Over-60s unfairly targeted in changes to superannuation tax concessions: advisers

Construction workers, farmers, doctors, lawyers, senior executives and self-managed retirees are among the 80,000 people who will be paying more tax on their super by 2025.

Construction workers, farmers, doctors, lawyers, senior executives and self-managed retirees are among the 80,000 people who will be paying more tax on their super by 2025.

Nine out of 10 of those estimated to be affected by the Albanese government’s move to reduce tax breaks on superannuation balances of more than $3m will be over the age of 60 and likely retired, according to tax data.

Financial advisers said Labor’s move would hit a wide range of professionals and unfairly target workers who had “spent their lives saving according to the rules”.

Clime Asset Management chair John Abernethy said Labor’s policy was an “attack on large funds which doesn’t solve the bigger problems or attempt to make the superannuation system fairer for everyone”, as he warned people with $3m in their super balances were not necessarily wealthy.

Mr Abernethy, who’s $1.3bn fund represents mainly self-managed super funds, said Australians who had put all their savings into superannuation funds could be “stuffed” under the changes.

“It is quite a pathetic response, picking on tall poppies again without solving the underlying problem that superannuation is not working for the majority of people,” Mr Abernethy said.

“I don’t think $3m is a lot of money. If you’ve got someone who has put all of their money into super, doesn’t own their own home and is renting, this person will be seriously stuffed by this sort of change.

“This does nothing to get a fair retirement system operating where the overwhelming majority of people don’t need to rely on the government pension. It’s an example of how the government doesn’t focus on the big policy issue but instead on the sideshow.”

Jim Chalmers said the changes would make the nation’s superannuation system “more sustainable and fairer with one modest change that affects less than 0.5 per cent of all Australians”.

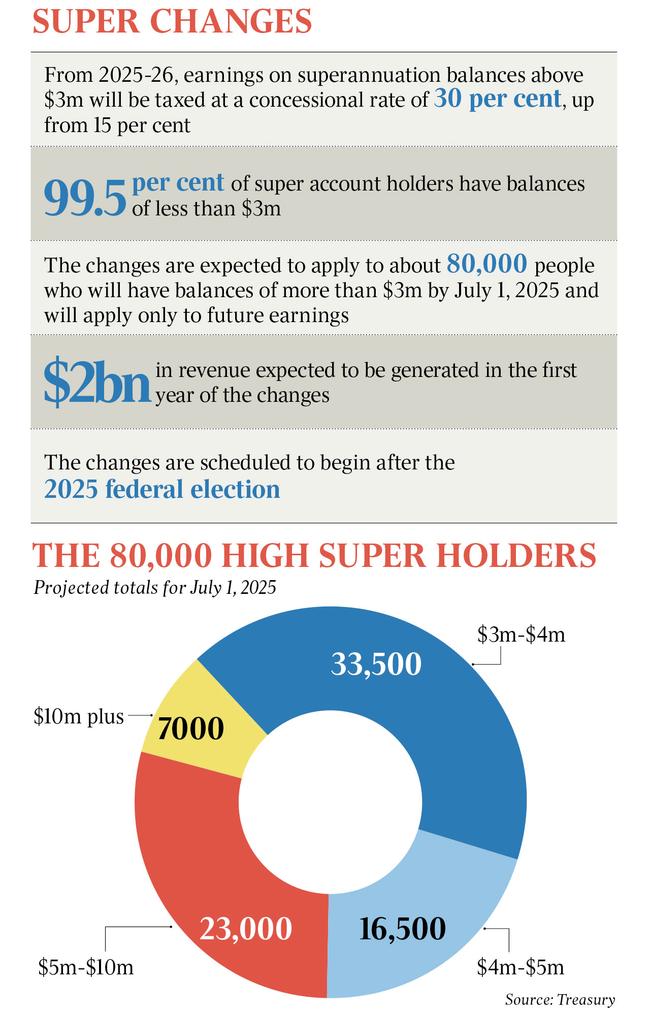

The tax change will impact 33,500 Australians with $3m-$4m in super, 16,500 who have $4m-$5m in savings, 23,000 with nest eggs between $5m and $10m and 7000 who have more than $10m.

The changes will generate $2bn in revenue, will not be applied retrospectively and are due to come into effect after the 2025 federal election.

According to the latest ATO data from 2019-20 provided to the Grattan Institute, 87 per cent of people with superannuation balances above $3m were above the age of 60. This group has an average balance of $5.5m in their super, with about one third of people in the top tax bracket, earning above $180,000 a year.

Sydney resident Malcolm Clyde said Labor’s decision to impose a higher concessional tax rate on high super balances was a broken promise. “During my working life, I gave up on buying a nicer car, going overseas on holidays, and put that money into super,” he said. “I was contributing on the promise by the government that those funds would be concessionally taxed. They’re going back on that promise.”

Mr Clyde said he built up his nest egg by working in mining development and finance.

He said he thought the changes would have downstream effects on the credibility of superannuation as a long-term investment.

Mr Clyde said he was hoping to leave his children and grandchildren money from his super fund.

“It’s only natural,” he said. “Any parent would want to help their children and their children.”

However, Grattan Institute economic policy program director Brendan Coates said the cohort had “substantial assets” outside of their super funds.

Hamilton Wealth Partners managing partner Will Hamilton said Labor needed to “explain themselves” to the 80,000 people affected, after Anthony Albanese promised he had “no intention of making any super changes” during the election campaign.

Mr Hamilton, who provides financial advice to wealthy Australians, said the move would erode confidence in the system and dissuade investors from investing their financial assets into super.

“It’s a disappointment, I think, regardless of Chalmers coming out and saying this,” he said.

“I do think they need to explain themselves. They have broken a promise, it’s a simple as that.

“We saw the Coalition play with superannuation in 2016 and here we are going again, it just erodes confidence in the system.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout