Need a home loan? Make an appointment with the Bank of Mum

Couples are increasingly turning to their parents for help in buying property, and are engaging lawyers to ensure the family investment stays on their side of the ledger if the relationship breaks down.

A “prenup” is no longer reserved for walking down the aisle.

Couples are increasingly turning to their parents for help in buying property in a surging market, and are engaging lawyers to ensure the family investment stays on their side of the ledger if the relationship breaks down.

Family solicitors have already noted a steady rise in loans and monetary gifts from parents being enshrined in loan agreements and financial arrangements as millennials and some older members of Generation Z are forced, by rapidly rising property prices, to put down larger deposits.

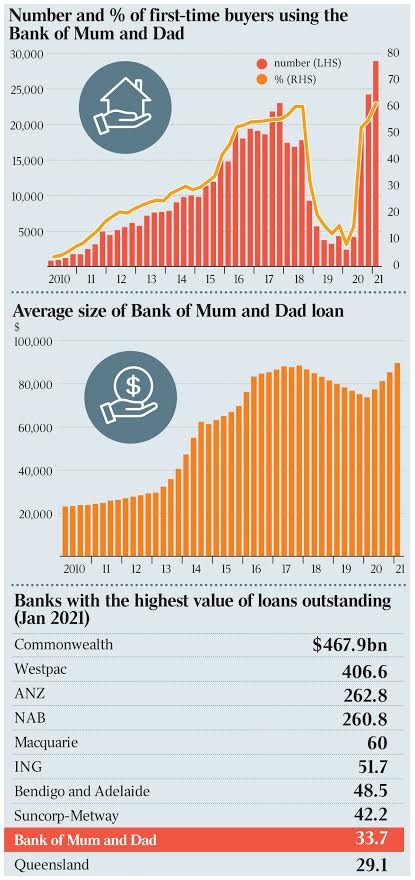

It is just the latest trend in Australia’s modern property market, where the passing of intergenerational wealth is now the nation’s ninth-biggest lender and partners are pooling every cent they can get their hands on in real estate.

When Vesna Koteska, 25, married George Frederiksen, 30, this year, her parents Goce and Jagoda, aged 58 and 55, gifted her a sum of money. They had done the same for her brother too.

The Melbourne couple used their new-found wealth to purchase an investment property in Cairns as they start to build a portfolio like the elder Koteskas, with whom they live.

“If I was in a situation where my parents were loaning me money and wanted to protect that pool of money so it stayed within the family wealth, absolutely I’d have some sort of contract drawn up,” Ms Koteska said.

“I would treat it like any other business transaction.”

The number of first-time property buyers asking parents for help hit a record high in March — 61 per cent — after plummeting to as low as 8 per cent last year in the midst of the coronavirus pandemic, according to figures from research and consultancy firm Digital Finance Analytics. A decade ago, in March 2011, it was only 9 per cent.

And the surge in house values has meant larger and larger family loans. According to DFA, the average loan is now $89,637, compared to $73,745 last year.

Will Stidston, a lawyer at Barry Nilsson, a firm which specialises in family law, said agreements for couples — whether married or not — were increasingly being struck to protect themselves and their parents’ money.

“It used to be a taboo subject, the whole prenup and binding financial agreement discussion, but I’ve got to say that more often than not now, the younger generation in their 20s 30s, are much more open to entering into these because they’ve seen what has happened to their parents, friends the family,” Mr Stidston said.

“You don’t want to be caught out later, (after) proceeding on a premise that you’re definitely going to get your money back because of a need to retire or supplement super, only to find down the track you won’t see it again.”

Separate figures released by CoreLogic on Friday show the total value of residential real estate in Australia is $8.1 trillion. That compares to $3 trillion in superannuation and $2.7 trillion in Australian-listed stocks.

Martin North, the principal of DFA, said the growing size of parental loans and gifts reflected the rapidly rising property prices.

The most recent figures, released by CoreLogic earlier this week showed average home values around the country rose 1.8 per cent in April. They have risen 6.8 per cent in the past three months.

But Mr North said adult children made for poor money managers. “If you look at people who were helped by the Bank of Mum and Dad, in the subsequent five years they are three times more likely to default on their loan, relative to those who went the long route and spent 10 years trying to save for a deposit,” he said.

Mr North said the loans and gifts were creating a two-tier market, effectively raising prices to push those without assistance out.

But Ms Koteska, an insurance lawyer, said her story was similar to many of her friends who had help to buy in recent years.

“I have some mates whose parents have been guarantors on their property, not so much monetary loans … mostly it’s gifts, just ‘Here you go, don’t worry about paying it back’,” she said.

A separate survey released by the Real Estate Buyers Agents Association shows 66 per cent of people looking to buy now plan on doing so with their partner, compared to just 23 per cent who plan to buy alone.

Association president Cate Bakos said both parties needed to be aligned in terms of strategy, risk, end goals and commitment to purchase to succeed.

“Property is a long game, so both parties need to be aligned for this (investment) strategy to work,” Ms Bakos said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout