Federal budget 2024: Our experts give their verdicts

The Treasurer is walking a tightrope between splashing cash in areas of need and reining in inflation. Here’s how he fared according to our experts.

Federal Treasurer Jim Chalmers has delivered a budget targeting cost of living, with the mantra of sensible spending. Our experts deliver their verdicts on the main policy areas Labor has targeted.

BUDGET OVERVIEW

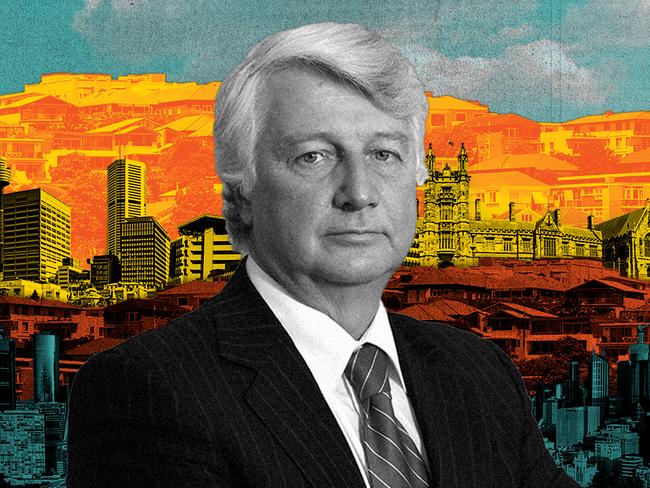

Dennis Shanahan

Jim Chalmers has tried to be a man for all seasons with this budget and hopes he will end up in eternal summer, but runs a real risk he will be stuck in the winter of discontent.

The Treasurer has tried to achieve contradictory aims, such as pouring money into relieve cost-of-living pressures, spending big on infrastructure and housing and providing billions to pick industry winners while aiming to get inflation under control by Christmas.

Energy bill rebates will be popular, even if falling short of election promises, and at the same time using the “relief” to use taxpayers’ funds to buy an inflation cut, he hopes, of half a percentage point.

This is part of Chalmers move to shift the focus from high interest rates – over which he has no direct control – to high inflation which he does. Declaring he wants to focus on “my job” Chalmers is shifting the pressure for rates – which Treasury says may not start falling until after the next election – on to the Reserve Bank and making the economic test for the Albanese government inflation, not rates, and opening a political election window for this year.

Main points

• Cost-of-living relief to pay for an inflation cut.

• Inflation now “lower, sooner” rather than “higher longer”.

HEALTH

Natasha Robinson

It is welcome news to see big-spending initiatives in this in this budget to address bed block and support the elderly to be discharged from hospital. Thousands are currently chronically stuck for weeks or months in wards with major flow-on effects for emergency departments and elective surgery. Resourcing for virtual care, funding for short-term accommodation with associated healthcare, and the prevention of avoidable hospitalisations should make a big difference.

The government’s strengthening Medicare agenda continues in this budget but with no new initiatives apart from even more Urgent Care Clinics, to the chagrin of GPs who are continuing to limp on trying to stay afloat amid severely depressed Medicare rebates that have sparked a thriving, and in some cases rapacious, commercial market in telemedicine.

Mental health investments seem a mixed bag. The expansion of Medicare Mental Health Centres, which to some extent support those with complex needs, is fantastic to see. Funding for mental health nurses within GP clinics is also welcome, but it’s doubtful these services will reach many of those with severe mental illness, who are unlikely to engage with GP clinics. The government still has not got the memo that providing housing to those with the most severe mental illness, who are exceedingly unlikely to access the new big-spending national digital early intervention service, is by far the best bang for buck. The mental health spending package is welcome but still neglects the significant needs of the most severely unwell.

Main points

• Big $882 million investment to assist the discharge of the elderly from hospitals, where they often stay for extended periods because of a lack of care in the community. States and Territories will be funded to provide hospital outreach in the community, deliver virtual care and prevent avoidable hospitalisations to address chronic bed block. The Federal government will fund short-term care for the elderly upon discharge.

• Establishment of a national digital “low intensity” early intervention mental service to provide support to people in the early stages of mental health distress, at a cost of $361m over four years.

• Much of the spending on Medicare is being poured into the Federal government’s signature Urgent Care Clinics, with an extra $227m being used to fund another 29 clinics.

MADE IN AUSTRALIA

Joe Kelly

The $22.7bn “Future Made in Australia” agenda is a modern day Labor experiment which greatly expands the role of government in securing the nation’s economic future.

The budget has provided greater clarity about what is involved – but there are major economic and political risks. The key winners are the renewable hydrogen, green metal, low carbon liquid fuel, critical mineral and clean energy technology sectors.

But, while the government has put investment guardrails in place, there is no guarantee the billions of dollars being spent by taxpayers will generate the economic returns being promised by Labor.

This will emerge as a long-term test of Labor’s credibility. The shake-up will also require at least two tranches of legislation to be passed. To avoid its budget centrepiece being held hostage in the parliament by the Greens, Labor will need to enlist Coalition support for its new Made in Australia agenda.

Main points

• Labor’s Future Made in Australia agenda will cost $22.7bn over ten years and $3.8bn over four years. The shake-up will require at least two tranches of legislation.

• The government will target private sector investment in five priority areas: renewable hydrogen, green metals, low carbon liquid fuels, critical minerals and the manufacture of clean energy technologies

• It will introduce a new investment “front door” to accelerate major projects and streamline environmental, planing, cultural heritage and foreign investment approvals.

AGED CARE

Stephen Lunn

Much remains up in the air on aged care, and the budget hasn’t cleared up any of the uncertainty. This will be of serious concern to the sector.

The government has yet to respond to its own aged care taskforce recommendations, now in its hands for almost five months.

Those recommendations have budget implications, including more support for regions and clarifying the preference of older people to age at home for as long as possible.

They also are critical to the future of residential aged care providers, half of which currently operate at a loss.

There is also uncertainty about when the government will meet the Fair Work Commission’s decision to award significant pay rises to many care workers. The government fully funded the FWC’s interim award, but plans for the next tranche is opaque beyond an unquantified commitment in a contingency fund.

Main points

• Sector hopes for government response to aged care taskforce report dashed.

• 24,100 more Home Care Packages in 2024-25, worth $531m, less than market expectations

• Big bump in tech, with $1.2bn to build a contemporary IT system in aged care.

• Aged care is the government’s fourth largest payment program, at $157bn over next four years.

HOUSING

John Ferguson

Whatever Labor has done in the budget may never be enough.

The size of the housing crisis is so vast that the challenge ahead means there is grave doubt the package will be enough.

Capacity constraints including skill shortages and shortfalls in building supplies are having effects that are difficult for governments to control.

But should Labor get a tick for trying?

Up to a point.

As we know from Australian political history, the bolder the goal the less likely it’s going to happen. Any children still in poverty?

The real mystery is whether the latest interventions can help meaningfully to address the challenges facing the homeless and victims of domestic violence.

If housing affordability and availability continues on the current trajectory then Australia is in danger of heading down the US path, with large numbers of homeless on some city streets.

So far the Lucky Country has avoided this dynamic.

There is nothing to say the next decade won’t produce the same result in Australia.

To that end, the budget measures need to work, regardless of your political bias.

EDUCATION

Natasha Bita

The nation’s education ministers should be put in the naughty corner until they stop squabbling over taxpayer funding for schools. Stressed teachers and struggling students can’t wait any longer for the missing “Gonski funding’’ and couldn’t care less which level of government pays for it.

This is the second year that the Albanese government has failed to announce any substantial increase in public or private school spending. One in three Australian children failed to meet the baseline standard in reading, writing and mathematics in last year’s NAPLAN test. Two-thirds of students missed the equivalent of a month of school last year. Youth crime is out of control. Australia can’t afford politicians playing games of financial chicken with kids’ education. As schools constantly remind families, “every day counts’’.

Main points

• Federal funding for public schools will rise 15.1 per cent to total $60bn over five years.

• In private and Catholic schools, federal funding will rise 16.2 per cent to total $98bn over five years.

• $113m for programs to support Aboriginal and Torres Strait Islander students in remote schools.

• $34.6m for a National Teacher Resource Hub with evidence-based lesson plans.

• Trainee teachers to be paid $320 per week for work experience in classrooms.

NDIS

Stephen Lunn

The Albanese government is banking on some “known unknowns” to moderate cost growth of the NDIS, if 9.2 per cent a year for the next four years can be considered a moderation.

Key among these are what disability supports will be provided to outside the scheme, including, critically, by the states through education, early learning and other community settings. Support for children with autism and developmental delay are top of mind for both levels of government.

That negotiation is ongoing, and will not be easy. The states don’t seem in any particular rush to settle what these “foundational supports” will include.

But there is a burning platform, with the state and federal governments committing to limit NDIS cost growth to 8 per cent annually from 2026.

More funding, $214m, announced ahead of the budget to fight fraud in the scheme, will help weed out the shonks ripping off their disabled clients and the taxpayer but it won’t be enough to hit the 2026 cost growth target.

Main points

• Government’s NDIS reform program projected to cut $14.4bn from scheme costs over four years, offsetting projected extra costs beyond last year’s budget.

• Total NDIS costs for next four years expected to rise by 9.2 per cent annually.

• Total NDIS costs for next four years budgeted at $218bn.

DEFENCE

Ben Packham

This is a budget that highlights the growing gulf between Australia’s military aspirations and the nation’s readiness to deliver on them.

Defence spending is rising to $55bn and beyond, as the nation sets its sights on rearming the force and joining the exclusive club of nations that operate nuclear submarines.

But the ADF’s growing workforce crisis poses an ominous warning for the government and those that follow. How will the nation crew nuclear subs, much less build them, when it can’t find the necessary people?

The budget allocates a meagre $101m to expand the submarine construction workforce and help Australian firms get into the program’s supply chain. Much more will be required.

Treasury is alert to the risks of the $368bn AUKUS program, acknowledging its final costs are unknowable.

The budget also reveals the obscene cost of the Hunter-class frigate program that has cost more than $4.3bn before construction has even commenced.

The troubled frigate program offers little hope that Defence can get the submarine build right. But it must. There are no alternatives.

Main points

• Defence’s workforce shortage forecast to hit nearly 5000.

• Defence spending to hit $55bn in 2024-45, or 2.02 per cent of GDP.

• $101m for defence industry and workforce initiatives.

COST OF LIVING

Rosie Lewis

Anthony Albanese wants Australians to believe he is serious about easing cost-of-living pressures and he plans to do that through two key measures – income tax cuts and energy bill relief. While last year’s package was largely targeted at low-income households, a looming federal election has seen the Prime Minister offer support to all families. Every household will soon start getting cheaper energy bills through $300 rebates. The $75 quarterly payments will start flowing in just as Australians begin benefiting from tax cuts, with the average tax cut worth $36 a week in 2024-25. Treasury officials noted the bulk of the five-year, $7.8bn cost-of-living package in the Albanese government’s third budget would be paid out in the next financial year. It’s no coincidence that’s the same year the federal election is due. Whether or not the support will assist the government at the next election will depend on whether voters feel Mr Albanese has been generous enough while remaining focused on reducing inflation.

Main points

• $7.8bn in new cost-of-living relief measures on top of the revised stage three tax cuts, which are worth $23bn in the first year.

• $3.5bn over three years in energy bill relief, with $300 rebates to be paid to all households in quarterly instalments from July.

INDIGENOUS

Sarah Ison

Labor’s third budget since coming to office stands in striking contrast to its first when it comes to its vision for Indigenous Australians.

Gone is the $20m in funding for regional and local voices – an idea which several Indigenous leaders were still hoping to be pursued – and no answers have been provided on if and when the government will move on the treaty-making and truth-telling body known as the Makarrata Commission.

Instead, there’s more than $2bn invested across jobs, housing, education, suicide prevention and justice outcomes and three lines in the Treasurer’s speech on the plan for Indigenous Australians that go purely to these practical measures.

Labor has taken a hard pivot from the grand plan of a constitutionally enshrined Indigenous voice to parliament and proposal to fundamentally change the way governments implement policies impacting Aboriginal and Torres Strait Islander people, to a return to the basics: Funding the practical measures that go to closing the gap.

Main points

• $777.4 million to replace the Community Development Program and create 3,000 jobs in remote communities across Australia.

•$700m to reduce overcrowding in remote Northern Territory communities.

• $110m in education initiatives including nearly $75m for a First Nations Education Policy and $2.5m for a First Nations Teacher Strategy.

WAGES

Ewin Hannan

Labor’s multi-billion dollar commitment to boost the wages of aged care workers and early childhood educators will be welcomed by thousands of workers enduring the cost of living crisis.

Despite the usual doom from some well-paid conservative economists, funding a modest wage increase for industrial weak, low paid workers is not automatically inflationary.

Are the struggling never allowed to spend? And if they aren’t, won’t small business employers, which the same economists champion ahead of employees, wither?

Significantly, employers are diverting from their usual script and backing the wage increases – provided the government coughs up the coin.

Think about it: 92 per cent of early childhood workers are women, often have more qualifications than men in higher paying industries but have to survive on as little as $23 an hour which would be outrageous during economic boom times let alone now

If the government funds the wage increase, it should also stop childcare employers passing on additional labour costs to families through fee hikes.

In short, a policy no-brainer.

Main points

• Billions of dollars to fund pay rises for aged care and early childhood workers

• Wages growth to fall to 3.25 per in the next two financial years but lower inflation means real wages growth.

FISCAL MANAGEMENT

Patrick Commins

The rhetoric might be the same, but don’t be fooled: Labor’s third budget is a different beast to its first two. The government’s strategy is word-for-word the same as it was six months ago: to “make the economy more resilient and put the budget on a more sustainable footing over time”.

In the shadow of the next election, however, it’s clear that the second half of that mission statement has become less of a priority.

A back-to-back surplus will deliver endless bragging rights, but Labor is now more aggressively pursuing a big-spending agenda, with the Future Made in Australia at its centrepiece.

And for a budget that is supposed to have fighting inflation at its core, the $24.4bn in net new spending out to 2027-28 is – alarmingly – front-loaded, with $9.5bn in the coming financial year.

Main points

• A $9.3bn surplus in this financial year would be the first back-to-back years in the black in two decades.

• But bigger deficits in the outer years mean cumulative deficits over four years are $14.4bn larger than expected in December.

• Labor in its third budget have committed to $24.4bn in net new spending out to 2027-28.

BUSINESS

Eric Johnston

With more than $8bn to be spent on cost of living relief from power bills to rents and billions more on “soft” infrastructure like housing this is a big spending budget under veil of austerity.

Treasurer Jim Chalmers is using the commodities and income tax windfall to spend up big this year, because there a worrying budget deficits in the years to come. But the real tension in this budget is the collision course with the Reserve Bank.

Chalmers has built this document around the heroic assumption that inflation will cool and fall away to be back below the 2-3 per cent target band as early as next year. It comes with the RBA still worried inflation hasn’t left the economy and has warned a cash rate hike still remains a live option. Chalmers’ big spending and broad based spending turns its back on previous discipline.

For business, the winners are those that operate in the clean, green energy economy. The centrepiece is $22.7bn to be spent over the coming decade under the “Make It In Australia” banner on powering green hydrogen and green steel measures.

Its moves like these that keeps mining billionaire Andrew Forrest onside. Critical minerals processing and green energy are in line for tax credits and in some cases direct investment to keep the boom at home. The nation’s key business Regulators get a boost for cybersecurity spending while Treasury forecasts economic growth is set to pick up to 2 per cent by next year.

Main points

• Inflation forecast to pull back to 2.75 per cent by mid-next year.

• A $13.7bn bumper package develop Australia’s green hydrogen sector.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout