NSW budget: 5000 homes ‘won’t fix crisis’

NSW will spend $2.2bn to build new neighbourhoods, 5000 homes as a booming population and reigniting property market paper over the cracks of a slowing economy.

NSW Premier Chris Minns will spend $2.2bn to build new neighbourhoods and 5000 homes in a bid to ease the state’s “fierce” housing crisis, as a booming population and reigniting property market papered over the cracks of a slowing economy for Labor’s first state budget in 13 years.

Treasurer Daniel Mookhey on Tuesday morning acknowledged the extra investment would not immediately ease the stress on households from soaring rents and unaffordable homes.

“We are in a housing crisis. We still have a lot of work to do, and that work starts now,” he said.

The extra money for housing includes a $300m injection into the state Landcom agency, which Mr Mookhey said would “restore trust in housing growth in NSW, to have a publicly owned company build housing for the public”.

He identified $400m in “idle money” left over from the Restart NSW project for a New Housing Infrastructure fund, and announced $1.5bn for housing infrastructure through the already legislated Housing and Productivity Commission.

Declaring the budget delivered the people of NSW “the fresh start they voted for”, Mr Mookhey confirmed a “small” estimated $800m surplus in 2024-25, ending five years of rolling deficits triggered by the Covid-19 pandemic.

Surpluses in each of the following two years were part of a modest $3.6bn improvement in the bottom line over the four years to 2026-27, the budget showed.

As revenues outpaced expenses for the first time since 2020-21, Mr Mookhey said a $14.8bn reduction in gross debt by mid-2026 would save $400m in interest payments every year.

Nearly half of that debt reduction was from not injecting borrowed money into the NSW Generation Fund.

“This is NSW’s largest-ever reduction in gross debt – actual or forecast – and it has been achieved without privatisation,” he said.

Moody’s said the improved fiscal outlook over the coming years was “a credit positive” but the state would struggle to limit growth in recurrent spending “given persistent inflation pressures, the recent removal of the wage increase cap and new operating expenditure initiatives such as increased essential services staff and health expenditures, and cost of living and housing support measures”.

S&P Global Ratings said NSW’s return to surplus in the next financial year would be “easier said than done”, but added gross debt was climbing more slowly than expected.

The budget predicted that cost-of-living pressures and soaring interest rates would squash the real economy, but a surge in overseas migration this financial year, solid employment growth, higher wages and a resurgent property market would deliver an unexpected tax windfall.

Taxation revenue was estimated to be $17.6bn higher over the four years to 2026-27 versus the pre-election budget update, driven by a $9.5bn uplift in transfer duties and a $4.9bn upgrade to land tax.

With employment remaining strong and migration booming, payroll taxes would be $2.8bn higher over the four years, the budget showed.

“The government has taken a restrained fiscal approach by directing some of the revenue improvement … to the state’s bottom line, helping rebuild the state’s fiscal buffers,” budget papers say.

Mr Mookhey said his government’s approach was “not just to shovel the money coming in straight out the door in a time of high inflation … We are putting that money away for a rainy day”.

He also confirmed Labor remained a government of big infrastructure spending, with $72.3bn in road and rail projects over the four years.

Capital spending would average $29.1bn over the four years to 2026-27, the budget papers showed, against $25.6bn in the previous four-year period.

The investments included an extra $1bn to “rescue” the Sydney Metro City and Southwest projects, and an extra $2.4bn for roads in the western Sydney region.

The budget included previously announced support for cost of living, including $1.3bn in energy bill subsidies that would assist some 1.6 million households and 300,000 small businesses.

Sydney drivers from January would enjoy a $60 weekly cap on tolls for two years, which Treasury estimates will save motorists $551m.

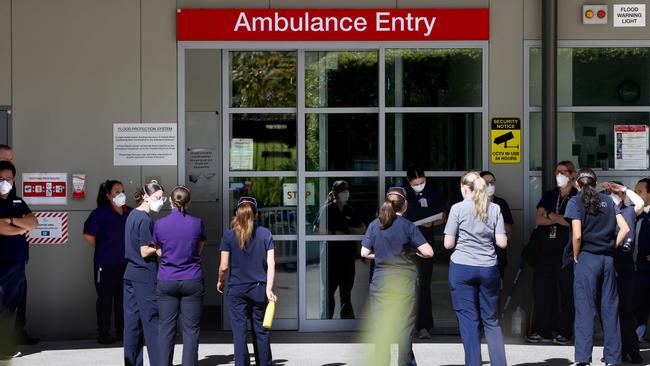

There was also $2.5bn over four years to pay for this year’s 4.5 per cent pay rise for more than 400,000 essential workers, including teachers, nurses and police.

Scrapping the previous government’s public services wage cap, there was a further $3.6bn for an Essential Services Fund that would pay for future wage claims.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout