Global central bankers in crisis meeting over coronavirus response

The world’s most powerful finance ministers and central bankers have discussed their coronavirus reponses as the RBA cut rates.

The world’s most powerful finance ministers and central bankers on Tuesday night held an emergency teleconference to discuss their policy response to the coronavirus, as the Reserve Bank kicked off a fresh round of easing by cutting interest rates to a record low.

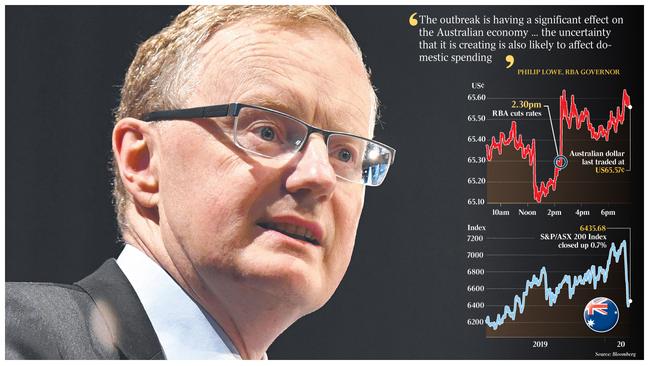

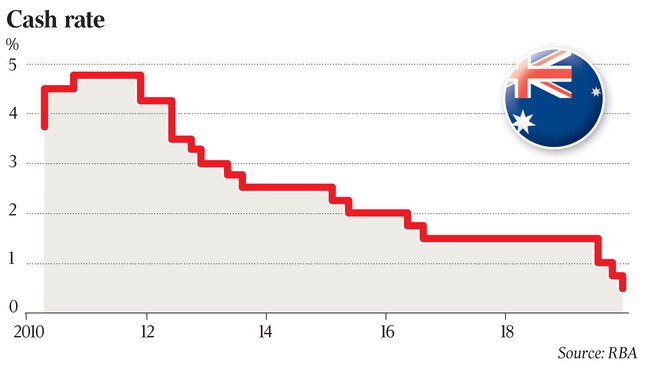

After recent turmoil in markets caused by the global spread of the virus and a slump in China’s purchasing managers data, the RBA cut its official cash rate 25 basis points to a new low of 0.5 per cent “to support the economy as it responds to the global coronavirus outbreak”.

The dollar rose 0.7 per cent to US65.66c, government bond yields rebounded and a rally in shares faded somewhat as interest rate cuts were widely anticipated by traders after global sharemarkets suffered some of their worst falls since the global financial crisis and the OECD slashed its forecasts for the global economy and warned that Australia’s outlook was particularly threatened.

US Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell led the early-morning G-7 conference call, which also included the finance ministers and central bank governors from Canada, the United Kingdom, France, Germany, Italy and Japan.

“Given the potential impacts of Covid-19 on global growth, we reaffirm our commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks,” the group said Tuesday following a morning conference call.

“Alongside strengthening efforts to expand health services, G-7 finance ministers are ready to take actions, including fiscal measures where appropriate, to aid in the response to the virus and support the economy during this phase,” they said.

The statement stopped short of stating specific actions countries might take in response to the virus.

Scott Morrison on Tuesday flagged a “targeted, measurable and scalable” fiscal response to the coronavirus, and financial markets have priced in the RBA cutting the cash rate again to 0.25 per cent by September, after which it is expected to turn to quantitative easing if further stimulus is required.

“The RBA’s decision caps a swift and brutal re-evaluation of the likely economic fallout from COVID-19,” said Australian Institute of Company Directors chief economist, Mark Thirlwell.

“This means the RBA now has only a meagre 25 basis points of conventional ammunition left to face down whatever else the global economy can throw at us this year.

“After that, it will be forced to turn to unconventional measures such as QE (quantitative easing). The pressure for fiscal policy to take more of the economic adjustment load will only increase.”

In his statement, Dr Lowe said: “The Australian government has also indicated that it will assist areas of the economy most affected by the coronavirus.”

Each of the big four banks all reduced loan rates by 25 basis points on Tuesday afternoon, with CBA and Westpac moving within minutes of the RBA.

After huge gains on Wall Street amid expectations of a 50-basis-point interest rate cut by the Fed this month and news of a G7 teleconference call to co-ordinate a policy response to the economic threat from the virus, Australia’s S&P/ASX 200 index rose as much as 2.1 per cent in early trading.

While the local bourse ended a seven-day losing streak — its worst since the GFC — it finished up just 0.7 per cent at 6435.7 points as US stock index futures also came off their highs following a Reuters report citing an unnamed G7 official with direct knowledge of the deliberations saying a draft statement from the group did not specifically call for new government spending or rate cuts.

But shares in Europe surged on opening on Tuesday, with London’s FTSE 100 up 2.3 per cent and Germany’s DAX up 2.7 per cent.

Regional equities were mixed, with Japan’s Nikkei 225 down 1.4 per cent, China’s Shanghai Composite up 0.7 per cent, South Korea’s Kospi up 0.6 per cent and the Hang Seng up 0.3 per cent.

The highly unusual emergency teleconference call by the G7 was due to take place at 11pm AEDT on Tuesday, with a statement expected to be released either on Tuesday or Wednesday.

It came after the US sharemarket experienced its sharpest ever correction from a record high — almost 16 per cent in seven days — and prompting Federal Reserve chairman Jerome Powell to release a rare emergency statement on Friday that the “coronavirus poses evolving risks to economic activity” and that the Fed would “act as appropriate to support the economy”.

US President Donald Trump attacked the Fed for being “slow to act” to cut rates and Bloomberg reported that Treasury Secretary Steven Mnuchin and White House economics adviser Larry Kudlow were both in favour of the Fed cutting rates before its March 17-18 meeting.

On Monday, Bank of Japan governor Haruhiko Kuroda also released an emergency statement saying the BoJ “will strive to provide ample liquidity and ensure stability in financial markets through appropriate market operations and asset purchases”.

That was followed by the equivalent of $7bn worth of liquidity injected in the financial system by the BoJ.

The RBA’s Dr Lowe said the virus had “clouded the near-term outlook for the global economy” and “means that global growth in the first half of 2020 will be lower than earlier expected”.

The outbreak overseas was “having a significant impact on the Australian economy at present, particularly on the education and travel sectors” and the “uncertainty that it is creating is also likely to affect domestic spending,” Dr Lowe added.

Economic growth in the March quarter would be “noticeably weaker than earlier expected” and, given the evolving situation, “it is difficult to predict how large and long-lasting the effect will be”.

“The global outbreak of the coronavirus is expected to delay progress in Australia towards full employment and the inflation target,” Dr Lowe said.

“The board therefore judged that it was appropriate to ease monetary policy further to provide additional support to employment and economic activity.

“The board is prepared to ease monetary policy further to support the Australian economy.”

CBA senior economist Gareth Aird said: “A targeted fiscal response looks forthcoming, although it is expected to be small and will not be a full offset to more RBA action.

“The government is unlikely to wait until the May budget to provide some of this policy response.”

JPMorgan said the RBA move was “prudent”, albeit a disappointment for those looking for a 50-basis-point cut.

Global markets strategist Kerry Craig said markets would “continue to look for another rate cut sooner rather than later” until the coronavirus outbreak was under control.

Finance Minister Mathias Cormann said the government would be announcing an economic response to the coronavirus crisis.

The Prime Minister and Josh Frydenberg on Monday met with Dr Lowe and RBA deputy governor Guy Debelle to talk about the impact of the coronavirus on the economy.

“We are both making judgments in relation to that,” Senator Cormann told a Senate Estimates committee on Tuesday.

“The Reserve Bank has announced its judgment today. The government will be announcing our decisions in relation to this in due course. The government is absolutely focused on what needs to be done. The RBA has done their bit. We will be doing our bit.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout