Emergency funding needed as aged-care sector ‘at risk of collapse’

Two in three nursing homes are operating at a loss, and the sector needs the federal government to step in, a study warns.

Australia’s aged-care system is at serious risk of financial collapse, with two in three nursing homes operating at a loss in 2021-22, and needs the federal government to step in with an emergency funding package, a study warns.

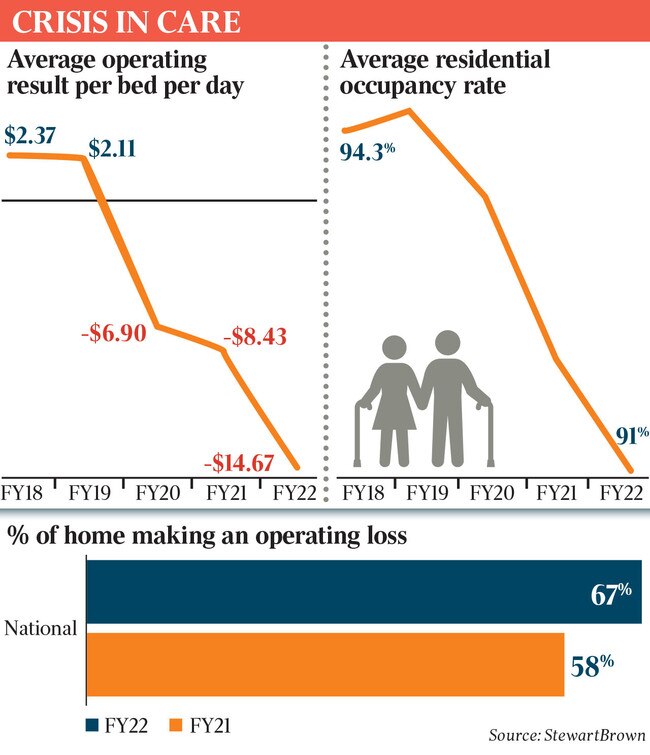

The analysis of the financial performance of aged-care providers in 2021-22 reveals significant worsening of an already dire situation, with residential aged-care homes losing $14.67 a bed a day compared with losses of $8.43 in the previous financial year.

The losses are all the more shocking given the former Coalition government poured an extra $10 a bed a day into the sector last year to deliver better quality care to residents as part of its response to the aged-care royal commission, at a cost to the taxpayer of about $800m.

With a week to the Albanese government’s first budget and Jim Chalmers having acknowledged aged care as one of the budget’s most serious cost pressures, the study by specialist accountants StewartBrown finds 67 per cent of nursing homes made an operating loss in the year to June 2022, a significant jump on the 58 per cent in 2020-21.

StewartBrown’s much anticipated aged-care financial performance survey, based on financial data from more than 1300 facilities across the country, shows operating results for nursing homes have deteriorated rapidly. In 2018-19, providers were making $2.11 a bed a day, but the financials have plummeted to a loss of $14.67 a bed a day.

The report also notes that occupancy in nursing homes continues to fall, the average now sitting at 91 per cent after being at 95 per cent in 2019.

It says while government payments to nursing home operators were indexed by 1.1 per cent in 2021-22, this paled against the financial burdens of extra compulsory superannuation payments, pay increases of up to 3.5 per cent for some workers, and annual inflation that ran at more than 6 per cent driving up costs.

The financial pressures are putting the sector’s sustainability at risk, it finds. And the risk is accelerating.

“The residential aged-care segment has sustained significant aggregate operating losses for the last five years totalling an estimated $3.8bn, with $1.4bn being the FY22 forecast,” it notes. “These losses have eroded equity and capital growth, which has caused a considerable decline in investment into the sector.”

The StewartBrown report calls for structural reforms to the sector so those older Australians who can afford it pay more for the accommodation component of their aged care, and for the costs of everyday living that those outside aged-care homes would be required to pay, such as food, utilities, cleaning and laundry.

But the situation has reached a more immediate crunch point, it says. “To avoid closure of homes and reduced service delivery, especially in regional locations, an emergency funding package also needs to be considered in the short term to ensure current viability and allow for the necessary funding reforms to be properly implemented,” the report says.

The economic plight of aged-care providers comes as demand for services, either in the home or in a nursing home, are only likely to increase given the inexorable march of baby boomers into old age. About 245,000 Australians reside in an aged-care facility across a year.

Efforts to address the deficiencies in Australia’s beleaguered sector have been under way since the aged-care royal commission handed down its report in March 2021, but appear to be making little difference to its long-term financial sustainability.

The Coalition government’s 2021 budget announced an $18bn program of extra investment in the sector over four years, including nearly $4bn to increase the minutes of care being provided to nursing home residents, and $3.2bn for the $10 a bed a day daily care supplement, which included improving nutrition.

As it deals with international and domestic economic headwinds approaching next Tuesday’s budget, the Albanese government has acknowledged that aged-care spending will increase from $29.8bn in 2022-23 to $52.5bn in 2032-33.

Aged Care Minister Anika Wells said last week even that was conservative. “This doesn’t include the government’s election commitment to improve aged-care quality, or the future spending requirements as a result of the current wages case (for aged-care workers,” Ms Wells told an aged-care conference.

“More room will need to be found in the budget to fund both existing projected spending and additional critical investments.”

StewartBrown partner Grant Corderoy said although there was structural funding reform going on in the sector, including a new funding model operating in 2023 that might help providers, there would be a lag period before it would take effect. “In the meantime, ongoing and past operating losses mean that emergency funding to ensure the survival of aged-care homes is becoming essential,” he said.

“More broadly, we must come to accept that while the provision of direct care remains taxpayer-funded, those who can afford to contribute more to their accommodation should, and the same with day-to-day living costs such as cleaning, laundry, utilities and food.

“The government will not let the sector implode, but on the current settings there is a growing risk which will be significantly mitigated through increased consumer contribution for these services, which we have always paid for during our lives.”

The StewartBrown report also found that the second arm of government-funded aged-care support, home care, faced “significant operating issues”.

“Home care financial performance has stagnated over the last four financial years with the average operating result for FY22 being $3.98 per care recipient (client) per day,” it concludes.

“This is not an adequate return based on the investment required and business risk to provide these essential services to the elderly in a domestic home setting.”