Frydenberg’s Budget update: Emergency IR changes aimed at reversing plunge in business investment

Josh Frydenberg backs extending emergency changes to workplace laws and providing incentives for business investment.

Josh Frydenberg has backed extending emergency changes to workplace laws and providing generous incentives to reverse a “free fall” in business investment, as he seeks to engineer a swift economic recovery from the COVID-19 pandemic.

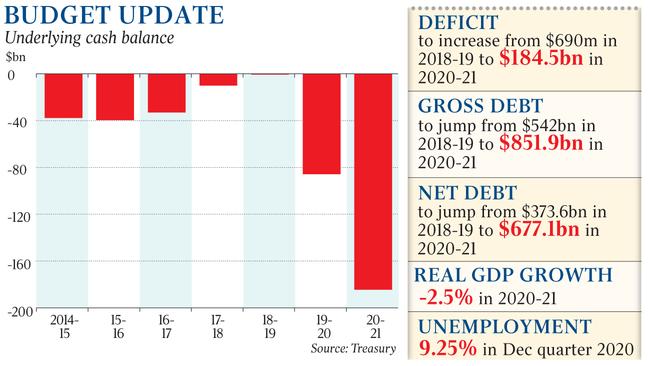

The economic and fiscal update showed the government had committed $289bn to shielding jobs and businesses from the worst of the global downturn, with gross debt surging to a post-war record of $852bn and unemployment on track to exceed one million people.

The budget update was released as Scott Morrison defended the government’s fiscal stimulus in response to the coronavirus pandemic, saying the alternative would have “seen not only hundreds of thousands of Australians become destitute, it would have seen thousands of Australians die”.

“When you’re faced with those rather existential threats and challenges as a prime minister, there’s only one response and we’ve provided it,” Mr Morrison told the Nine Network.

Mr Frydenberg will on Friday signal a shift away from the emergency phase of the crisis dominated by the provision of financial support and health measures to a recovery phase aimed at reigniting growth. In a speech to the National Press Club in Canberra, he will outline how the government will use the October 6 budget to implement its five-year blueprint focused on fast-tracking deregulation, lower taxes and major investment inducements.

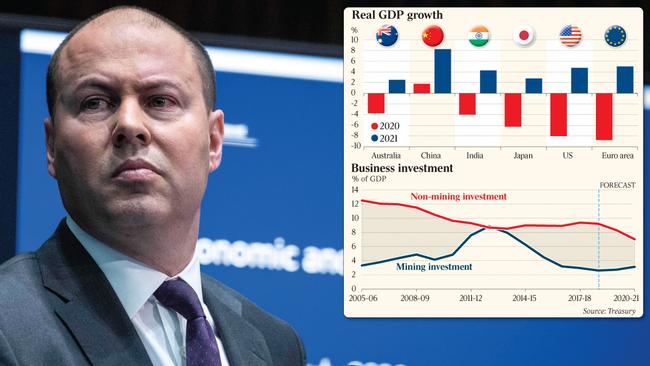

Sketching out the extent of the COVID-19 economic damage on Thursday, the Treasurer and -Finance Minister Mathias Cormann said real GDP was forecast to fall by 3.75 per cent in 2020 before bouncing back by 2.5 per cent in 2021. The forecast recovery was based on Victoria being in lockdown for six weeks from July 9, with restrictions being progressively eased and other states continuing to open their economies in line with national cabinet’s May strategy.

Mr Frydenberg, pressed on the government’s policy agenda, identified industrial relations ¬reform aimed at injecting greater flexibility into the labour market as the “first cab off the rank”.

He said the government’s $164bn spending on direct fiscal measures had lowered the peak of the unemployment rate by five percentage points, preventing the loss of about 700,000 jobs.

“These are mums and dads. Sons and daughters. Friends and colleagues. At 7.4 per cent in June, the official unemployment rate is expected to peak at around 9.25 per cent in the December quarter,” Mr Frydenberg said.

Modelling from PwC suggested the budget would not return to balance until 2040-41 and the nation would not reach zero net debt until 2060-61 after the government’s economic update revealed a deficit of $85.8bn in 2019-20 and $184.5bn in 2020-21.

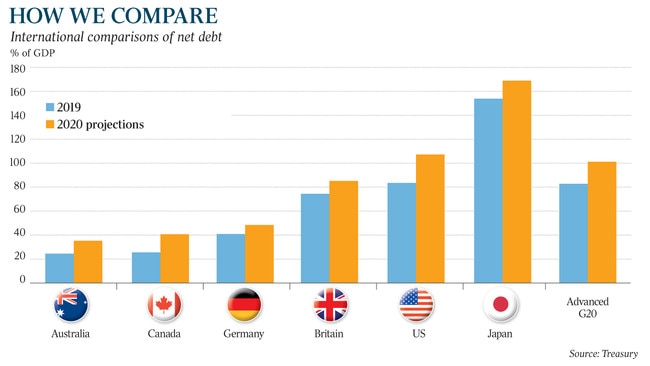

Mr Frydenberg said Australia’s debt burden was manageable, owing to historically low interest rates, with net debt rising to $677.1bn, or 35.7 per cent of GDP, at the end of June next year.

“The average debt-to-GDP ratio for major advanced economies is now expected to exceed 100 per cent in 2020,” the Treasurer said. “Australia is experiencing a health and economic crisis like nothing we have seen in the last 100 years.”

Senator Cormann, who will retire in December, defended the nation’s rising debt bill as a necessary cost. “In the circumstances, what was the alternative?” he said.

“Are you suggesting that we shouldn’t have provided the support we did to boost our health -system, to protect jobs, to protect livelihoods?”

As the government presses for industrial relations changes to apply to employers coming off JobKeeper, The Australian understands it would be prepared to consider a lower revenue-loss threshold that employers no longer on the subsidy would need to meet before they could access key industrial relations exemptions allowing them to cut employee hours and change their duties. The issue is likely to be discussed when Industrial Relations Minister Christian Porter and ACTU secretary Sally McManus resume talks next week.

The government needs to pass legislation extending JobKeeper and the ¬industrial relations -exemptions when parliament resumes sitting for a fortnight from August 24. “Our view is that those flexibilities that apply to the employer, and give them the ability to change duties, to change hours and to change the location of staff, should continue, not just for those firms that meet the reapplied eligibility test, but should apply to those firms on JobKeeper right now,” Mr Frydenberg said.

Australian Industry Group CEO Innes Willox said a large number of businesses were likely to be forced to terminate employees who were currently working reduced hours or more flexibly if they lost access to the workplace provisions. He said the depth of the crisis “showed how reckless it would be to wind back the temporary IR flexibilities” helping keep businesses running and people in work.

ACTU president Michele O’Neil said granting the industrial relations exemptions to employers ineligible for JobKeeper 2.0 was unwarranted. “There is no justification whatsoever for changing workers’ rights for business that are no longer struggling,” Ms O’Neil said. “The union movement will protect and defend workers and their rights, especially during this pandemic.”

Labor also signalled its opposition. Industrial relations spokesman Tony Burke accused the government of using the pandemic to “leave workers permanently worse off”. Ahead of the October budget, Mr Frydenberg will signal the government will adjust its economic plan to match the rapidly evolving COVID-19 crisis in a bid to spark economic growth. “The OECD is forecasting a contraction of 6 per cent in global growth this calendar year. This is equivalent to a reduction in activity of around $12 trillion and around 60 times the size of the contraction that occurred in the GFC,” he will tell the National Press Club.

“We need to keep adjusting our economic plan to match these changing circumstances. The initial phase of our plan was focused on preparing our health system for this crisis, saving jobs and protecting the economy. In the next phase of this crisis, our focus will shift to enabling growth.”

Senator Cormann said the government would move to maximise investment across the economy as a key priority given a huge drop in business investment of 12.5 per cent forecast for 2020-21.

Business Council of Australia chief executive Jennifer Westacott warned “business investment is in free fall” and must be reversed. She also called on the government to use the national cabinet to deal with tax and regulation reform. Master Builders Australia CEO Denita Wawn said the government needed to “maximise private investment”.

“The policy reform priorities being pursued by the government to date are largely on the money but the need for continuing IR flexibility and IR reform is now greater than ever,” Ms Wawn said.

Mr Frydenberg said the $289bn provided by the government in support had saved lives and jobs, but the outlook remained “very uncertain”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout