Inflation surge feared: rapid rates rise drives crash fears

The Reserve Bank may be forced to accelerate rate hikes and risk crashing the economy, as Jim Chalmers warns ‘the world economy is entering a difficult phase’.

The Reserve Bank may be forced to accelerate its aggressive rate hike cycle and risk crashing the economy if inflation comes in hotter than expected over the three months to June, as Jim Chalmers warns that “the world economy is entering a particularly difficult phase”.

Ahead of his first major economic address to parliament on Thursday, the Treasurer said the government would prepare for growing global challenges as the International Monetary Fund reported the world was on the verge of recession.

As Anthony Albanese said on Tuesday that the government would be “doing our bit” to alleviate inflationary pressures on Australians over the next few months, economists warned the RBA would risk crashing the economy if it raised rates to 3.5 per cent in the next year.

Responding to an update to the IMF’s World Economic Outlook, Dr Chalmers said: “This confirms that the challenges facing the global economy are substantial, they are growing, they will be with us for some time, and they are impacting us here at home.”

He also said that he would use Thursday’s economic statement to parliament “to talk more about these challenges and how we are responding”.

“Our economic plan is all about making the economy more resilient, lifting the speed limits on growth and giving Australians more opportunities to get ahead,” he said. Wednesday’s Australian Bureau of Statistics figures are anticipated to show inflation accelerated from 5.1 per cent in March to 6.2 per cent in June – the fastest pace in over three decades, driven by higher petrol, food, rent and home building costs.

The Prime Minister said: “We face economic headwinds, we face rising inflation, we face rising interest rates, and there are real challenges.

“We know that working people in particular are under real cost-of-living pressures. They’re going to the supermarket and they get hit with a bill that’s higher than what they got hit with a year ago. The Reserve Bank is responsible for part of that, but so is the federal government, and we’ll be doing our bit to take pressure off working people by addressing things like cheaper childcare that will have an impact on improving their standard of living.”

Mr Albanese said the government’s focus was on the jobs and skills summit scheduled for September, and rejected suggestions he would have to shelve his election commitments because of the economic crunch facing the nation. “We intend to honour our promises because that is how you build a more productive economy,” he said.

An outcome in line with the consensus would cement expectations for a 0.5-percentage-point rate hike at the next RBA board meeting on August 2, bringing the cash rate to 1.85 per cent.

But analysts warned that price pressures were more likely to prove stronger than weaker in the June quarter, and that a materially higher inflation number would raise the risk of a triple rate hike of 0.75 percentage points in under a week’s time.

AMP Capital chief economist Shane Oliver said the RBA risked “crashing the housing market and the economy” if it pushed rates as high as 3.5 per cent by next year – a level already predicted by investors and some analysts.

Dr Oliver said recent RBA analysis suggested that a cash rate of 3 per cent by the middle of next year would result in 1.3 million households paying at least 40 per cent more on their mortgages. Record household debt accumulated through decades of generally low and falling interest rates meant the “tipping point” for households and the economy was much lower than in previous cycles, he said.

“In 1989 and 90 the Reserve Bank kept pushing and pushing until we had a recession. It’s a bit like that now, but the tipping point for rates is a lot lower because debt is three times higher than it was back then.

“This is going to have a huge impact on household spending, and I don’t think it’s correct to be relaxed about this. Already consumer confidence is at levels normally associated with recessions after only three months of rate hikes.”

Barrenjoey chief economist Jo Masters said this year’s peak in inflation – widely predicted at 7 per cent by the end of this year – was largely set in stone, and tighter monetary policy was aimed at taming price pressures through 2023. “There’s a lot of focus on the June quarter (CPI) data and on what will be the peak, but the reality is that monetary policy can’t do anything about inflation between now and the end of the year,” Ms Masters said.

She agreed that government income support would prove counter-productive, as it would work against the central bank’s efforts to dampen demand, while the additional debt burden would come at a higher cost in an environment of rising rates.

Dr Chalmers has already made clear that the massive debt and deficits inherited from the previous government limited the scope for additional spending.

With inflation climbing around the world, the International Monetary Fund on Tuesday night warned the world was “teetering on the edge of a global recession”.

IMF director of research Pierre-Olivier Gourinchas revealed a more pessimistic set of forecasts, saying “the outlook has darkened significantly” since the organisation released its World Economic Outlook.

Despite the climbing costs to households from a global jump in interest rates, the IMF endorsed central banks’ aggressive rate hike cycles. “Taming inflation should be the first priority for policymakers,” the IMF said. “Tighter monetary policy will inevitably have real economic costs, but delay will only exacerbate them.”

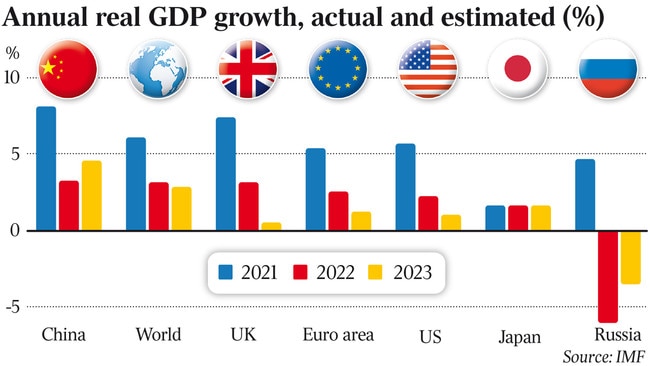

With the world economy shrinking over the three months to June, the IMF said growth in the world’s three largest economies – US, China and the Euro area – was “stalling”, as it downgraded global GDP growth for this and the next year. The IMF’s economists now expect global growth to be 3.2 per cent this year, 0.4 percentage points lower than the April estimate and barely half the 6.1 per cent increase in 2021.

World GDP would expand by 2.9 per cent in 2023, or 0.7 percentage points more slowly than predicted three months earlier.

Global inflation this year was anticipated to reach 6.6 per cent in advanced economies, and 9.5 per cent in emerging economies — upward revisions of 0.9 and 0.8 percentage points, respectively.

Higher than forecast inflation – including a full shutdown of Russian gas flows to Europe – was a key risk to what the IMF described as a “plausible” downside scenario that would drag global growth down to 2.6 per cent this year, and to as little as 2 per cent in the next. Such an outcome would be one of the weakest results in recent history.