COVID comeback to give $10bn boost to budget: CBA

A sharp upgrade to the economic outlook since the October 6 budget could shave $10bn off the federal deficit in next week’s MYEFO, CBA says.

A sharp upgrade to the economic outlook since the October 6 budget could drive a $10bn boost to the federal government’s bottom line in next Thursday’s mid-year economic and fiscal update, according to analysis by CBA.

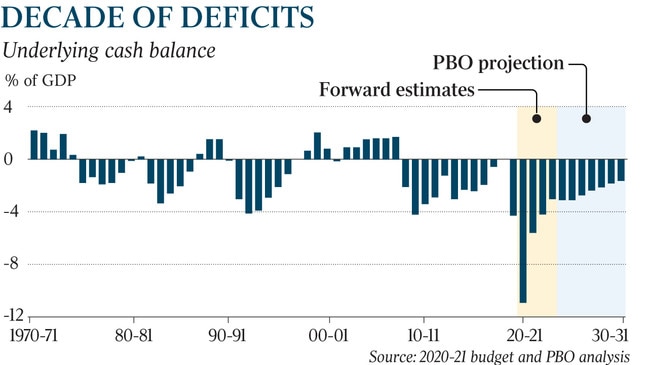

In handing down a delayed 2020-21 budget, Josh Frydenberg revealed a peacetime record estimated deficit for this financial year of $214bn, or more than 11 per cent of GDP, as the COVID-19 recession triggered tens of billions in stimulus spending, even as tax revenue collapsed.

But the pace of the recovery over recent weeks has surprised policymakers and private sector economists. Starting with the faster than expected 3.3 per cent rebound in GDP over the three months to September, a series of upbeat economic signals — including consumer confidence hitting a decade high in early December — have forecasters pencilling in solid growth for the current quarter.

A faster-paced recovery, higher iron ore earnings and less demand for the massive JobKeeper wage subsidy program should drive the 2020-21 deficit down to $204bn, or a little over 10 per cent of GDP, the CBA estimates showed.

Over the forward estimates, a faster economic growth trajectory will trigger a $66bn improvement in the government’s financial position.

CBA head of Australian economics Gareth Aird said: “The size of the projected budget deficits will remain extraordinary, but overall we can look forward to some good news in the MYEFO relative to what was presented in the October budget.”

The parliamentary budget watchdog’s annual medium-term outlook, released on Thursday, confirmed that COVID-19’s “profound impact” on the country’s fiscal position would leave the country with a deficit at still over $50bn by the end of the decade, while gross government debt would climb over most of the coming 10 years.

With the 2020-21 budget substantially delayed due to the pandemic, the mid-year economic and fiscal outlook will be delivered only 10 weeks later, rather than the usual six months.

Mr Aird said the compressed period between the two documents “should mean a smaller prospect of material revisions to the budget bottom line but this is no ordinary year and the economic recovery is occurring a lot faster than the government expected”.

The bank estimates the government’s 2020-21 financial position will receive a $13bn boost, thanks to higher revenue and lower payments, largely due to lower JobKeeper costs.

The extension of the JobSeeker supplement into the New Year, however, will cost an additional $3bn, but Mr Aird said he did not expect the government to unveil any other major policy initiatives.

Revenue should be $8.6bn more than expected only two months ago, Mr Aird said. Of this, the iron ore price’s surge to $US150 a tonne will account for about $2bn.

The rapid lift in consumption in the September quarter and into the final months of the year — helped along by a sharp lift in spending in Victoria since it reopened — will add to economic growth, while a bigger than anticipated increase in working hours will add to income tax receipts.

Treasury has released figures showing there were 700,000 fewer businesses applying for JobKeeper from the start of October, which will save the government $5bn in the December quarter alone, Mr Aird said.

Josh Frydenberg has unveiled a fiscal strategy that will continue to prioritise job creation over driving down the deficit until the jobless rate is substantially below 6 per cent — compared with 7 per cent recorded in October.

The Parliamentary Budget Office estimated that gross debt as a share of GDP is expected to reach about 55 per over the coming years — its highest level since World War II, and in line with budget projections.

But historically low interest rates mean repayments on that debt are projected to remain lower than for most of the past 75 years, at about 0.9 per cent of GDP.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout