Federal budget 2023: Interest rates reality bites Jim Chalmers’ spin as Peter Dutton makes pitch for middle

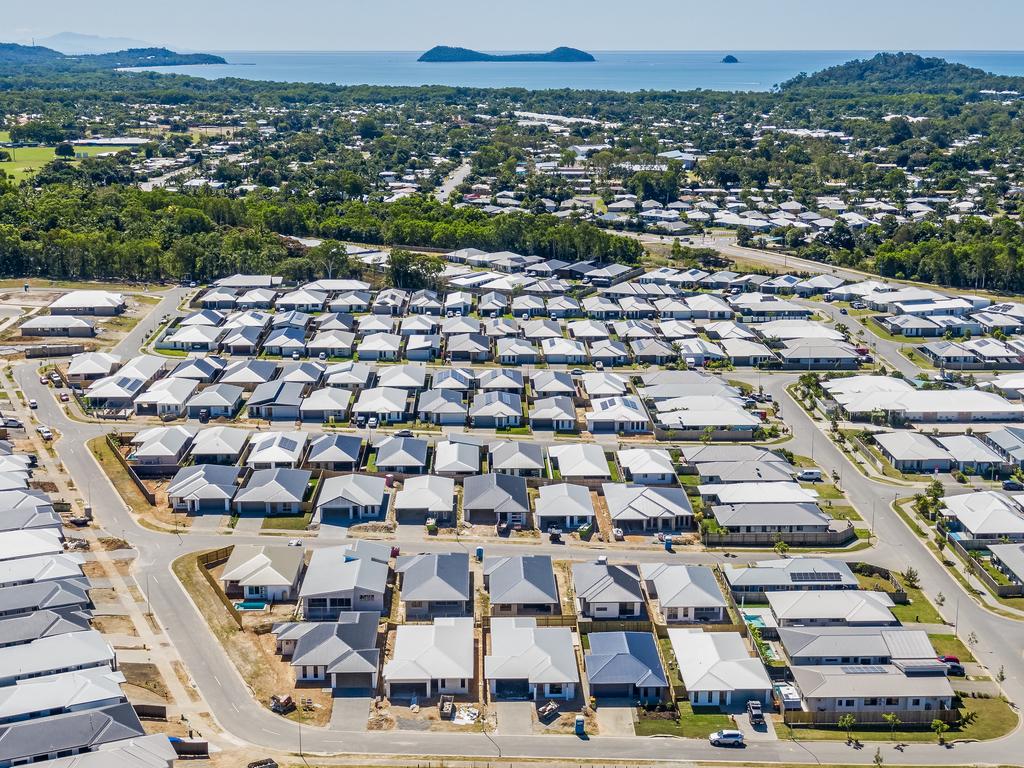

Middle Australia faces a penalty from Labor’s big-spending second budget, with analysts warning mortgage holders are likely to be hit with higher rates for longer.

Middle Australia faces an economic penalty from Labor’s big-spending second budget, with leading analysts warning that mortgage holders are likely to be hit with higher interest rates for longer despite government assurances that $21bn in extra spending will not fuel inflation.

Jim Chalmers and Anthony Albanese on Wednesday rejected arguments the budget would add to inflationary pressures in the economy, dismissing suggestions the government would be responsible for any future central bank rate hikes.

Peter Dutton will launch a push on Thursday night to win back middle Australia in his budget reply speech, unveiling new “values-based family friendly social policies” and attacking Labor over broken promises on aged care and superannuation.

The Opposition Leader, who is expected to support some budget measures including the $2.4bn petroleum resource rent tax hike slugging gas companies, will focus on millions of Australians facing mortgage stress and the inflationary impact of higher government spending.

On Wednesday, the Treasurer defended the government’s fiscal strategy, restraint and $3bn energy relief plan as “key to dealing with the inflation challenge”.

“Our budget is contractionary when inflation is at its highest – the result of our efforts to improve the fiscal position by around $125bn over two years since coming to government,” Dr Chalmers said.

“This represents a turnaround of around 3.6 percentage points of GDP in 2022-23; a 1.8 percentage point turnaround in the next.”

Asked whether the government would be at fault if the RBA hiked rates at its next meeting, Dr Chalmers said he wouldn’t “pre-empt decisions taken independently” by the central bank board.

“Our fiscal position is clearly not working against the RBA,” he said. “Our targeted interventions in those areas where price pressures are most acute will directly take the pressure off inflation – by some three-quarters of a percentage point next year. That means inflation will be lower in 2023-24 than what we forecast in October.”

Anthony Albanese also said the budget would not add to inflation because it would boost productivity and workforce participation. “We are producing the first projected surplus in 15 years,” the Prime Minister said. “We’re banking, putting 87 per cent of the revenue gains to the bottom line. We produced $40bn of savings over two budgets. This is a responsible budget that deals with the pressure of inflation which is there, whilst also understanding that we need to assist people who are under pressure.”

While Dr Chalmers quoted Westpac chief economist Bill Evans in parliament, saying he did not expect the budget to “put upward pressure on interest rates”, Mr Evans told The Australian that mortgage holders could still face the prospect of higher rates for longer.

“Do I believe it (the budget) will trigger a rate hike? No. Do I believe the rates relief I thought we would get in February could be delayed? Yes,” he said.

“When we look at the new spending in the budget relative to the 10 years before Covid, it is almost twice as strong as we’ve seen in the past, so people will argue this is a big spending budget.

“The improved position of $146bn they managed to save most of it – so it’s still $126bn. So that’s an achievement, but $20bn going into the economy in the space of three years is what I would call big spending.

“The RBA won’t be raising rates in anticipation of that $12bn (additional spending in 2023-24), but it could mean that over the course of that year that the opportunity to cut rates as early as February starts to fade away – that’s the one thing I’m worried about with regard to the budget.”

UBS on Wednesday delayed by three months its forecast of a rate cut from November this year but warned about the “increasing risk” of another 0.25 per cent rate hike with additional cashflow in the economy.

In its post-budget report, UBS said lower-income households were more likely to spend money and increase demand. “We formally push back our expectation of the first RBA easing to February 2024,’’ said UBS chief economist George Tharenou.

UBS said in a statement: “There is an increasing risk (the RBA) will raise the cash rate again by another 25 bps (to 4.1 per cent), with the most likely timing in July after the minimum-wage decision, or potentially in August.”

KPMG chief economist Brendan Rynne said government spending and wage support presented a “risk that interest rates will need to be higher and that the fight against inflation will be prolonged”.

ANZ head of Australian economics Adam Boyton said: “If households pay less for some goods and services, that frees up cash to spend on other items which could support demand and possibly prices elsewhere.”

CFMEU Victorian boss John Setka accused the Albanese government of promoting “pie in the sky” inflation forecasts in the budget, which he took “with a grain of salt”. He dismissed the RBA’s warnings of a wage price spiral and declared he expected construction workers to launch industrial action in pursuit of annual pay rises of at least 5 per cent.

The CFMEU chief, who attacked the central bank for 11 interest rate hikes, starting last May, said the inflation forecasts were “crystal-ball stuff”. “It’s all pie in the sky. You have got to take with a grain of salt some of the things they say. Who knows?

“It depends on what happens with world markets. Everything has got to go right for all this to play out the way they say it will play out,” Mr Setka said.

In his budget reply speech Mr Dutton will reiterate core Coalition values and policies, including: allowing first home buyers to access their superannuation; boosting productivity and building infrastructure; and promoting new social and economic policies to help families.

Mr Dutton will attack Labor for failing to deliver 24/7 nurses and mandated care minutes in nursing homes and announce the Coalition’s position on Labor’s $40-a-fortnight JobSeeker hike and increased payments for more single parents.

Senior Liberal sources said it would be difficult to argue against the modest JobSeeker rise but did not rule out opposition to other increased welfare payments.

Mr Dutton, who is under pressure from colleagues and party strategists to accelerate the Coalition’s policy agenda, will criticise Labor’s tax hit on Australians with super balances over $3m and the government’s broken promise to lower electricity bills.

Following the Aston by-election defeat and plunging support for the Coalition, Mr Dutton will use his second budget reply speech to rally the troops and promise a full suite of policies ahead of the 2025 federal election.

Mr Dutton said an average family with a mortgage and three children would be “$25,000 worse off under Labor”, paying higher mortgage payments ($20,676), groceries ($2236), electricity ($564) and losing out on the low-and-middle-income tax offset ($1500).

Following criticism from the AiGroup, Master Builders Australia, Business Council of Australia and Minerals Council of Australia over the budget’s productivity plan, Mr Dutton said: “There’s no mention of infrastructure, there was no mention of productivity … so, there are things that they could have done to reduce the inflationary pressures”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout