Coronavirus: Households fear for their financial future

The COVID-19 lockdown is exacting a heavy and ongoing economic toll, a new survey shows.

The COVID-19 lockdown is exacting a heavy and ongoing economic toll, a new survey shows, with 70 per cent of Australians saying they are concerned about their financial situation.

Half of all households with children under 18 report a reduction in income, with 30 per cent experiencing a substantial drop, the Australian Institute of Family Studies survey of 7000 people finds.

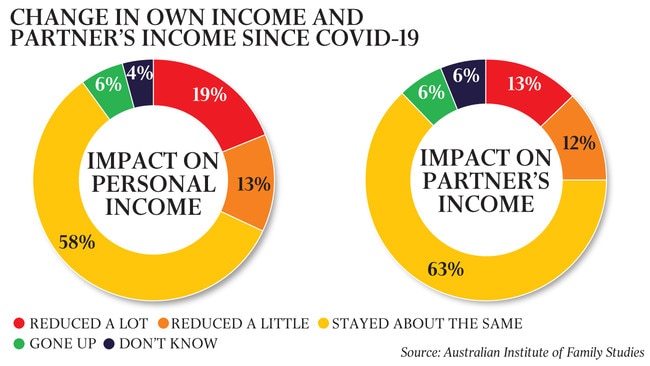

Overall, one in five people said their income had dropped a lot, and another 13 per cent said it had reduced a little.

Sixty per cent of people are at least “a little concerned” about their current financial situation, and more than one in four people have used savings to cover everyday expenses, the report, Life During COVID-19, concludes.

“A significant proportion of Australian families have been impacted financially, whether by job losses, reductions in hours, having to close their businesses, or lower returns on investments impacting the incomes of self-funded retirees,” report author and AIFS senior research fellow Diana Warren said. “Subsequently, there are significant levels of concern among Australians about both current and future financial wellbeing.

“This is especially true for people who have experienced a drop in income, but even those who haven’t been directly impacted are worried,” Dr Warren said.

Worry about the future was influencing spending patterns, the report found. Of those who had suffered a substantial drop in income, eight in 10 had cut spending on non-essentials and 52 per cent were spending less on essentials, including groceries.

One in five had asked for financial help from friends or family, and 15 per cent had requested a pause on rental or mortgage payments, the AIFS research found.

More than one in 10 said they or a household member had applied for early super access. In households where there had been a significant reduction in income, that number was 26 per cent.

“While some of the reduction in spending might be attributed to there being fewer things to spend money on — thanks to restrictions on social activities, for example — people are also worried about their future job security,” Dr Warren said.

“The COVID-19 pandemic is a health issue unlike anything we’ve seen in our lifetimes, but the flow-on impacts, financially, have been one of the other key challenges of the pandemic,” she said.

The findings on financial hardship are supported by a separate survey commissioned by the Australian Housing and Urban Research Institute that reports a quarter of tenants are having problems meeting rent payments, and another one in three fear they will not be able to pay their full rent in the next few months.

Only half the tenants who had asked for rent reductions reported that the landlord or property agent had fully accepted their requests, the report by researchers from RMIT University and the University of Adelaide found.

“With moratoriums on evictions, rent increases and mortgage deferrals all coming to an end, the issues uncovered by this research risk rapidly worsening,” lead author David Oswald said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout