Homeowners’ income strained as tax take soars

Rapid-fire interest rate hikes and cost of living pressures have left one in twenty mortgaged households unable to pay for essentials, new RBA analysis reveals.

One in 20 mortgaged families is unable to pay for food and power, as the climbing tax take from workers helps to deliver a $4bn bonus to the federal budget.

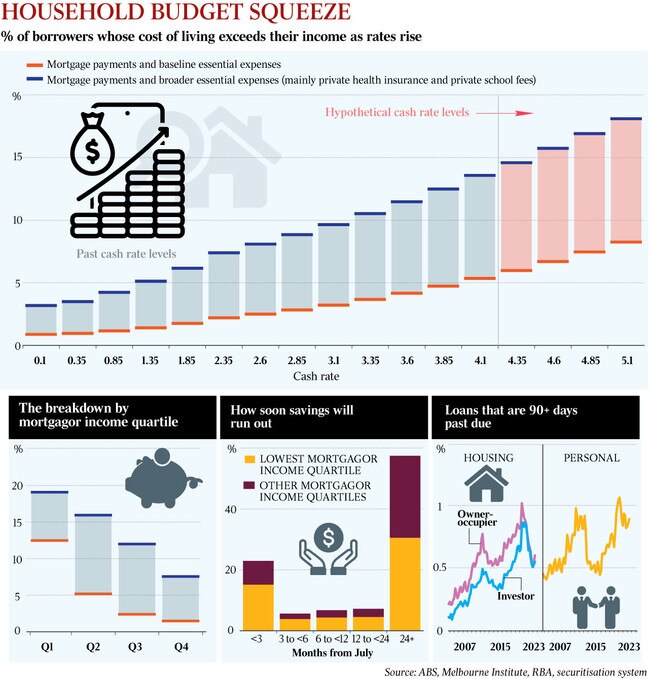

New RBA analysis reveals the share of struggling borrowers has ballooned from one in 100 in April last year, immediately before the central bank began its series of 12 rapid-fire rate hikes that sent mortgage repayments soaring by as much as 50 per cent.

Of those unable to pay their bills, three in 10 will have run down their savings by January, the RBA said, leaving them in a precarious financial position in the new year.

The financial pressures are most acute among households earning less than $78,000, where the share of mortgage holders who can’t afford to pay for the basics stretched as high as one in eight in July.

As an increasing number of the mortgage belt runs down savings and slashes spending to make ends meet, Department of Finance figures revealed the federal budget for this financial year was already running $4.4bn better than predicted in the two months to August, at a deficit of $7.1bn.

Independent economist Chris Richardson said the monthly financial statements reinforced expectations that Labor could be in the position to declare a second consecutive surplus in 2023-24.

Mr Richardson said that while soaring commodity prices had fuelled massive revenue upgrades over the past year, the latest improvements were increasingly the result of a larger-than-anticipated income tax take. “It points to the changing dynamics on the politics. The ‘who pays’ of the budget improvement is bending more to families than it has been,” he said.

As petrol prices soar above $2 a litre and deliver a fresh blow to family budgets, Jim Chalmers said: “We know Australians are doing it tough and higher interest rates will continue to bite, particularly as more and more households come off lower fixed-rate mortgages.

“In these difficult times, the Albanese government is focused on making the budget more responsible and our economy more resilient, while rolling out billions of dollars of cost-of-living relief in a way that doesn’t add to inflationary pressures.”

The central bank’s six-monthly financial stability review said a small but rising share of borrowers were “on the cusp, or in the early stages, of financial stress”.

“While almost all borrowers have been able to make adjustments that have allowed them to continue servicing their debts and cover essential spending, the share falling behind on their mortgage payments has begun to pick up from a low level,” the report said.

Broadening the definition of “essential” spending beyond basics to include other items families are often unwilling to cut, such as health insurance and private school fees, the RBA estimated the proportion of households whose income did not cover their costs jumped to 13 per cent – from only 3 per cent in April last year.

If the basket of “essential spending” was again extended to expenses such as insurance, then the share of lower income mortgage holders who could not cover costs jumped to nearly 20 per cent.

Despite growing distress among some households, the RBA concluded that most households and businesses remained well placed to manage the impact of high inflation and higher interest rates given the strength of the labour market and sizeable savings buffers.

AMP chief economist Shane Oliver said one way to interpret this “surprisingly benign” conclusion by the central bank was that it “left the door open for another rate hike” – potentially as early as the next meeting on Melbourne Cup day.

Dr Oliver said there were “worrying signs” in the RBA’s numbers, not least that one in five mortgaged households was committing more than 30 per cent of its gross income to loan repayments – a common threshold used to define financial stress.

“Beneath the surface there are growing signs of stress,” Dr Oliver said. “We’re not yet at a point where it’s a major threat to the economy, but we seem to be heading in that direction.

“The risks are ramping up, and you’ll see arrears and bad debts going up.”

The RBA estimated a further two rate hikes, taking the cash rate from 4.1 per cent to 4.6 per cent, would send the share of variable-rate owner-occupier borrowers who were unable to cover their basic expenses from 5 per cent, to about 7 per cent.

While the financial stability review highlighted a growing number of people calling the National Debt Hotline, the major banks have so far only reported small increases in mortgage arrears rates to about pre-Covid levels. Jason Yetton, Westpac’s head of consumer banking, said that, overall, customers had been resilient, and the bank was paying particular attention to customers rolling off super-cheap fixed-rate loans.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout