Financier Soo Kim warns that Star rescue package could still fall over

The $300m deal to keep troubled casino operator Star Entertainment in the game could still unravel.

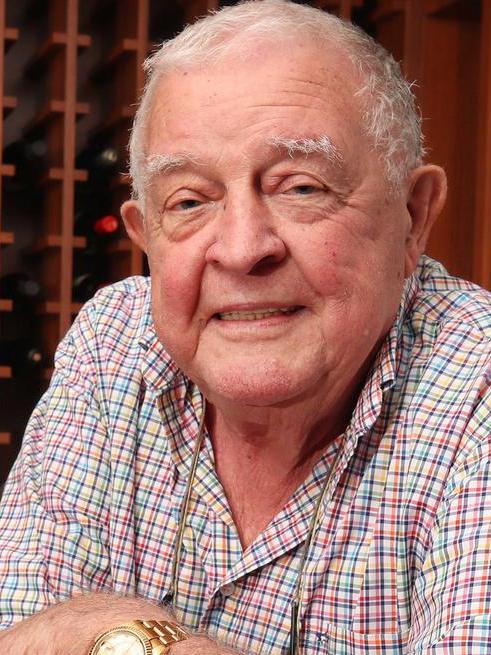

US financier and casino rescue specialist Soo Kim has warned that his $300m bid to seize control of Star Entertainment is vulnerable to a separate bailout by the troubled group’s key Chinese investors.

Mr Kim spoke out as state governments and regulators in Queensland and NSW came to grips with his audacious move on Star, first reported by The Australian. He said the deal for his company, Bally’s Corporation, to acquire a majority stake in the cash-strapped casino operator would stand alongside the in-principle agreement Star had for a separate lifeline from its Hong Kong-based venture partners, Chow Tai Fook Enterprises and Far East Consortium.

But Mr Kim cautioned that he did not have a full understanding of the complex transaction for the Chinese companies to acquire Star’s 50 per cent interest in Brisbane’s new $3.6bn Queen’s Wharf casino, hotel, leisure and apartment complex in return for a $50m cash injection and asset swaps. CTFE and Far East Consortium were to take on Star’s share of the Destination Brisbane Consortium’s reported debt of $1.6bn.

“Look, there are a number of agreements that this company has signed that haven’t come to fruition, right?” Mr Kim said of Star’s attempts to stave off collapse, including failed negotiations with other funders to refinance its debts.

“There’s been some approvals necessary or there’s some conditions … that have to be met and for whatever reason were not met. So we are prepared for the possibility that it goes through and we are prepared for the possibility that it does not.”

On last month’s heads of agreement between Star and the Hong Kong venture partners in DBC, which developed Queen’s Wharf on a prime CBD site owned by the Queensland government, Mr Kim said: “We acknowledge that the agreement exists, but the long form hasn’t been written yet. When that comes together we hope to be in the room.”

Mr Kim’s comments underline the potential for the rescue plan with Bally’s – operator of 19 casinos in the US, mostly acquired when in financial distress – to unravel even though the US company was due to make the first payment of $100m on Wednesday to allow Star to keep its doors open.

In addition to Queen’s Wharf, which is yet to be completed, Star operates one of Sydney’s two licensed casinos and the former Jupiters casino on the Gold Coast, employing more than 8000 people in total.

In an announcement to the ASX on Monday, Star confirmed Bally’s would acquire a 56.7 per cent stake in the company under the $300m deal, initially resisted by the Star board. Bally’s outlay was then cut by a third when Star’s biggest shareholder, billionaire pub and poker machine baron Bruce Mathieson’s family-owned company, agreed to inject $100m into the venture.

Mr Kim said Bally’s would seek to take over Star’s casino licences in Queensland and NSW, jeopardised by revelations that the business had been used by organised crime to launder cash. David Crisafulli’s Liberal National Party government in Queensland has now deferred suspension of Star’s Gold Coast licence until September after the special manager appointed to provide independent oversight reported that the “recent challenges” had prevented it making headway on “some key measures within the set time frame”.

Mr Kim said his team had spoken to Star’s DBC partners “just once” and, at the very least, “there’s absolutely an opportunity for us to remain the manager” of the Queen’s Wharf casino precinct. “Even if the deal were to go through as currently structured, they still need a manager,” he said.

Mr Kim has said he saw more value in keeping the Star group intact rather than breaking up the three-casino operation. But he was cautious when asked if staffing levels would be maintained. “We’ve had conversations,” he said of Bally’s interaction with the state governments. “I think they have expressed how important these jobs are and of these businesses working well. But, what I would say is … those conversations are just preliminary and nothing definitive has happened.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout