 per cent in the past 12 months, far outstripping wage growth of 2.2 per cent over the same period.

“If your wages are not going up ... the amount of money you can borrow is a lot less than the purchase price, so it’s never keeping pace” Mr Bouris told the program.

With both property prices and interest rates on the rise - what hope can aspiring homeowners have?

“If you grew up in Paddington, you need to start thinking ‘should I buy in Lismore, Ballina, just to get on the property market?’ Buy where you can afford, rent where you want to live,” Mr Bouris suggested.

“If you want to live in Paddington, go rent. If you want to buy ... buy in Lismore, Ballina, regional, wherever you are, Orange, I don’t care - just get onto the property market.”

RBC Capital Markets’ macro rates strategist Robert Thompson on Monday tipped a much more modest rise in dwelling values next year of 4 per cent followed in 2023 by a 5 per cent fall as higher interest rates begin to bite.

That same day, Commonwealth Bank economists predicted dwelling prices would rise 7 per cent in 2022 before “an orderly correction” of about 10 per cent in 2023.

Last week, ANZ flagged prices would rise just over 6 per cent next year then fall by about 4 per cent in 2023.

The Reserve Bank of Australia has said it doesn’t expect the need to lift the official cash rate from historic lows before 2024, but there’s a chance that may happen in 2023.

Regardless, banks have started raising interest rates and CBA expects the RBA will “commence normalising the cash rate in November 2022”.

Federal Housing Minister Michael Sukkar doesn’t seem worried, telling 4BC’s Neil Breen on Wednesday that first-home buyers were at the highest numbers in 15 years.

“A moderation of house prices certainly doesn’t, at this point, concern the RBA or the banks, who are the ones ultimately providing those loans,” Mr Sukkar told the broadcaster.

“From a government perspective … we want to see modest, moderate, steady house price growth.”