Given a choice between working on the Shipping News or the Treasury’s Tax Expenditures and Insights statement – it has had various names — most young people would go for the Shipping News. At least the ships are real and they do come and go.

In the case of tax expenditures, many of them are simply imaginary and the estimation of their cost is completely arbitrary depending on the benchmark selected.

Take the (close to) $50bn that is regularly trotted out as the cost of the superannuation tax concessions. Take it from me, this figure is simply wrong because it uses income tax as the benchmark.

A more appropriate benchmark is the GST: it is a consumption tax and an incentive to save, which is what superannuation is all about. Using this benchmark, the cost of the superannuation tax concessions fall to a fifth of the figure using the income tax benchmark and does not grow over time.

It is a case of nothing really to see and nothing for the government to go after in the name of repairing the budget. Getting rid of the concessions wouldn’t yield anywhere near $50bn and it would destroy confidence in the system for ever.

There is great deal of piffle written about the superannuation tax concessions, including by the Grattan Institute. The claim is made that it’s unfair for today’s workers to pay around $35,000 in tax if they earn $100,000 when a retired superannuant pays no tax earning the same amount as the return from their $1.7m balance cap. The reality is that the person with that sum of money has paid tax on contributions and on earnings to get to that sum – in total much more than $35,000 in net present value terms.

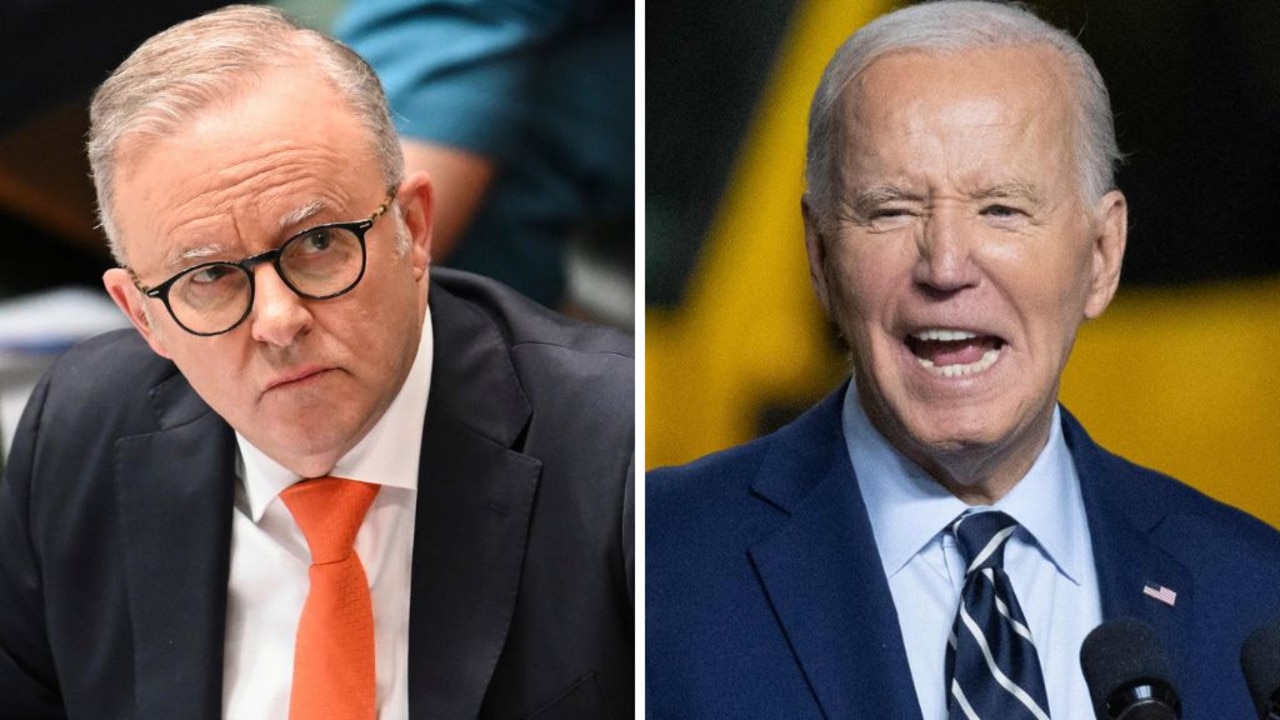

Treasurer Jim Chalmers, himself, doesn’t seem to get it. He claims that “over 55 per cent of the benefits of superannuation tax breaks on earnings flow to the top 20 per of the income earners, with 39 per cent going to the top 10 per cent of income earners”.

But this is only the case if you use the income tax scales as the benchmark. Bear in mind that these top income earners will have been paying the top marginal tax rates for most of their working lives and, more recently, will have been paying 30 per cent contributions tax under Div 293.

The broader point is that the income tax and transfer system is there to deal with inequality and redistribution. It is serious policy error to use the taxation of other activities for this same purpose – efficiency and simplicity should be their guiding principles. Mind you, the taxation and regulations that apply to superannuation are now so complex that expensive professional advice is close to mandatory.

More generally, the new Tax Expenditure and Insights statement contains no new insights and continues the erroneous path of delineating tax expenditures that are not tax expenditures and estimating their value. It might be a requirement of the Charter of Budget Honesty but that doesn’t excuse the Treasury from making such a hash of it.

More Coverage