A casino hunter shoots for Star. Is this deal too good to be true?

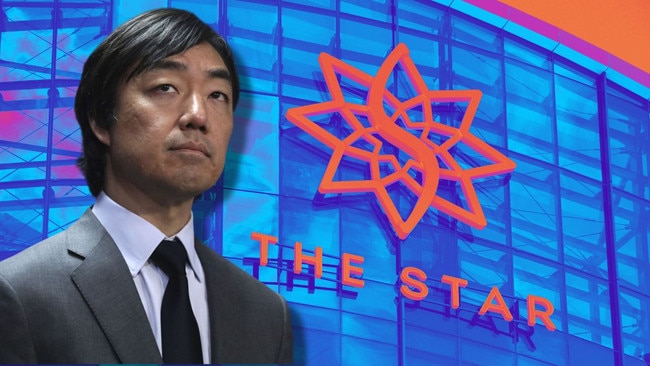

The surprise move by New York-based financier Soo Kim on the troubled Star Entertainment group raises two bedrock questions. Thousands of Australian jobs now depend on getting them right.

This week’s surprise move by New York-based financier and casino operator Soo Kim on the troubled Star Entertainment group raises two bedrock questions.

Why swoop now, so late in the day, when a heads of agreement was already in place for Star’s principal Chinese venture partners to take over?

Could the deal outlined by Kim – a $250m-plus cash injection in return for a majority stake in the operation, which his people would also run – be too good to be true, serving up Star as meal for yet another vulture capitalist?

The stakes here are self-evidently steep: thousands of jobs at three casino sites in Sydney, the Gold Coast and Brisbane; billions of dollars in existing shareholder value and debt tied to the ailing gaming operation; control of a sizeable chunk of an industry brought low in Australia by its own greed; and, in the case of the Queensland capital, the future of a landmark new entertainment and hotel precinct that occupies an estimated 10 per cent of the CBD.

Talk about a flurry of activity. No sooner had Kim made his audacious, uninvited pitch to Star chairwoman Anne Ward on Monday than a team from Hong Kong’s Chow Tai Fook Enterprises jetted into Brisbane for sensitive discussions over their plans for the $3.6bn Queen’s Wharf complex, anchored by Star’s recently opened casino.

The riverside site’s proximity to Queensland Parliament House and 1 William Street – the so-called tower of power crammed with senior state government bureaucrats, ministers and staff – reinforces how the casino saga blurs lines between politics, high finance, big business and public policy.

Star’s board and management seem determined to stick with the deal announced on March 7 for Chow Tai Fook and Hong Kong-listed partner the Far East Consortium to lift their investments in Star and buy out of its debt-exposed position in Queen’s Wharf with a cash payment of $53m and asset swaps. As we will see, this proposal has major shortcomings.

At face value Kim is offering more, though not necessarily to Star’s management and board given his people would take charge of the business. His targets are one step removed – the regulators, notably, but also the creditors, shareholders and employees of Star who will take a bath if administrators are called in. The trouble is Kim has no record in Australia and limited juice with our decision-makers. In gambling parlance, the cards are stacked against his company, Bally’s Corporation, which operates 19 casinos in the US, including in Las Vegas, and is about to open its first overseas venture in Britain.

Bally’s also has a sizeable digital footprint in online gambling and interactive gaming.

Kim, 50, certainly makes a convincing case for his “alternative proposal” for Star. His company has more than cash to bring to the table. Bally’s specialises in turning around failed and failing casinos – 17 of the properties in its stable were rescued from financial distress, insolvency or bankruptcy – and has the expertise to keep Star out of administration, he claims.

“We valued a controlled transaction,” he tells Inquirer. “We are willing to put up our own money to fund whatever losses it takes and we’re trying to see if we can do this in … as gentle a manner as possible. We’re not asking the creditors or the government for anything.”

In his letter of offer to Ward on Monday, Kim said Bally’s had $US171m ($271m) in cash on hand and a further $US620m in a revolving credit facility, subject to no drawdowns other than letters of credit. The “capital raise of at least $A250m” would be delivered through convertible notes issued by Star, subordinated to its primary lenders. Those notes, in turn, would be convertible into at least 50.1 per cent of Star’s fully diluted shares.

Bally’s would underwrite the entirety of the recapitalisation and be supportive of providing Star’s existing shareholders the right to “participate in a significant portion” of the program on a pro rata basis.

Essentially, the Americans proposed to convert debt into equity.

Sounds like a superior deal for long-suffering Star investors, crunched by the plunge in its share price to barely 11c before trading was suspended on March 3, after the board said it was unable to sign off on the half-yearly company results. The deal struck with the Hong Kong venture partners was a shocker for Star, shredding $1bn-plus in value in its prized Brisbane casino by turning over the stake in Queen’s Wharf – and the associated debt – to Chow Tai Fook and Far East Consortium, which also own minority positions in the casino operator. It was a measure of Star’s desperation and most likely its last chance to avoid collapse.

Star Entertainment’s response to Kim, though, was hardly effusive. The “unsolicited, non-binding” offer from the Bally’s chairman did not include details of other proposed terms and conditions, the company noted in an announcement to the Australian Securities Exchange. The board would “review Bally’s proposal”, the statement said. “However, there is no certainty that it will be progressed.”

The March 7 transaction with Chow Tai Fook was critical to securing the project’s long-term viability, Far East Consortium said separately. The Hong Kong companies each have a 25 per cent stake in Queen’s Wharf, the rest held by Star. Under the new setup, the 12ha precinct studded with restaurants, hotels and pricey apartments would be “well positioned to continue thriving”, FEC insisted.

Queensland’s Liberal National Party government will have the final say on any deal. The state was a partner in the consortium that developed the plum site and also controls the casino licence, still under a cloud for Star. Premier David Crisafulli’s priority is continuity of the business and the 5000 jobs it supports in Brisbane and at the former Jupiters casino on the Gold Coast. There’s a school of thought that the Hong Kong buyout could be the best bet to keep Star’s doors open, at least for now.

But that’s not Crisafulli’s only concern. The LNP man is caught in a trap of his own making, sprung ahead of the state election in October 2024. Then premier Steven Miles had ordered a probity report into Chow Tai Fook Enterprises’ alleged link, through a casino in Vietnam, to Macau’s disgraced junket king, Alvin Chau, jailed there for 18 years in 2023 over illegal gambling and involvement in organised crime.

The report was not released after CTFE – the private investment company of billionaire Henry Cheng’s prominent Hong Kong family – went to court to quash it, though the Labor government issued a brief statement that, although the company did have dealings with a “business associate of ill repute”, not disclosed to Queensland’s casino regulator, there was “insufficient evidence that CTFE was aware of this person’s background during the period of their association”. The company was effectively cleared.

The problem for Crisafulli is that he vowed to release the probity report if elected. Just what the Queensland Office of Liquor and Gaming Regulation uncovered remains a matter of intense speculation in Brisbane business circles. So where is the probity report? A spokesperson for state Attorney-General Deb Frecklington says: “We’re working through the steps required to release the report, as we committed to do.”

Kim’s game plan also is hotly debated around the traps in George Street, where a who’s who of business, politics, government, lobbying and the legal profession in Queensland rub shoulders and break bread, sometimes in Queen’s Wharf’s swanky new restaurants.

The consensus is that the crackdown on the money laundering and organised crime infiltration that rocked Star and rival operator Crown Resorts smashed the business model for casino gaming in Australia, killing off the lucrative junket trade focused on high rollers from China.

One government relations specialist familiar with the Queen’s Wharf machinations says the numbers don’t stack up, not when the Hong Kong partners are taking on debt of $1.6bn in the project and counting because construction is still not complete. The identity estimates that the original rate of return was 30 per cent with the high rollers in play at the casino, every bit of which was needed to cover the mountainous borrowings and liabilities.

Today, the return on investment would be more like 10 per cent, this person believes.

“I can tell you, whoever takes it over is going to be hitting the Queensland and NSW governments for the tax breaks and other stuff Star wanted,” the identity says, referring to overtures that Crisafulli and his NSW counterpart, Chris Minns, rejected.

Kim maintains he can square the circle by refocusing on the Brisbane market. None of Bally’s casinos participates in the junket business and he can’t see why anyone would when it was dependent on “another country” – China – granting gamblers visas to travel.

“When we look at the Star casinos we see fine businesses,” he says. “Maybe the businesses’ operating structure is targeted to a junket customer that’s not coming back; maybe they just need to focus on a business that is probably more like a mega-pokie and still quite profitable, still sustainable.

“I just think people, you know, fall in love with the glamour of it all. But in the end the casino business is just an arithmetic business. You just have to understand how the math works and make sure that you don’t think of it in any way other than that.”

Kim has quite the backstory. The son of Korean migrants to the US – his father is a medical doctor – he learned English by watching Sesame Street on TV as a five-year-old. He attended public schools in New York City before securing a place at prestigious Princeton University and went on to a glittering career on Wall Street. The hedge fund he founded, Standard General, has billions in assets under management.

Kim calls himself an “opportunistic investor”, but others would say he’s more like a vulture capitalist, perpetually on the hunt for new prey. What’s the difference? “Well, vulture sounds a bit deleterious,” he says, carefully. “Like … we don’t destroy what we get involved in. What we’ve done historically is to go into situations that everyone has felt were unfavourable and non-interesting or unfashionable and … we’ve identified value where others haven’t seen it. We’ve been able to then put in place the conditions – whether it’s encouraging a change of management or a change of strategy or the sale or purchase of an asset – to enable us to invest in an active way.

“And that’s exactly how we’re looking at the Star business. You’re saying, ‘Hey this business doesn’t make sense without a junket business’ and I’m saying, ‘Well, I disagree.’ You don’t need a junket business at all.

“Almost by definition when we get involved in something it’s going to be a contrarian view.”

Why the delay in moving on Star? After all, Kim says he started getting calls about the struggling casino group more than a year ago and had been researching the publicly available records and accounts. He spoke to the “various constituents, which in my case means the creditors and equity holders”. But he was immersed in one of the deals of his career, the finalisation in February of the $7.7bn buyout of publicly listed Bally’s Corporation by Standard General.

“It was just a matter of timing,” he says. “Frankly, it was on my list of things to do, to go down to Australia and check out these assets in person, just walk the floor. But I couldn’t get away until my own private deal was concluded.”

As Kim tells it, he realised there was no point investing unless his team also ran the show.

“From our perspective, this wasn’t about the amount of water you put in the bucket; it was about fixing the holes in the bucket,” he says.

His hand was forced when the Hong Kong partners agreed terms with Star just more than a week ago, when the operation was reported to be on the brink of going under. “We … didn’t know whether or not we would be dealing with Star in administration or outside of administration,” Kim says.

“But we were prepared for each eventuality. What we didn’t see was that they would try to sell all their assets one at a time, outside of administration. That wasn’t something that we thought would be possible. When we saw the announcement last Friday, we said, ‘Hey, you know, this is a situation where we can just patiently wait for it to come to us.’ We need to raise our hand and see if we can’t present our solution. It’s a viable alternative and we hope that Star will engage with us.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout