Banks quick to announce rate cuts amid levy fears

Banks announced the 25-basis-point cut would flow through to borrowers quickly after CEOs were phoned by the Treasurer.

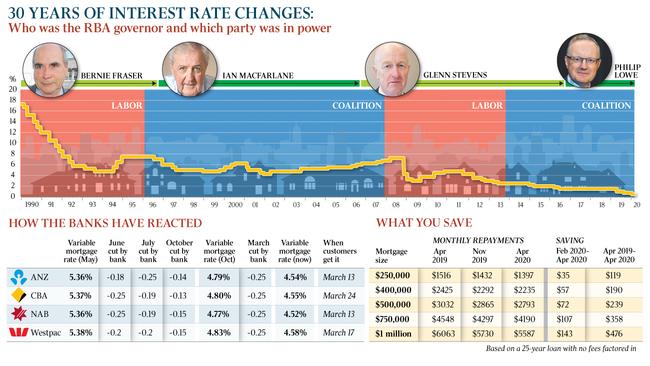

The big four banks have moved swiftly to pass on the Reserve Bank’s interest rate cut to a record low of 0.5 per cent, amid fears the Morrison government could increase the bank levy in the wake of the global coronavirus epidemic.

For the first time in five years, the banks all announced on Tuesday the 25-basis-point cut would flow through to borrowers quickly, after chief executives were telephoned directly by Treasurer Josh Frydenberg.

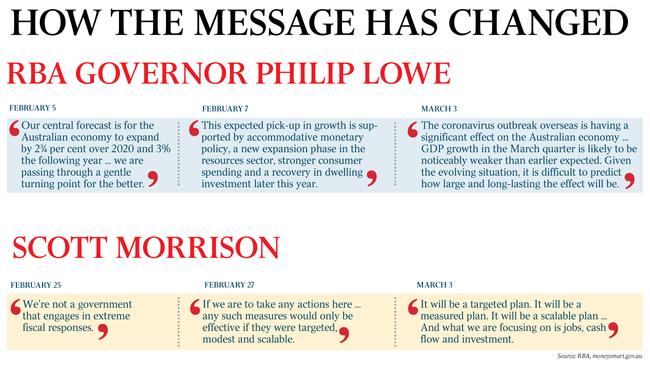

RBA governor Philip Lowe’s fourth rate cut in 10 months fuelled calls for Scott Morrison to act quickly with the government’s own “measured” fiscal response to stave off the prospect of recession.

Investment tax breaks for businesses are being seriously considered, with the Prime Minister saying a key priority will be to lift business spending once the crisis passes.

Overnight on Wednesday Australian time, the US Federal Reserve followed suit with a half-percentage rate cut at its first between-meeting move since the global financial crisis. The emergency cut lowered the federal-funds rate to a range between 1 per cent and 1.25 per cent. The action was approved unanimously and the Fed in a statement held out the prospect for further stimulus.

Earlier, Donald Trump had called on the Fed to follow the Australian lead. “Australia’s central bank cut interest rates and stated it will most likely further ease in order to make up for China’s coronavirus situation and slowdown,” the US President tweeted on Tuesday night. “Our Federal Reserve has us paying higher rates than many others, when we should be paying less. Tough on our exporters and puts the USA at a competitive disadvantage. Must be the other way around.”

Australia’s Central Bank cut interest rates and stated it will most likely further ease in order to make up for China’s Coronavirus situation and slowdown. They reduced to 0.5%, a record low. Other countries are doing the same thing, if not more so. Our Federal Reserve has us....

— Donald J. Trump (@realDonaldTrump) March 3, 2020

Dr Lowe warned that the coronavirus outbreak had “clouded the short-term outlook” and was likely to affect domestic spending. He said it was already having a “significant effect” on the economy, particularly in the education and travel industries.

“Given the evolving situation, it is difficult to predict how large and long-lasting the effect will be,” Dr Lowe said.

Former RBA board member Warwick McKibbin warned that even a “mild” pandemic scenario could cost the world economy trillions of dollars. ANU released modelling showing it would lead to more than 15 million deaths globally and cost the world economy $US2.4 trillion.

The research by Professor McKibbin and Roshen Fernando also showed that, for Australia, the same scenario could kill 21,000 Australians and subtract 2.1 per cent from GDP in 2020 — costing the economy $US27bn.

“Our scenarios show that even a contained outbreak could significantly impact the global economy in the short run,” Professor McKibbin said. “In the case where COVID-19 develops into a global pandemic, our results suggest that the cost can escalate quickly.

“Even in the best-case scenario of a low-severity impact, the economic fallout is going to be enormous and countries need to work together to limit the potential damage as much as possible.”

The Australian understands that, in the days leading up to Tuesday’s RBA board meeting, senior figures in the Morrison government floated the option of a modest increase to the bank levy, introduced by the Coalition in 2017 to raise about $6bn. The bank levy was not raised in the phone discussions between Mr Frydenberg and the bank CEOs on Monday night but senior banking executives are known to have approached the government over bank levy fears.

Senior government sources said banks were “jumpy” about the possibility the government might move to lift the levy before the budget, which is under pressure due to the virus outbreak. “They were definitely jumpy,” a senior government source said, adding that there has been no formal consideration by the Treasurer or the Prime Minister of raising the levy. “We welcome the decision by the banks to pass on the rate cut in full … this is good news for borrowers which would see somebody with a $400,000 mortgage around $700 a year better off,’’ Mr Frydenberg said on Tuesday. “Importantly, monetary policy and fiscal policy are supporting economic growth.”

While some banks announced within seconds of the RBA’s decision that the cut would be passed on, customers won’t receive the benefits for 10 to 21 days.

The Australian understands that Mr Frydenberg was due on Tuesday night to hold a phone hook-up with the International Monetary Fund, which will provide a global economic update on the coronavirus outbreak.

A number of economists expect the Australian economy to contract in the March quarter under the dual weight of this summer’s “black summer” bushfires and the damage associated with the health emergency.

There are fears that, should the virus continue to spread, the toll on economies will stretch into the June quarter and threaten a first Australian recession since the early 1990s.

The national accounts for the December quarter, to be released on Wednesday, could show the economy was growing by between 0.3 and 0.4 per cent, delivering annual growth of 1.9 to 2 per cent.

The economy grew by 1.7 per cent over the year to September.

John Edwards, a senior fellow at the Lowy Institute and former RBA board member, said he was surprised the central bank moved so quickly to cut the cash rate rather than wait until next month to gather more information on the economic impact of the coronavirus. He warned that, as rates were so low, the RBA move would not have a “substantial impact”. He said it was a signal the RBA was concerned and, “most importantly, that it is prepared to do more”.

Mr Morrison said the recent G20 finance ministers meeting in Saudi Arabia had formed a view the coronavirus outbreak would deliver a V-shaped economic trajectory in relation to recovery. He cautioned that it was looking more like a U-shape, suggesting a more extended hit to the economy. He reaffirmed that the government was working with Treasury on a “targeted” plan aimed at affected industries. “We will ensure that we do not make the same mistakes of previous stimulus measures that have been put in place,” he said.

Labor hit back at the government, claiming the economy had been underperforming before the bushfires and the coronavirus hit, and that the RBA cut was a result of poor economic management.

“Before the fires and the virus, growth had already deteriorated, stagnant wages were driving weak consumption, business investment and productivity were falling, and government debt and household debt had reached record highs,” said opposition Treasury spokesman Jim Chalmers.

The RBA is in the vanguard of a new wave of global monetary policy easing, with the Bank of Canada expected to cut to 1.5 per cent when it meets on Wednesday night, Australian time.

US Federal Reserve chairman Jerome Powell said on the weekend the central bank would “use our tools and act as appropriate to support the economy”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout