Homeownership dream alive despite pressing affordability

Aging millennials, realising the security property provides, have been forced to adjust their expectations — but it’s come at a cost.

Young Australians are still buying into the Great Australian Dream of owning their own home despite it being less affordable now than at the turn of the century.

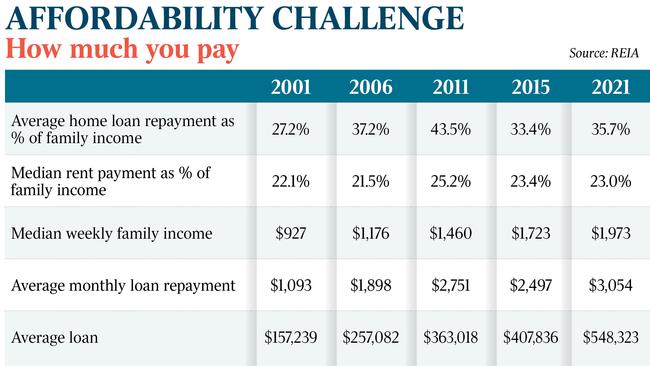

First-home buyers are taking on more housing debt than they were 20 years ago, and while incomes have risen, the buyers are dedicating a larger portion to pay that mortgage down.

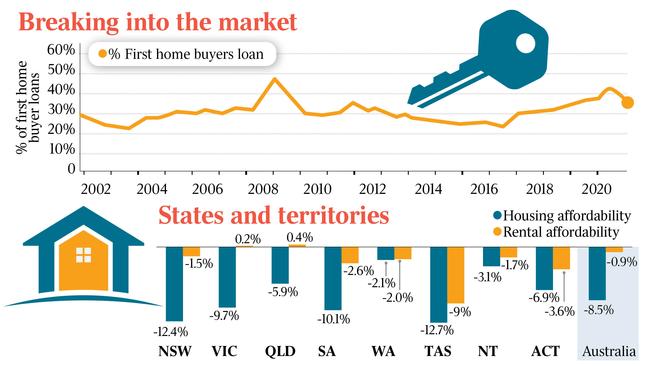

Expense has not been a deterrent, with the number of new entrants into the market steadily increasing, particularly over the past five years on the back of lower interest rates. First-time buyer numbers are now 67 per cent higher as of June than they were in the same month in 2002.

A new Real Estate Institute of Australia report analysing housing affordability over the past 20 years has found increases in the average family income of 112.8 per cent since 2001 have been unable to keep up with the rise in weekly home loan repayments – from $1093 per week to $3054 a week, a rise of 179.4 per cent – and the average home loan, which has soared 248.7 per cent from $157,239 to $548,323.

Bernard Salt, executive director of The Demographic Group, chalks the dynamic up to the maturing millennial generation finally giving up their cosmopolitan inner city lifestyles for a house in the suburbs.

“The reality is that to own your own home gives you security,” Mr Salt said. “We’re about to see the rise of the middle-age millennial. Many of them have postponed this life stage so they’re not young first homeowners. They are earning good money, there’s two of them and they have 20 plus years in the workforce to repay (a mortgage) so they can outbid anyone.”

REIA president Adrian Kelly added many are also looking to get out of the rent trap, with people realising the long-term investment potential of bricks and mortar.

Affordability has deteriorated in all states and territories over the past 20 years but most significantly in Tasmania (down 12.7 per cent) and NSW (down 12.4 per cent), followed by South Australia (down 10.1 per cent), Victoria (down 9.7 per cent), ACT (down 6.9 per cent) and Queensland (down 5.9 per cent). The smallest falls were in Western Australia (down 2.1 per cent) and the Northern Territory (down 3.1 per cent).

Borrowers have enjoyed single-digit interest rates over the past two decades, peaking at 9.5 per cent just ahead of the 2008 global financial crisis.

NAB home ownership executive Andy Kerr said the record low interest rates and the low-deposit First Home Buyer Lending Deposit scheme have recently helped more buyers get in.

The deposit continues to be the greatest obstacle to ownership, with an increasing number of buyers requiring cash help from parents. It was this leg-up that Jan and Ceilene Catarroja, aged 34 and 33, used to buy their home in the northwest Sydney suburb of Riverstone last month. The couple had been saving for 10 years, receiving a boost in the pandemic as travel expenses were saved.

“We had kids very young, so in terms of priorities buying a house was on hold,” Mr Catarroja said. “But at some point, we had to get in and it’s money we know is going into an investment for our kids.”

While the cohort of first-time buyers set the groundwork for price rises in November, they have largely dropped out due to cost and having compete with a growing number of investors.

McGrath Parramatta agent Sam Dalgliesh said this was exemplified by the Catarroja’s new home, which sold in seven days after receiving multiple offers.