Retailers ‘hope and pray’ for rates reprieve ahead of Christmas

Retailers fear that another interest rate hike will stop Australians spending in the all-important pre-Christmas period.

Retailers are “cautiously optimistic” that spending in the all-important pre-Christmas period starting next month will be on par with the year before — provided the Reserve Bank holds fire on interest rates.

The Australian Retailers Association and Roy Morgan predict shoppers will spend $66.8bn between the start of November and Christmas Eve, essentially the same as in 2023.

ARA chief executive Paul Zahra said: “We are starting to see discretionary retail slow significantly. We’re still spending, but it’s in decline.”

The former David Jones boss said retailers were “cautiously optimistic” about the crucial festive period, which accounts for around two-thirds of annual profits.

Financial markets place roughly even odds of another RBA rate rise by December, and Mr Zahra said the prospect of another rise on Melbourne Cup day or in early December hangs heavy over retailers.

“There’s no doubt a rate rise would have a significant impact on discretionary spending,” he said.

“This is a really crucial moment where we hope and pray the RBA pauses interest rates through those crucial months.”

Food spending in the pre-Christmas period would be up against a year earlier, according to the ARA/Roy Morgan forecasts, as would spending in the broad “other retailing” category, which includes the likes of books and cosmetics. But Australians will spend less on hospitality, household goods and clothing.

Mr Zahra said the prospect of the same level of pre-festive period spending as a year earlier needed to be put in the context of powerful population growth of more than 2 per cent, and high inflation, which the Reserve Bank estimates will be 4.1 per cent by the end of the year.

“The reality is volumes are in decline, and people are buying less. Households are under significant pressure,” he said.

The warning from the country’s retailers comes as new figures revealed a similar picture of weakening household spending growth that is yet to collapse under the weight of intense cost-of-living pressures.

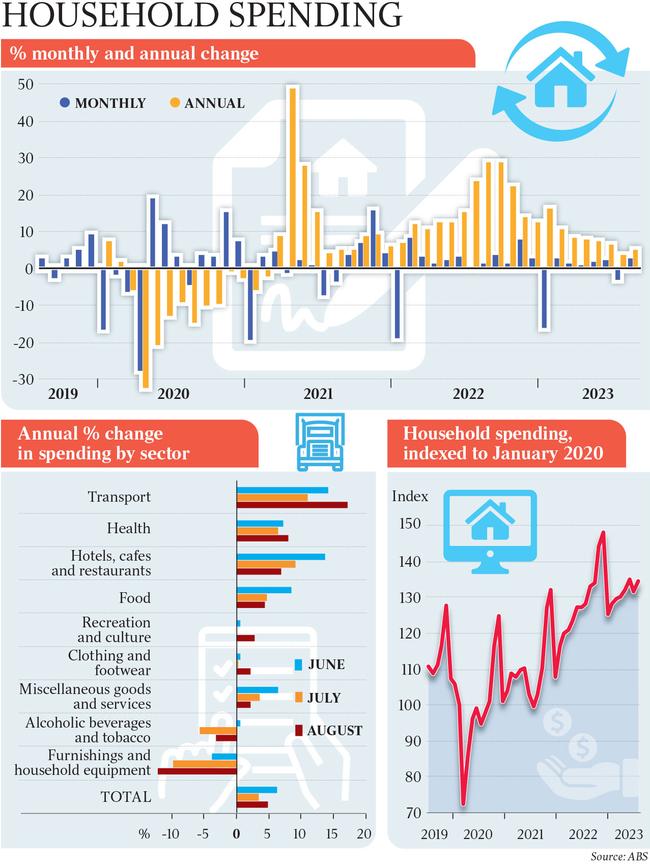

The Australian Bureau of Statistics’ household spending index for August, which pulls together bank and card transactions to reveal a comprehensive picture of spending patterns, was 5 per cent up on a year earlier.

The surprisingly strong result, however, was driven by a 17 per cent jump in spending on fuel and other transport costs, echoing a 14 per cent surge in petrol prices over the same period.

There was also evidence of households trimming spending on luxuries.

Spending on essential goods and services in August was 9 per cent higher on a year earlier, while discretionary spending was flat.

After jump in transport spending, growth was biggest in health – up 8 per cent on August 2022 – and in hotels, cafes and restaurants, which was 7 per cent higher.

UBS chief economist George Tharenou said: “The household spending data is quite significant, given its coverage is about twice the (ABS) retail sales release.”

That retail sales data, released last week, showed growth of just 1.5 per cent in the year to August 2022.

The ABS also significantly revised annual growth in household spending for July, from a drop of 0.7 per cent to a 3.4 per cent increase. “The trend of consumption is now much stronger than it previously appeared,” Mr Tharenou said.

Despite obvious areas of weakness, “overall, the recent data is still broadly consistent with our view that spending is slowing sharply, but is still not collapsing,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout